At a time when the stock market is on a relentless march, everyone is looking for a margin of safety. Long-ignored PSU stocks have attracted investor fancy and how!

Despite an over 50% surge year-to-date, the Nifty PSE Index is still trading 8% below its all-time closing of January 4, 2008. Many PSU banks are still trading at single-digit price-to-book values. Non-banking PSUs are also trading at a discount to historical averages. This even as many PSUs are offering high dividend yields.

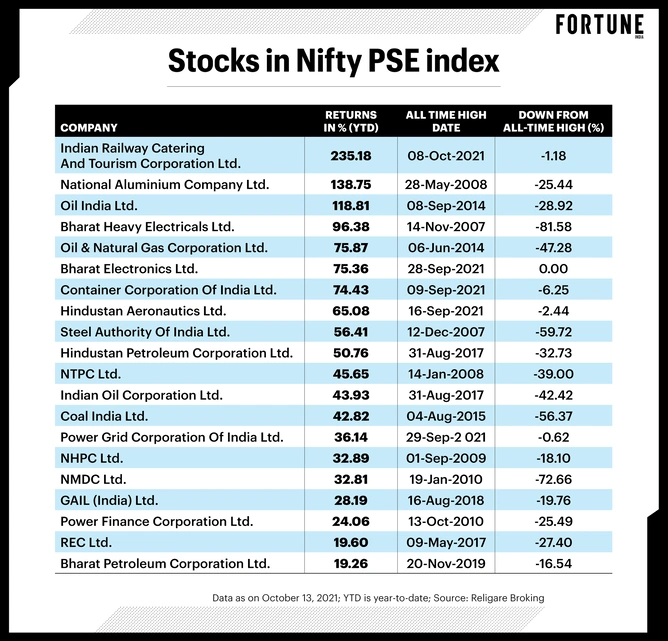

Among individual stocks, National Aluminum Company Ltd. [NALCO] and Oil India have risen over 100% year-to-date, but are still down 25% and 29%, respectively from their all-time high levels. IRCTC tops the chart, but it was listed only in October 2019. It has risen over 1400% till date against its issue price of ₹320.

“Cheaper valuations compared to private counterparts and high dividend yield of PSUs make them ideal re-rating candidates. Historically, the BSE PSU Index has traded at a 50% discount to the Sensex; however, the valuation gap has widened in the past couple of years to 65%. The Sensex and the BSE PSU Index are trading at CY22 P/E of 22x and 8X, respectively. Additionally, improving business prospects and divestment could attract investors towards PSU stocks,” says Vinit Bolinjkar, head of research, Ventura Securities.

What’s Driving The Rally?

The government has an ambitious divestment target of ₹1.75 lakh crore for FY22. It has achieved only about ₹9,000 crore so far in the fiscal. It is on an aggressive privatisation drive, and recently announced the sale of Air India to the Tata group, while LIC IPO is underway. In the coming months, it is likely to sell stake in companies such as BPCL, Container Corp, IDBI Bank, BEML, SCI and Pawan Hans.

The government's capital expenditure plans may also materialise during the second half of FY22. Data shows against the estimated ₹5.54 lakh crore of capex planned for FY22, only Rs 1.28 lakh crore has been achieved so far between April and July 2021.

A jump in commodity prices has also been driving the recent rally in PSU stocks. Post-pandemic demand recovery and limited production of key commodities have led to shortages across the commodity market, says Bolinjkar. A surge in fuel, natural gas and metal prices has been driving stocks such as ONGC, IOC, BPCL, NACL, BHEL and BEL, etc.

According to Bolinjkar, the disruption could be short-term. “Commodity PSU stocks may not sustain the inflation-driven rally. However, India’s economic recovery will aid the overall revenue performance because while average realisation may go down due to decline in commodity prices, sales volume will go up due to higher demand for metals and other key commodities.”

What Should You Do?

Stick to quality names with high-dividend yields, say experts. The Nifty PSE Index has a dividend yield of over 5%, which is more than 9% for PSU stocks such as BPCL and IOC. In comparison, the one-year FD rate at State Bank of India is 4% for the general public and 4.9% for senior citizens.

“Given the high dividend-paying nature of PSU stocks, it can be one of the criteria to pick them. However, one should choose stocks from the universe of fundamentally sound PSUs with strong growth prospects. Avoid buying stocks based solely on privatisation news,” says Ajit Mishra, vice president, research, Religare Broking. Mishra is positive on Container Corp, BPCL and BEML.

The formation of the National Asset Reconstruction Company is also expected to drive re-rating of the space.

“Finance minister Nirmala Sitharaman has indicated that National Asset Reconstruction Co. Ltd. (NARCL) would be operational soon and will acquire stressed assets of about Rs 2 lakh crore in phases. This is expected to reduce the NPA load on PSU banks and free them to rejuvenate their lending. We are expecting a strong re-rating in the sector as most of the PSU banks stocks are still trading at less than 1.0X of their book value,” says Mishra of Religare Broking.

On technical charts, too, the PSU space looks attractive. “At 4,388 as on October 14, the Nifty PSE Index is about 60 points away from the all-time intra-day high of 4,446 hit in October 2017. Once it is breached, the index may remain sideways for a while. Crossing it the second time will take it to roaring highs,” says Vinay Rajani, senior technical and derivative analyst at HDFC Securities.

If one doesn’t want to take direct exposure in stocks, one may also go for exchange-traded funds such as CPSE ETF or PSU Bank Bees ETFs and index funds such as SBI PSU Fund, Aditya Birla PSU Equity Fund or Invesco PSU Equity Fund.

Leave a Comment

Your email address will not be published. Required field are marked*