As Battlegrounds Mobile India sets new sales benchmark, PUBG maker Krafton doubles down on cricket to deepen India play

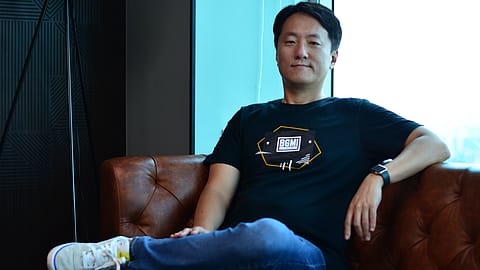

The Indian subsidiary of Korean video games publisher Krafton is now betting on the country’s favourite sport even as it sharpens its India focus in 2025. Fortune India decodes Krafton India’s next big move with CEO Sean Hyunil Sohn.

As IPL 2025 races to the grand finale, cricket fantasy sports advertisements have been ubiquitous across platforms during the last two months. Last year, My11Circle outbid Dream11 to become the official fantasy sports partner of IPL for a period of five years, starting 2024, and agreed to pay over ₹600 crore during the tenure.

According to consulting firm Deloitte’s latest report (Beyond the field: India's sports tech evolution), India's sports technology market saw ₹26,700 crore generated in revenues in FY24, and that number is expected to reach ₹49,500 crore by 2029.

Being one of the fastest-growing markets for fantasy sports, with an estimated fanbase of 492 million for the sport, cricket leads the pack in India. Kabaddi comes second with an estimated 119 million fans. With cricket’s dominance, Krafton India has now jumped on the bandwagon even as its Battlegrounds Mobile India (PUBG) remains one of the country’s most played online games.

Earlier in March this year, Krafton picked up a controlling stake in Pune-based Nautilus Mobile, creator and publisher of the Real Cricket mobile game series, investing over $14 million. Sean Hyunil Sohn, Krafton India’s Bengaluru-based CEO, sees this acquisition as having big revenue potential in a nascent market, given that in the real world, cricket may offer billions of dollars in terms of media rights and sponsorships, while as an e-sport, the market is yet to be developed.

“The existing game from Nautilus Mobile has a good user base; in terms of daily active users, it has a few million, which is sizable by Indian gaming industry standards,” he says.

While Real Cricket 24 already has some officially licensed teams and players of IPL—like Punjab Kings, Mumbai Indians, among others—Krafton now sees its expertise in tech and design contributing to growth. “We want to make the game bigger in terms of revenue base, and we want to see more esports opportunities—from simple cricket games to some multiplayer modes in the game. I think 78% of users are playing only in single-player mode. So, we want to see more multiplayer, which can expand the number of users,” he adds.

The promise India holds for the company comes on the back of what it sees reflected in the numbers. According to the company’s annual results, in 2024, Battlegrounds Mobile India (BGMI) recorded its highest-ever sales, contributing to a 35.7% year-on-year increase in mobile revenue. This year (2025), the company is planning to strengthen BGMI’s presence through large-scale content updates, targeted marketing, and building new IPs.

In its four years of operations in India, the company’s insights into what works in the market are likely to come in handy. “We believe that India is a very unique market. So, there are certain global games which work well in India, but there are a lot of other global games which work in other countries but not in India,” Sohn says.

With PC and console gaming culture largely absent and India having directly jumped onto the mobile phone revolution, the limitations in terms of screen size and playing hours have also shaped the market, adds Sohn. For instance, the company sees games that have a real-world connect—like shooting games, board games like Ludo, and strategy games—to a certain extent work very well, whereas role-playing games, not so much.

While esports may be attracting users, monetisation of games still remains a tricky path for the industry in India. Krafton’s esports foray into India began with the company picking up a minority stake (16.3%) in Nodwin Gaming, a subsidiary of Nazara Technologies, in 2021. It is not just an investment that has grown 3–4x, but Nodwin has also been hosting the BGMI Masters Series (BGMS), an offline esports tournament which is telecast live on Star Sports and other OTT platforms since the investment.

“Although esports itself is not a very profitable business, because for big brands—not just in India, but globally—it’s still an undiscovered brand marketing. There are certain brands, especially smartphone OEMs and mobility companies, that have found the core target audience to be esports,” Sohn says, adding that they are also some of the biggest sponsors of their tournaments.

(INR CR)

Although for popular games like BGMI, it sees esports as good for revenue, for other monetisation opportunities like brand merchandising, in-app purchases, etc., a sizable number of users and popularity become very important metrics.

In 2025, Krafton says its top focus would be to strengthen BGMI’s position in the market—which is its cash cow—along with growing Real Cricket. “I think the next priority is making Real Cricket better and having some newer content for the audience so that we can position it as the biggest cricket game in the country. It already is in terms of numbers, but we want to make the gap even bigger with other competitors so that we can strongly position that and provide a good gaming experience for the cricket game audience,” adds Sohn.