Inflation to remain higher than 6% until December: RBI governor

ADVERTISEMENT

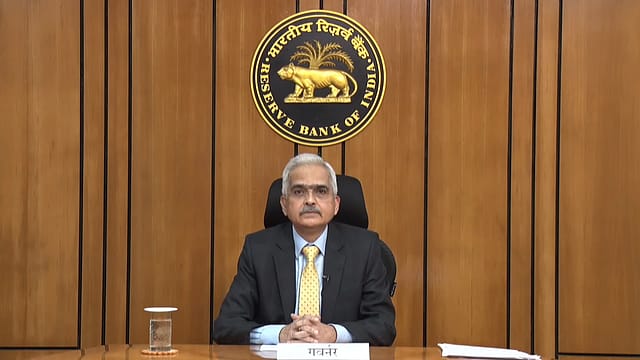

Consumer Price Index (CPI) inflation is expected to remain higher than the upper tolerance level of the Reserve Bank of India until December, according to RBI governor Shaktikanta Das.

"Thereafter it is expected to go below 6% as per our current projections. There will be inflationary pressures, and only in the fourth quarter, we have projected it to go below 6%," Das says in a newspaper interview.

India's retail inflation fell from an eight-year high of 7.79% in April to 7.04% in May, staying above the central bank's upper tolerance limit for the fifth straight month. The drop in CPI inflation came after the government announced a tax cut on petrol and diesel on May 21.

The Reserve Bank had earlier this month hiked its inflation projection for the financial year 2022-23 to 6.7% from 5.7% earlier on the back of rising crude oil prices.

Meanwhile, RBI deputy governor Michael Patra, while delivering a keynote address, says that there are indications that inflation may be peaking.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

"As monetary policy works through into the economy and inflation falls back into the tolerance band by the fourth quarter of 2022-23, it will be playing out of the baseline scenario," Patra says. "It is our hope that required monetary policy actions in India will be more moderate than elsewhere in the world and that we will be able bring inflation back to target within a two-year time span. If the monsoon brings with it a more benign outlook on food prices, India would have tamed the inflation crisis even earlier," he adds.

Patra warned that the world has been overwhelmed by the fallout of geopolitical conflict, which threatens to snuff out a recovery that was hesitantly making its way through multiple waves of the pandemic and multiple mutations of the virus.

India's economic prospects are also challenged by these ongoing developments, and the outlook is darkened and highly uncertain, Patra notes.

Emerging market and developing economies are bearing the brunt of these geopolitical spillovers, Patra says. "Capital outflows and currency depreciations have tightened external funding conditions, and along with elevated debt levels, put their hesitant and incomplete recoveries in danger. Heightened volatility in financial markets and surges in prices of commodities - especially of energy, metals, grain futures and fertilizers – have accentuated risks to growth, inflation and financial stability," he adds.

India too faces major risks, the immediate ones being soaring crude prices and tightening financial conditions, the RBI deputy governor says.

While the external sector is reasonably well-buffered with high levels of reserves and a modest current account deficit, it is prudent to be watchful about the rising intensity and scale of headwinds from the geopolitical conflict which could be overwhelming for all EMEs, including India, Patra adds.

With inflationary pressures from global commodity prices, a number of steps have been taken on the supply side to ease domestic prices, Patra points out. "For June so far, cereal prices have increased but pulses and edible oil prices have registered a decline."