Getting more bite

ADVERTISEMENT

THE AROMA OF DOUGH, chocolate, and nuts is likely to make a visit to one of Cookie Man’s 42 stores in shopping malls and airports across India irresistible. If an outlet cannot activate a customer’s sensory instincts within five minutes, red flags go up at its headquarters in Chennai, where company president S.B.P. Pattabhi Rama Rao and his team must address the issue.

They generally solve the problem, and Cookie Man stores see a steady stream of customers. Australian Foods, the company that brought the brand to India from Australia, plans to grab a 10% share of the Indian cookie business by expanding to 60 outlets by year end.

According to research firm Euromonitor, almost 87% of the overall Indian biscuit market (of which cookies comprise a little over 20%) is shared between Britannia, Parle Products, and ITC. With the entry of Kraft and UniBic, competition will intensify.

Cookie Man’s advantage is that none of them offers freshly baked products. Some local bakeries do, but they lack Cookie Man’s scale and pan-Indian reach. There are always 54 varieties on the shelves, with the lowest-selling 10% replaced annually. “Everyone has a chocolate chip cookie but the taste differs, even in packs of the same brand. We offer global uniformity,” says Rao.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

To ensure this, Cookie Man creates new recipes only at the Australian headquarters in New South Wales, with India the only exception. For example: “We created an eggless cookie recipe when entering Indore,” says M.V.S. Sai Kumar, senior vice president (institutional sales), Australian Foods, who is in charge of new varieties. The innovative Indian eggless cookies have become part of the Australian portfolio and are being exported to other countries. For the Indian operations of an unnamed U.S. fast food chain, Sai and team also create cookies that do not dissolve or bleed colour when put in milkshakes. After their success in India, these creations may be exported to bulk customers in Thailand and Nepal.

Since 2000, Australian Foods has invested almost Rs 40 crore to establish the brand through outlets: It doesn’t advertise. Currently, the Chennai factory mixes 500 tonnes to 600 tonnes of dough annually, to feed an average of 24 lakh customers.

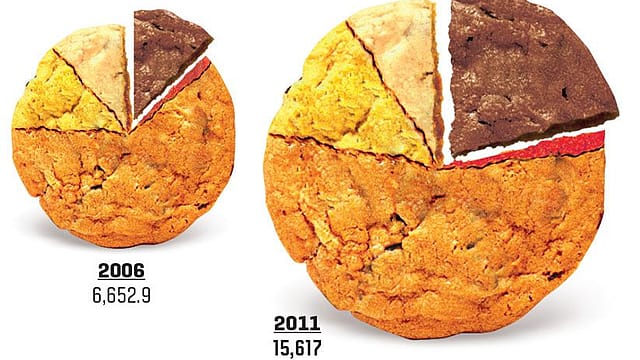

The cookie market has quadrupled from Rs 845.2 crore in 2006 to Rs 3,377.6 crore in 2011, but Cookie Man had to close 12 unprofitable outlets and revisit its store model. As real estate gets costlier and the company looks to increase sales, average store size will be halved to 200 sq ft. The company is also experimenting with 50 sq ft stores and considering high street shops. The first such shop has opened in Bhubaneswar, Orissa, and its success will decide whether more will be opened.

Cookie Man’s menu is growing: Muffins, brownies, and ice creams are already available, and soon puffs, pastries, and chocolates will be too. “In the next two or three years, I expect these products to contribute 50% of our revenue,” says Rao. Only time can tell whether this smart cookie has made a good bet.