The 44-year-old waiting at the lounge of global investment management firm, Capital International, at London’s 40, Grosvenor Place in the summer of 2010, had chutzpah, as later events would reveal. Capital’s director Mark Denning was in his room, studying a $4 billion (Rs 21,736 crore) project from a global pharma company. He could spare a few minutes, at best. His visitor, Ravi Shankar Kailas, was there to pitch for a $5 billion wind power company. Kailas wanted the money and majority control, but wasn’t stumping up any money on his own, and did not have any assets on the ground. And though this was his fifth startup, it was his first foray into energy. All he had was a supplier agreement from wind turbine maker, Suzlon Energy, Rs 10 lakh as incorporation money (the legal costs of setting up the company) and four employees, including the receptionist. Even the valuation he was expecting, around $300 million, was based on future cash flows from 400 MW of wind power that the company, Mytrah Energy, would generate over two years.

Kailas shot straight: He laid down the risks (the direction of wind changing, regulatory shifts affecting tariff, etc.) and rewards (the fixed contract for turbines would insulate costs escalating later) upfront. He argued that wind power would have enough takers as India was energy-deficient—and if the business failed, its assets would still be good enough for investors to recover their capital.

Any other startup would not have made it up to Denning’s door—but Kailas got in, chatted for about an hour, and ultimately Capital picked up 3% in Mytrah for about $10 million at the company valuation of about $300 million. It was what Kailas sought, and Capital did not lower that. In fact, it recently upped its stake to 7.8% by buying out some of the other investors—an endorsement of Kailas’s style of functioning—thereby becoming the largest outside shareholder in the company.

There’s the entrepreneurial way and then there’s the Kailas way. Typically, an entrepreneur has to prove that his business idea is viable, replicable, and scalable. That means he has to bring in the initial capital, demonstrate that the business really works, and get the early customers, before getting investors in.

Those who know Kailas, like G.V. Prasad, vice chairman and CEO of Dr. Reddy’s Labs, say he creates a blueprint of the business that outlines its value proposition, enablers, and drivers in detail. “He understands how and why businesses fail. In his place, I would be more intuitive,” says Prasad, who is a member of Mytrah’s group advisory board.

Kailas, though, pitches just the idea. The common thread in his ventures is zeroing in on a sector that few have entered or been successful in; detailed homework of what he’s up against, getting a few big names on board; hounding investment bank chiefs one on one—he avoids analysts or fund managers who do not have the authority to clear funds or who are under pressure to show returns on capital deployed—moving fast to expand the business, and, yes, walking the big talk. And he does all this with negligible capital of his own.

Call him maverick, nonconformist—or just damn smart. Fortune India spent a few days with Mytrah Energy’s chairman and CEO to figure how he does it and the lessons it holds for other entrepreneurs.

At the core of entrepreneurship is audacity, says Kailas. It intrigued Denning at any rate. No one had seriously tapped into the potential of wind energy. Sure, India has an installed capacity of almost 18 GW, but much of it has come up to earn tax breaks through the government’s accelerated depreciation scheme. Which means wind energy is not core to many players. And here was Kailas pitching to become the largest independent power producer (IPP) with an output of 5,000 MW—that’s one-third the incremental capacity expected to be added between 2015 and 2017.

It’s been like this ever since he turned entrepreneur. Growing up in Hyderabad, Kailas says his father, who owned many companies, always encouraged him to do his own thing. Kailas thought family investments came with emotional baggage and stood in the way of making the right decisions. “It is human nature to protect your money and you tend to become defensive. It restricts risk taking and creative abilities,” he says.

So, back in 1994, he wanted to start a domestic calling cards business, Indus, for which he asked the Department of Telecommunications to sell him talktime at a discounted rate. The department refused, so Kailas turned his attention to the international market. (He says he always had a “thick skin” to negative comments. “Treat them as inputs; do not let them get you down.”)

That meant reassessing his model. “I wanted to enter the [calling cards] business because I was passionate about it and not because it had the potential for making the most money,” says Kailas. “I kept deconstructing and reconstructing it in my mind to see if there was a better way to do it.” In those days, some 4 million people travelled abroad every year and they needed to call home. But there was a quota on foreign currency spending; plane tickets could be bought with rupees but all other expenses (hotels, cabs, etc.) would have to be in foreign currency, and within the limits set by the Reserve Bank of India. Unless the RBI changed the rules, Kailas would not be able to sell the cards to travellers.

For 12 months, Kailas held meetings with RBI officials, and when it finally allowed the use of rupees to buy calling cards outside the stipulated dollar spending limits, he knew he had played his own, small part.

Kailas then wasted no time in approaching international operators such as AT&T and Orange with his unique, zero-inventory model. It worked like this: Card buyers (international travellers) would pay for a certain amount of talktime. Travel agents selling these cards would note their numbers and furnish details to Indus. Computer-generated talktime would then be assigned to the cards and, accordingly, payments were made to the operator from whom Indus bought the talk time. It meant Kailas wasn’t buying talk time in bulk (as was standard practice then) but buying it as he sold cards. Kailas created a network of 800 travel agents to aggressively sell the cards and ended up creating a business worth Rs 20 crore to Rs 25 crore with margins as high as 70% to 75% before he exited.

Russell walls, an independent director on Mytrah’s board and chairman of the audit committee of global insurer Aviva, says Kailas researches how individuals react to pitches, and, by extension, how they would react to his idea. “He had researched Denning and his approach with entrepreneurs,” remembers Walls. Kailas says different situations require different pitches. “You need to focus on different parts of the story for a generalist investor, or a specialist investor; or one who has experience in the sector or geography.” He avoids flashy presentations (“People rarely read presentations before they come to a meeting”), focussing instead on dialogue. “People have short attention spans. I am precise, concise, and knowledgeable about the subject, and have all the key facts at my fingertips.”

Take ZipFone, his venture after Indus. In the late ’90s, Hughes Telecom was building a fixedline network in Maharashtra. It was not in good shape financially, and could not roll out networks or spend on customer acquisition. Worse, given how capital intensive the telecom business was, the parent company (Hughes U.S.) had decided not to pump in money. Hughes desperately needed a ready customer and Kailas knew it. The Hughes team would often breakfast at the coffee shop of Mumbai’s Oberoi hotel, and Kailas made it a habit to be there. He walked over one day, introduced himself, and made friends. Soon he was lobbing them an idea. He would build a payphone business (ZipFone) that would run on Hughes’s lines.

The mobile revolution was far away and there was demand for payphones. A fifth of BSNL’s revenue came from payphones, but those accounted for 0.1% of its landlines. If someone democratised payphones, unlike BSNL, which was highly regulated and often made allotments to keep politicians happy, the business could take off. There were regulatory risks and the uncertainty of whether new-fangled phones would cut ice with customers, but the high realisations per line meant the rewards were great.

Though initially sceptical, Hughes figured that Kailas had thrown it a lifeline. But he needed to find a vendor for the instruments. He approached Godrej Telecom, part of Godrej & Boyce. Its chairman Jamshyd Godrej was looking to shut down the business because purchases from its biggest customer BSNL had plummeted. Kailas needed Godrej to make the phones for around $200 a piece since importing them would cost upwards of $3,000. Godrej needed eight months of advance working capital and a minimum order of 5,000 units. Kailas did not have this money but he managed to convince Godrej it was win-win for both. He started with an order of 5,000 telephones a year, and 5,000 later, to honour his commitment to Hughes for 10,000 lines. He also introduced innovations (display advertising on the screen) as well as a modern look (goodbye black boxes).

Kailas then approached Rohit Phansalkar of New York-based merchant banking firm, Anderson Weinroth & Co. Phansalkar was the first Indian investment banker to enter the Wall Street big league; he had been managing director at Bear Stearns and founding chairman of The India Fund, a multi-billion dollar NYSE listed company. Phansalkar could not believe that someone had caught on to the multi-crore private payphone opportunity in India. Kailas raised $27 million by 2002 in two rounds. At that time, it was the largest private equity funding for any Indian company. Of the first tranche of $10 million, $7 million was put together by a group of about 12 investors and The India Fund managed the investment. “Luck and timing have worked in his favour—he has a distinct advantage of being at the right time and place,” says Phansalkar. He also put Kailas in touch with members of the investor community.

“I did not have a licence, neither did I own a network, but the company was still valued at $100 million for the second round of funding,” says Kailas. “They bet on my ability to execute and deliver on what I was saying.” By 2001-02, ZipFone contributed almost 70% to Hughes business from Mumbai and Maharashtra. In 2005, when Tata Teleservices bought Hughes, its revenue was Rs 140 crore.

The other big theme in Kailas’s playbook is governance. “It is vital,” he says. Investors, he says, are willing to take risks and pardon failures, but not the ones due to bad governance. He kicks off a “credibility enhancement” exercise at the start of any venture by associating with industry leaders who command respect. “The fact that he wants to run a company of global governance standards gives confidence to all the stakeholders,” says Walls.

David Yeung of AIG (the insurance major was an investor) sat on ZipFone’s board. And later, Kailas snagged Suzlon’s promoter Tulsi Tanti as a supplier partner in Mytrah even before he met Denning. For Suzlon, a committed wind energy player was good news. “Ravi is a visionary,” says Tanti. “Unlike others who spoke about 5 MW or 10 MW, he wanted to build 3 GW. I also needed one strong IPP to expand the sector, and he became my anchor.” However, a clause in the contract read that Kailas had to raise the required capital in Mytrah within five months of signing. Kailas managed that through a listing on Alternate Investment Market (AIM) in London in October 2010. Between the five equity investors in Mytrah Energy, Kailas raised $80 million through the AIM listing and another $112 million through mezzanine financing.

Living in London, Kailas had hobnobbed with Angad Paul, son of Swraj Paul, the India-born, Britain-based business magnate. In return for a 10% non-voting stake in the company, Kailas sought the brand name of the Pauls’ Caparo Energy as a credible banner for raising funds. The ‘green’ opportunity was the bait for Caparo.

Not all investors fall for Kailas, though. Of the 150 investors he met, only five agreed to buy his wind story. In 1999, no institutional investor, except AIG, was willing to take a bet on his payphone business. Kailas says with every rejection there was a lesson to be learnt. “If I am not able to convince these guys to put their money behind the venture, the idea is not worth pursuing,” he says.

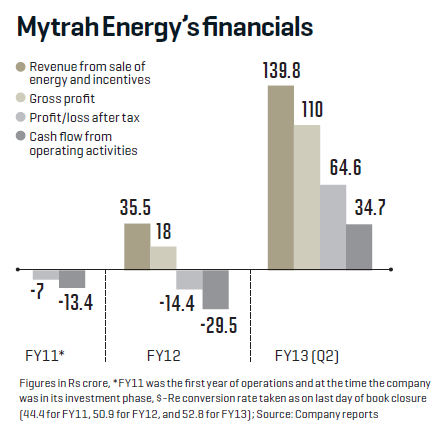

Mytrah fell short by 90 MW of the 400 MW target at the end of last year. But investors, who own 26% of the company through the AIM listing in London, believe the intention is there. “The investors wanted to see whether the model was working or not. Kailas has proved that things can move profitably in the wind power sector,” says Augustine Hothschild, renewables analyst at London-based Mirabaud Securities. Meanwhile, Kailas is set to acquire 60 MW capacity from the energy subsidiary of a Chennai-based auto major. The Rs 350-crore deal has been signed and should be announced any time now.

Leave a Comment

Your email address will not be published. Required field are marked*