SOME YEARS AGO, it was just a gigantic piece of marshland, but today it’s one of Mumbai’s premier business districts. Though it’s far from the traditional financial hub of Nariman Point, the swanky Bandra Kurla Complex (BKC) has already managed to attract some of the biggest companies from JP Morgan and Citibank to tech giants Facebook and Amazon India. In 2011, even the U.S. consulate shifted from south Mumbai to the sprawling commercial district built on around 915 acres of reclaimed land near the suburbs.

But BKC isn’t just a business district: It is also home to some of the city’s most high-end apartments priced between a whopping Rs 25 crore and Rs 55 crore. The buildings made headlines for their jaw-dropping prices and because they attracted prominent buyers such as banker Uday Kotak, actress Aishwarya Rai, former Citibank head Vikram Pandit, and former Deutsche Bank executive Gunit Chadha.

Some of the credit for spotting the luxury housing potential of the farflung wasteland goes to then fledgling Mumbai-based real estate company Sunteck Realty. Many builders might have shied away from developing luxury apartments next to commercial complexes, but the new kid on the block took a chance—and it paid off. Sunteck chairman and managing director Kamal Khetan bet on undervalued pockets of land in a tough market and ended up making the company one of the fastest-growing luxury developers in Mumbai in less than a decade. “It takes a certain level of patience when you’re betting on wastelands because in Mumbai the creation of a new district is slow but, once in motion, it has to happen,” says Khetan.

How did Khetan pull off such a project in such a fiercely competitive market? For starters, he aligned himself smartly. He roped in billionaire Ajay Piramal as co-investor and bought four acres in BKC for residential use in 2006 for Rs 664 crore when everybody else was only thinking commercial. Prices at Sunteck buildings have already leapt from Rs 18,000 per sq. ft. at the time of booking to Rs 60,000 today. “Credit goes to [Khetan’s] maverick streak coupled with an appetite for risk but the underlying strain with Sunteck’s projects is that they are all futuristic acquisitions, and he pushes the envelope on price,” says Gulam Zia, executive director at property management company Knight Frank India.

Zia says Khetan spotted an opportunity for high-end housing in what was going to be the fanciest business district in Mumbai and acted on it before anyone else. Sunteck’s three BKC buildings—Signia Pearl, Signature Island, and Signia Isles—do more than just establish Khetan’s brand. Two of the buildings are ready and have the potential to bring Rs 1,600 crore into Sunteck’s coffers. The third has received clearance and will boost revenue further.

Technically, Sunteck started as an office-leasing venture in 2000 and got into buying land for large-scale residential development only in 2006. Khetan, an electronics and communications engineer from Mangalore University, might be a relative newbie in Mumbai’s real estate market, but he’s already got some big projects under his belt. Since he entered the real estate market with the BKC land, he has bought 23 acres in Goregaon, started residential projects in the Mumbai suburbs of Airoli and Borivali, and signed joint development agreements or both residential and commercial projects in Nagpur, Goa, Jaipur, and downtown Dubai. Sunteck has invested around Rs 289 crore in projects outside of Mumbai.

In a market where luxury projects have been dominated by old real estate families such as the Rahejas and Hiranandanis, Sunteck isn’t in the big league yet. But it has grown at an impressive pace because of a combination of luck and clever business planning. Today, it has 23 millionsq. ft. of both commercial and residential development across 25 projects, of which 21 are in Mumbai. Its land holdings and other assets (unsold inventory) are worth around Rs 5,000 crore.

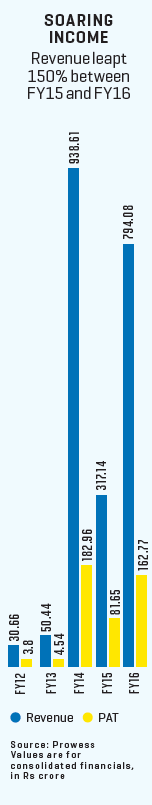

As business grew, Sunteck’s revenue leapt more than 150% from Rs 317 crore in FY15 to Rs 794 crore in FY16. During this period, its market cap jumped from Rs 1,430 crore to Rs 2,390 crore. With the impressive increase in revenue, Sunteck broke into Fortune India’s list of Next 500 companies this year, one of two new real estate firms to make the cut. The other is the privately held Lodha Group. Sunteck moves in at No. 412 by revenue but by profit it stacks up at a much higher No. 53. Sunteck posted a profit of Rs 163 crore in FY16, up 139% over the previous year. This places it second only to Oberoi Realty, which tops the 12 real estate companies on the Next 500 list.

Bolstered by the success of BKC, Khetan began to snap up land in the suburb of Goregaon in 2012 for mixed-use development. Again, with investment support from Kotak Realty Fund, he picked up two lots of 23 acres for Rs 450 crore. It was quite a gamble because, until then, slum clusters and buffalo stables in the area had kept most developers at bay.

But Khetan saw potential in the area now called Oshiwara District Centre (ODC) by the Mumbai Metropolitan Region Development Authority (MMRDA) because of expected infrastructural changes: a flyover connecting the area to the developed suburb of Powai, a highway, a railway station, and two metro rail stations. “What also got my attention was that large corporations had back offices in Goregaon but there wasn’t much in terms of residential facilities,” says Khetan.

THE QUESTION THAT many are now asking is: Can Sunteck redefine Goregaon on the same lines as the Bandra Kurla Centre? He might have struck gold with BKC, but can he pull it off again in today’s faltering real estate market? Many big builders are struggling as demand, especially for luxury apartments, has slowed considerably since demonetisation. With the real estate sector unlikely to turn the corner any time soon, Sunteck’s bet on Goregaon might be slower to pay off.

But Khetan is confident. Sunteck is creating a mixed-use project that includes commercial, residential, and high-street retail across his land in the Oshiwara District Centre. One swathe of seven acres is purely residential. Khetan is thinking it will pan out like Andheri West, with a busy confluence of residential complexes, malls, and offices. Khetan points to how the Hiranandani Group turned around once far-flung Powai with the premium Hiranandani Gardens township consisting of condos, houses and offices. Sunteck says almost half its revenue now comes from Goregaon, even though sales have been slower than expected because of demonetisation and overall sluggishness in real estate. Existing projects have appreciated around 30% since 2013 and Sunteck officials expect prices of Rs 15,000 per sq. ft. to reach Rs 25,000 in three years. But that might not so easy given the state of the market today.

The other issue is that the ODC buildings could dilute Sunteck’s premium positioning. Khetan doesn’t think so: “Is low cost in Mumbai really low cost?” His take is that even the middle-market housing he’s selling in Goregaon is priced between Rs 15,000 and Rs 16,000 a sq. ft., pegging it above all metros barring Delhi. The company is also getting into housing priced at a lower Rs 8,000-Rs 10,000 per sq. ft. but under a new brand. Sanjay Dutt, CEO of Ascendas Singbridge India, a real estate services company that specialises in business parks and urban townships, thinks Goregaon balances Sunteck’s portfolio and helps hedge against risks. “It (Goregaon) actually de-risks Sunteck from super-premium and forces diversification into lower price points which is what will sell now.”

Another question on everybody’s lips is: Will Khetan ride the tide of change in real estate caused by the Real Estate (Regulation and Development) Act (RERA), the new set of regulations aiming to enforce strict rules such as holding booking deposits in escrow and penalties for developers for missed deadlines? RERA will make developers maintain stringent financial control on money realised from sales. Some 70% of funds will be held in escrow until a project is complete, thereby restricting the use of money from unfinished projects for new ones. Khetan isn’t worried: “We will be (RERA) compliant in accordance with official deadlines.”

Analysts are also optimistic about Sunteck shares. Brokerage house Edelweiss Securities has a “buy” recommendation on Sunteck because of its pipeline of launches across Goregaon, BKC, an upcoming project in Borivali, and Dubai. An Edelweiss report highlights “potential upside from surplus land and the ability to source value-accretive land-buying opportunities in Mumbai”. Recently, Boston-based Fidelity Investments bought around a million Sunteck shares for around Rs 46 crore. In thelast year, the stock has gone up almost 100% to Rs 460.

But the future remains uncertain because of the effect of demonetisation, pull-backs in luxury spending, and lack of clarity on new real estate regulations. Many real estate companies have been forced to increase borrowings because of the sluggish market. However, Sunteck has used internal accruals to slash its loans by 26% to Rs 845 crore.

One could argue that it’s a double-edged sword that Sunteck has 63% of its land in Mumbai and the rest across Nagpur, Jaipur, Dubai, and Goa. According to Knight Frank India, half early research shows home sales in Mumbai have increased from the previous year, but the tide could turn. Still, Khetan doesn’t plan to shift his focus from Mumbai, which accounts for over 80% of the value of his holdings. He says that any downward price revision won’t go beyond 10% to 15%. “In a real estate sense, Mumbai is, after all, like Manhattan. It always bounces back.”

Leave a Comment

Your email address will not be published. Required field are marked*