ROHAN KINNI, PAVAN MUTHANNA or Praveen Prabhakaran never imagined that their business cycles would revolve around the cycles business. That was until their career detours—giving up desk jobs in varied fields such as software development, 3D animation, and retail.

The cycles they hawk aren’t for your average, everyday ride. We’re talking high-end, sleek machines meant for serious cyclists. “We weren’t thrilled with the kind of customer service available for these bikes or the range available,” says Krishnendu Basu, who, along with Gokul Krishna, started The Bike Affair, a bicycle shop in Hyderabad.

For 29-year-old Kini, the trigger for turning retailer was the paint chipping off the frame of his newly-acquired Rs 11,000 Firefox Target bicycle. Repeated complaints with customer service execs went unanswered till Kini decided to write to the Gurgaon-based Firefox’s managing director, Shiv Inder Singh. Singh resolved the issue quickly but realised that Kini was more than just a cycling enthusiast. He was well entrenched in the bicycling community in Bangalore and understood the complexities of the product.

Singh had just started distributing U.S.-made Trek bicycles and was looking to build a dealer network for high-end bicycles retailing above Rs 20,000. “When we were bringing in Trek, we knew most of the dealers, even the ones we had appointed [for his other brand Firefox], were going to struggle. Trek’s cycles require a higher degree of technical competence because they have more components and are priced steep. Its customer would be very demanding,” says Singh.

He made Kini a retailing offer. At stake was Kini’s comfortable job developing software at the Bangalore office of Chicago-based IT consultancy ThoughtWorks. “It was a big commitment,” Kini says.

Along with a friend, Nikhil Eldurkar, Kini began devising a business model where they would start a part-time business with zero inventory, contact prospective customers through e-mail, and meet them only by appointments scheduled on the weekend. They pitched in with Rs 50,000 each and converted the rooftop of Eldurkar’s house into the first location for BumsOnTheSaddle (BOTS), which sold “only those bikes that passionate riders would want to buy”, says Kini, who is ‘chief wrench’ at BOTS.

By 2011, BOTS had moved to a 2,000 sq. ft. showroom and now deals in top-of-the-line brands such as Cannondale and Dahon (both U.S. brands), Bianchi (Italy), and Bergamont (Germany).

Today, BOTS sells on average 25 to 30 bicycles per month, each priced upwards of Rs 30,000. Even though he isn’t making as much as his ThoughtWorks salary of Rs 18 lakh per annum, Kini says he’s breaking even.

AROUND THE TIME THAT Kini was shuttling between his weekdays at ThoughtWorks and weekends at Eldurkar’s rooftop in 2008, Basu, a team lead at Minvesta Infotech, an IT firm in Hyderabad, was pedalling 22 km to work and back a few times every week. But when he wanted to upgrade his bike, the options were limited—just two international brands: Trek, distributed by Firefox Bikes, and Merida, a Taiwanese bicycle brand that had found a distributor in Delhi-based APPL Bikes.

Krishna, Basu’s colleague at Minvesta, who had been toying with the idea of a startup, suggested they start a bicycle shop. “We wanted to create a BOTS for Hyderabad,” says Basu. Within a couple of months, a website was up, the two together had committed about Rs 4 lakh to The Bike Affair and converted a friend’s hall into a store.

Basu and Krishna then met distributors, including Ashwath Kapur of APPL Bikes, to retail Merida bicycles. “We didn’t have a business background or any experience in setting up a shop. But what we brought to the table were networks within the cycling community,” says Basu. The first order was for 15 bikes costing between Rs 16,000 and Rs 30,000 each, including four demo ones because they wanted the customers to “get an idea about what they would ride”, says Basu, adding that this is a key differentiator between shops run by cyclists and traditional cycle shops.

The Bike Affair recently moved into its third home—a 2,800 sq. ft. showroom, which not only has about 70 bicycles on display, but also has room for a service area, showers, lockers, a TV set and a small pantry. “The idea is that bikers can shower, get a coffee and have a chat while their bike is getting serviced,” says Basu. The idea is not just to maximise sales, but also to build a community. “The relationship doesn’t end when you buy the bike, it starts,” he adds. Most customers at stores such as The Bike Affair and BOTS are extremely loyal not just because of the service but also for the expertise.

Dasarathi G.V., a mechanical engineer who runs a technology company in Bangalore, and has been cycling 30 km everyday to work for the last 12 years, says, “Even though I might be paying a 10% to 15% premium, I prefer BOTS because I know I’ll get an expert’s advice there.”

The way a bicycle is set up or assembled can have a big impact on riding quality, safety, performance, longevity, and even the fun factor. While it doesn’t matter so much for entry-level bikes, for high-end ones the likes of Kini and Basu need to take into account the rider’s profile and the terrain.

Kini says the advantage of running a shop staffed with riders—all eight staffers at BOTS are cyclists—is that they are able to test ride the new models and understand the machine from a rider’s perspective. “It helps us sell better. We recently tested some new Bergamont bikes and realised that the saddle was much better than the others, and the handlebar was a bit wider. So, for a tall customer, this might be a good option,” he says.

NONE OF THE STORES offer discounts or bargains, which often lead to sales losses. The other common factor is that they stock multiple brands. “Initially, distributors discouraged this, but we were quite sure that we would not work to build any one brand. We would sell cycles that were best suited for the rider,” says Kini. This practice, while new to India, is common in developed markets where high-end brands retail only through independent bicycle dealers.

Choice, or the lack of it, is what made Arvind Ganesh set up Happy Earth, a distributor of high-end bicycle accessories in Bangalore. After spending 13 years across IT firms in California and London, Ganesh was freelancing after relocating to India in 2009. He brought his bicycle back with him, a Trek 7200, and soon became a regular at cycle forums and BOTS.

The lack of choice in cycle accessories bothered him. His experience in writing software for DHL’s warehousing systems and his father’s background as a distributor of food products got him thinking about a distribution business. “I’d seen my dad build a successful business and had an idea about what was needed. I wanted to be as efficient as some of the distribution firms I had seen abroad, but in the cycling space,” says Ganesh.

That was around the time when around 40 cyclists in Bangalore got together and placed a bulk order on eBay for mini-pumps, a device used to inflate tyres. The shipping costs for such imports were high and the package wasn’t cleared by the customs for a month as its value was higher than the approved limit for a personal package. “Nobody repeated the mistake again. That was a distributor’s job. This was the sign for me,” says Ganesh, who initially invested Rs 30 lakh to build his inventory. He has pumped in Rs 50 lakh till date and is looking to raise funds.

He spent most of 2010 visiting trade shows in the U.S., Europe, and Japan, and building relationships with accessories manufacturers. “I stock some of the top accessories brands and prefer specialists to brands that make everything,” says Ganesh. He prefers supplying to stores run by cyclists because they understand the components’ value and are willing to stock even slow-moving and low-margin items. These stores know there are customers also who understand the value. “Traditional bike shops wouldn’t get this.”

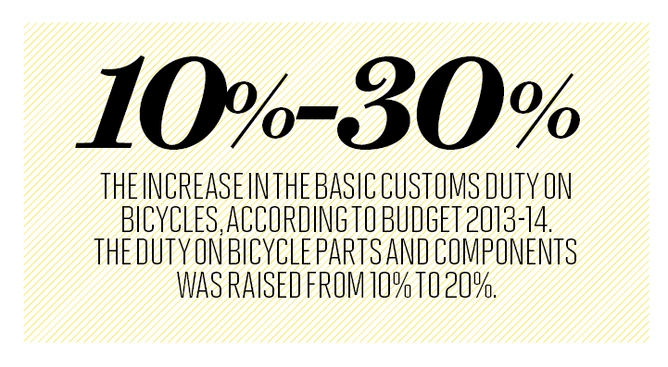

Being picky has its downsides. None of these bicycle startups are highly profitable. Stocking only high-end bicycles often means beginners might get intimidated by the price tag and drop the idea. A tripling of basic customs duty in March 2012 pushed prices of imported bicycles steeply, leading to low volumes.

The annual demand for high-end bicycles—those priced above Rs 25,000—is between 12,000 and 15,000. For the ones priced between Rs 5,000 and Rs 25,000, the corresponding figure is around 350,000. Entry-level bicycles, priced below Rs 5,000, however, are still the mainstay of the Indian market, with almost 12 million bicycles sold every year.

“You cannot expect a young techie making about Rs 50,000 to shell out Rs 30,000 for a bike,” says Shilpa Shah, who has just inaugurated her second Yellow Jersey bicycle store in Hyderabad. Yellow Jersey stocks about 200 Firefox bikes and nearly 70 high-end ones from Trek and Scott. About 80% of her sales come from Firefox and she’s expecting the first store to turn profitable by the end of this year.

Kini also expects the high-end bicycle market to reach an inflection point in the next few years. For one, the list of pedallers-to-peddlers in India continues to grow. There’s Pavan Muthanna, the ex-head of retail operations and projects at Indus League Clothing, a group company of Pantaloon Retail, who started Cyclists For Life, a Bangalore shop stocking high-end cycles; Ajay Dongre, a college professor in Goa who operates two stores called Escapades; Vikram Limsay, a serial entrepreneur in Bangalore who runs Helicon Consulting and has invested in a bicycle shop there called Procycle; and Prabhakaran, a Pune-based animation artist who learnt to build bicycles himself and has sold three Psynyde bicycles for upwards of Rs 1 lakh. (Psynyde is the name of his bicycle brand.) The wheels, it seems, have started to turn.

Leave a Comment

Your email address will not be published. Required field are marked*