India-UK CETA spurs launch of ₹234 cr Scotch whisky investment fund in Bermuda

A new alternate investment fund ‘The Caledonian Malt Fund L.P.’, was registered in the tax haven of Bermuda just a week before Prime Minister Narendra Modi and UK Prime Minister Keir Starmer officially sealed the deal.

The just signed India-UK Comprehensive Economic and Trade Agreement (CETA) may take some more months for ratification in the UK Parliament and turn operational, but investment experts are quick enough to sense the promise it holds.

A new alternate investment fund ‘The Caledonian Malt Fund L.P.’, was registered in the tax haven of Bermuda just a week before Prime Minister Narendra Modi and UK Prime Minister Keir Starmer officially sealed the deal. The fund considers its USP is the India-UK CETA, which slashed the import duty on Scotch whisky coming from Britain to India from 150% to 75%, with a promise to reduce the duty further in the coming years. The promoters of the £20 million (₹233.61 crore) fund, which invests exclusively in Scotch whisky casks, say the India-UK CETA will open up the world’s largest whisky market, India, to Scotch whisky in a big way.

“This fund is in Bermuda, but the investment will be made in Scotland. It is the only such fund in the world today which is regulated and which is investing into Scotch whiskey as a pure play investment asset class”, says Amit Tripathy, the fund manager. Tripathy leads White Hill Partners, a Dubai-based investment advisory firm.

As the prices of Scotch whisky moderates in India, Tripathy adds, its consumer base and demand will expand. “Today India is the world’s largest whisky consumer. And most of the whisky is produced locally, called IMFL. But in the premium curve of this market, lot of Indian companies buy bulk whisky from Scotland, blend it in India, and they sell it at a premium. The FTA will increase their profitability, and consumer base. It will have a huge impact in a market like India,” he says.

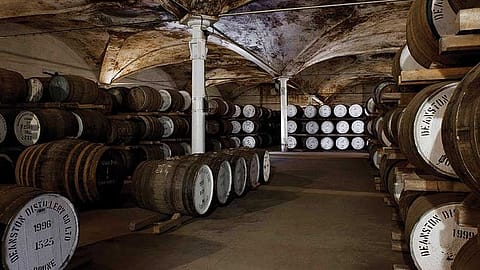

“We will go and buy scotch whisky in wooden casks from investors and distilleries, and it will mature in Scottish bonded warehouses. Every year the quality of that asset will be monitored and once we see the value in the market, we will sell it as bottles or as casks,” Tripathy explained.

An additional advantage for investors here is that direct investment in Cask whisky is exempt from capital gains tax in the UK. Casks that remain in UK government bonded warehouses are also not subject to duties.

Internationally, whisky cask investment is gaining attention as an institutional asset class, from the point of view of providing uncorrelated diversification to an investment portfolio. In a blog on alternative investments published on the Nasdaq website, Samuel Gordon, President of Braeburn Whisky points out that for the right investor, whisky cask investing can be a profitable endeavour. Typically, this is achieved through building a diversified portfolio of whisky casks over a period of time that consists of different distilleries, ages and cask types, such as ex-bourbon or sherry, he says.

Recommended Stories

The India-UK CETA seems to have made pure play scotch also more attractive than it was ever before.