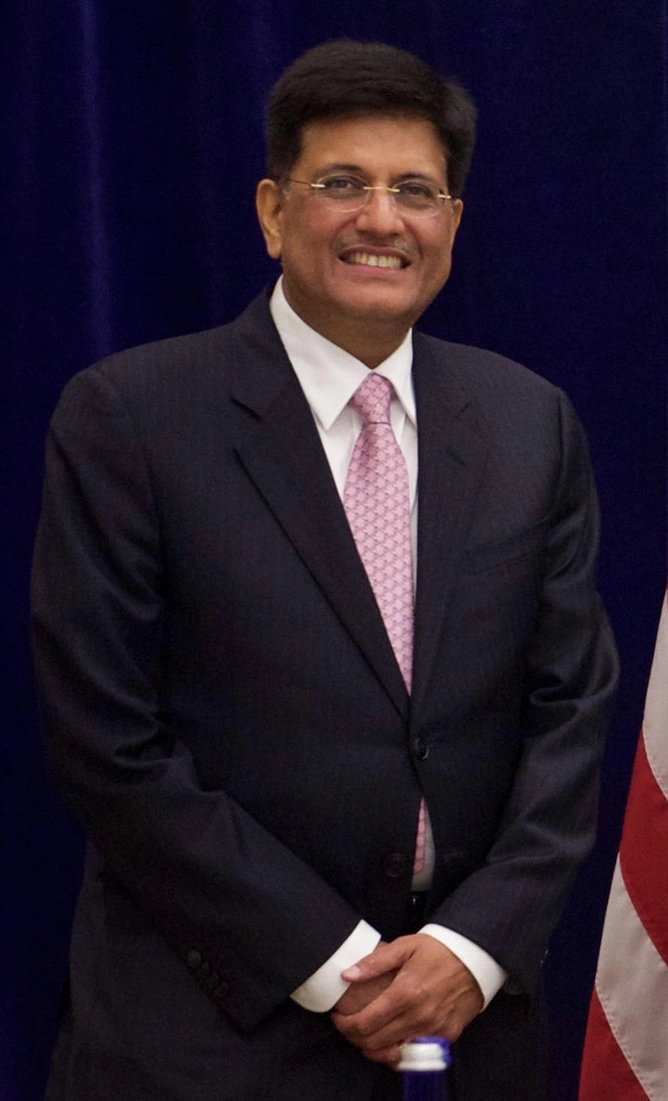

Ever since the Bharatiya Janata Party (BJP) came to power in 2014, there has been a considerable ramp up in capacity addition from renewable energy sources like solar and wind power. The suave minister of state (independent charge) for power, coal, new and renewable energy, and mines Piyush Goyal has set a rather ambitious goal of generating 100,000 MW of power from solar alone by 2022. And over the past three years this has resulted in several power farms sprouting across the country. Furthermore, during this time installed capacity has increased from 2,631 MW to 13,114 MW, while tariffs have fallen from Rs 8 to Rs 2.44 per unit of power. This steep fall in tariff attracted international attention as it is among the lowest in the world.

However, it also came with its own set of troubles which Goyal did not envisage when he was relentlessly promoting policy measures taken by the BJP government to nurture the solar power industry. He is yet to tweak policies to address the shifting dynamics in the sector, and he needs to act fast if he really hopes to achieve the tough targets he has set. Last week, in the first ever appraisal of the National Solar Mission under Goyal’s tenure, the Lok Sabha’s Standing Committee on Energy highlighted some of its concerns in a report (National Solar Mission–an appraisal) tabled in the lower house of Parliament. Here are the four key issues:

Withdrawing the viability

gap funding scheme

As part of the National Solar Mission, viability gap funding (VGF) schemes over

three phases—750 MW, 2,000 MW and 5,000 MW—were launched to set up large-scale

ground mounted solar projects. Developers under this scheme would get an

assured Rs 4.43 per unit from the Solar Energy Corporation of India (SECI). But

right now with tariffs in several locations in the country falling below Rs

4.43 a unit, perhaps such a scheme is not required. Moreover, the Standing

Committee report found that the “results of the scheme are not encouraging”. According

to the report’s findings, under the first batch of the VGF scheme of 750 MW,

only 680 MW was commissioned. Under the second batch of 2,000 MW, power

purchase agreements (PPAs) have been signed for 2,295 MW but the commissioning

status is not known. And under the third batch of 5,000 MW, 2,500 MW should

have been commissioned till 31 March 2017, but SECI has only signed PPAs for

970 MW till date. Clearly, the scheme is dated.

Stop bundling solar

power with thermal

Goyal and his team had also devised a bundling scheme wherein unallocated

thermal power was to be bunched with solar power and sold to distribution

utilities by NTPC’s power trading arm, NTPC Vidyut Vyapar Nigam (NVVN). Under

the scheme, 15,000 MW of solar capacity was envisaged to be set up. However,

with solar power now becoming cheaper than thermal in many cases, the objective

of the scheme to incentivise solar power is lost. In fact, continuing with such

a scheme would be akin to solar power incentivising thermal power.

Ensure states comply

with renewable purchase contracts

Another fallout of falling tariffs is that states like Tamil Nadu have

started reneging on power purchase contracts and now want to renegotiate

existing PPAs. Projects which were set up earlier with a promise to buy power

at a certain rate are not being paid as states are able to access power at

lower prices. Such a scenario was not considered when Goyal pushed for solar

energy. Though distribution utilities, which contract power purchase, are

controlled by state governments, according to the Standing Committee on Energy,

the Centre can come up with penal provisions if states do not comply with renewable

purchase obligations set out by the Ministry of Power.

Support local

manufacturers of solar power equipment

It looks like the government’s Make in India programme has given the short

shrift to the solar business. Although it has helped power producers, what is

happening now seems to go against the very grain of promoting local

manufacturing. One of the main reasons for falling tariffs is a steep decline in

solar panel prices which are imported from China, leading to lower project

costs. The Standing Committee on Energy has recommended several measures

including starting a dedicated programme to establish India as a solar

manufacturing hub so as to provide policy support to the complete value chain.

So far, the government has resisted demands by domestic solar panel

manufacturers to levy an anti-dumping duty on Chinese imports as it did not

want to disrupt the downward trajectory of tariffs. With targeted capacity

still a long way to go, Goyal may have to bite this bullet sooner than later.

Leave a Comment

Your email address will not be published. Required field are marked*