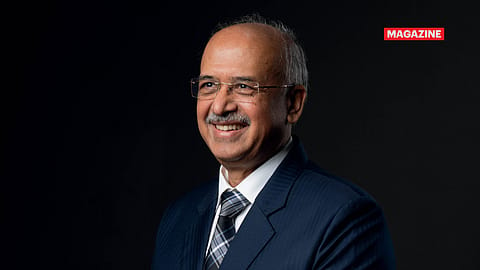

India’s Best CEOs 2025: Dilip Shanghvi, the Gentle Strategist Guiding Sun Pharma

Winner-LARGE: A low-profile visionary with a razor-sharp mind, Shanghvi has been quietly transforming the industry.

This story belongs to the Fortune India Magazine indias-best-ceos-november-2025 issue.

IT ISN’T EASY for celebrity billionaires in India to lead a simple, private life, where every move is not under constant public and media scrutiny. But Dilip Shanghvi is a rare exception. The founder and executive chairman of Sun Pharmaceutical Industries — and the eighth-richest Indian with a fortune of ₹2,18,963 crore according to the 2025 Fortune India-Waterfield Advisors study of India’s Top 100 billionaires — maintains a remarkably low profile. Unlike many of his peers, there’s little public information about his or his family’s lifestyle, private jets, or luxury cars.

But then, this is not by chance, but by choice. In fact, Shanghvi has mastered the art of keeping his personal life out of the spotlight, preferring to live like an ordinary person. “That is how I am,” he says with humility.

While most corporate houses are headquartered in and around South Mumbai, Sun Pharma’s nerve centre, Sun House, is situated on the Jogeshwari-Goregaon (East) border, along the Western Express Highway — about an hour’s drive from Colaba. In 1983, Shanghvi founded the company with a small manufacturing unit in Vapi, Gujarat, along the same route, about three hours away. Over the successive decades, Sun Pharma has grown into one of the world’s leading innovation-led pharma majors, operating in over 100 countries with 40 manufacturing facilities and employing 43,000 people globally. Yet, the only visible transformation is the modern Sun House, a new building acquired in 2014, and the arrival of the Jogeshwari East metro station (an elevated station on Metro Line 7) right in front of the building.

Our meeting with Shanghvi was scheduled on a Friday evening, when Mumbai’s traffic was at its peak. Delayed by a few minutes, we entered the ground-floor conference area — and there he was, walking briskly down the corridor like any other employee. Unlike the hushed reverence one often senses in the corridors of large corporations, there was no palpable buzz among Sun Pharma employees on spotting their big boss. With a gentle smile, he excused himself: “Give me five minutes, I am coming.”

True to his word, Shanghvi returned within two minutes — exactly on time — dressed in simple trousers and a crisp blue-striped white shirt with neatly cuffed sleeves. There was no entourage, no air of power — Shanghvi remains the same person as he was throughout his life — soft-spoken, a man of few words and a down-to-earth personality.

Beneath his calm and understated persona, Dilip Shanghvi is an astute and determined businessman with razor-sharp intelligence, deep market insight, unwavering focus and flawless execution capabilities. There is remarkable clarity in his thoughts, words, and actions — a rare alignment that defines both the man and his enterprise.

FY25 has been a landmark year for Sun Pharma — it crossed ₹50,000 crore in revenues. Over the past three years (FY22-25), net sales recorded a 10.4% CAGR (compound annual growth rate) to ₹52,041 crore, while PAT CAGR grew 49.5% to ₹10,929 crore, according to Capitaline data. Return on capital employed and total shareholder return was 17.6% and 28%, respectively, during the period.

More Stories from this Issue

This pace of growth is nothing new for Sun Pharma — a consistent outperformer that has long stayed ahead of its peers. “Philosophically, we don’t look at conventional business metrics,” Shanghvi explains. “Our goal is to create what patients need and doctors expect. We design our processes around that, and it makes us successful.”

He emphasises that Sun Pharma’s strategy revolves around improving efficiency and reducing costs wherever possible, to ensure it continues growing faster than both the market and the broader industry. Before its landmark $4 billion all-stock acquisition of Ranbaxy Laboratories in March 2015, Sun Pharma maintained a 30-35% net margin. While the Ranbaxy integration, and other factors like intense competition in major markets, brought it below 20% initially, the company has been steadily rebuilding profitability. “After Ranbaxy, our margins came down, but each year we improved by 0.5% or 1%,” Shanghvi says. “It’s not a radical change — just small, steady improvements helping us get back to where we were.” By FY25, Sun Pharma had restored some of its old financial strength, reporting a gross margin of 79.3%, an Ebitda margin of 29%, and a net profit margin of 22.8% — all steadily improving year after year.

From the very beginning, Shanghvi was determined to set himself apart from his competitors. Born in Amreli, Gujarat, he moved to Kolkata at the age of four or five, where he was raised. The son of a wholesale drug distributor, he learnt the fundamentals of the pharma trade from his father’s business. After earning a bachelor’s degree in commerce from the University of Calcutta in 1982, he relocated to Mumbai and, a year later, founded Sun Pharma with just five psychiatric products, including Lithosan, used for the treatment of bipolar disorder.

Right from the start, Shanghvi focussed on high-margin niche therapeutic segments with limited competition, later expanding into specialised areas such as cardiology and gastroenterology. While most of his peers spent only 3-4% of revenues on research and development (R&D), Shanghvi invested over 6% of annual sales in R&D — a commitment that now supports a global team of over 2,900 scientists across multiple research centres.

(INR CR)

In 1997, Sun Pharma made its first international move by acquiring Caraco in the U.S. The company went public in 1994, raising ₹55 crore through an IPO to fund its expansion. One of the most defining chapters in its growth story came in 2007, when it entered into a merger agreement with Taro Pharmaceutical Industries, an Israel-based company with a strong presence in dermatology and operations across the U.S. and Canada. When Taro withdrew from the agreement a year later, Sun launched a hostile takeover battle, fighting legal cases in both American and Israeli courts. In 2010, Shanghvi succeeded in securing a controlling stake in Taro — and it took another 14 years of persistence to gain full ownership in July 2024.

The Taro episode has since become emblematic of Shanghvi’s relentless pursuit of strategic goals and his tenacity in business negotiations. Over the years, Sun Pharma has completed several acquisitions across India, the U.S., and other key global markets, but none as transformative as the purchase of Ranbaxy Laboratories — then India’s largest drugmaker — which gave Sun scale, expanded its U.S. footprint, and added multiple bulk drug manufacturing facilities to its kitty.

“Any acquisition opportunity needs to be strategic,” says Shanghvi. “At the same time, we need to see that it is not a short-term bet, but one that helps us continue to grow in the long term. Another is whether we can run that business better than the current owners.”

Despite his wealth, Shanghvi and his family have refrained from diversifying into unrelated ventures. Their only major investment outside pharmaceuticals has been in wind turbine manufacturer Suzlon Energy. ‘’It is just an investment, I don’t have board positions in Suzlon Energy,’’ Shanghvi says. Then, why be restricted to pharma? It’s because Sun Pharma still has big growth possibilities, he feels. The Indian market is only 2% of the global pharma market. In the U.S., Sun is still a small player (the 12th-largest generics company).

‘’It is simple,” Shanghvi says with a quiet smile. “There are two models of diversification — either you stay in the same business and expand overseas, or you stay within one country and learn to build multiple businesses in that system. I chose the first.”

That clarity of focus defines Shanghvi’s leadership philosophy as well. His mantra is simple: solve a real problem for the customer — and do it better than anyone else. He believes in building teams that share the same mindset and commitment. “An organisation that is not political, one which provides a great work environment — that’s what drives performance,” he says.

Such focus and discipline have helped Sun Pharma evolve into a multi-engine growth machine. Today, 33% of its revenues come from India, 31% from the U.S., 18% from emerging markets such as Romania, Brazil and Mexico, 14% from rest of the world, and 4% from bulk drug sales. In the U.S., Sun’s focus is on innovative medicines and complex generics with high entry barriers.

In India, Sun Pharma leads with an 8.3% share. Continuous efforts are underway to enhance brand equity among doctors, improve productivity of its vast medical representative network, and strengthen product portfolio through in-licensing partnerships. One of the company’s most promising new growth engines is its portfolio of innovative medicines in dermatology, ophthalmology, and onco-dermatology. As of FY25, 27 such innovative medicines are in the market, contributing nearly 20% of total revenues, up from just 7.3% in FY18. The segment has grown at a CAGR of 23% since FY20. Its flagship product, Ilumya — used for psoriasis treatment — alone reported sales of $681 million in FY25.

Now 70, Shanghvi has quietly begun transitioning leadership to the next generation. His son, Aalok, who joined the company in 2006, took over as executive director and chief operating officer in February. His daughter, Vidhi, also an executive director, heads the consumer healthcare, nutrition, and India distribution businesses.

Away from the boardroom, Shanghvi remains grounded and introspective. A lifelong vegetarian and an avid reader, he used to catch most of the new action films released in Mumbai theatres. “Nowadays, I don’t go to theatres; I watch them on OTT,” he says with a chuckle. “I only like action movies — not real-life dramas that make you emotional. Thrillers aren’t real life, so you can relax watching them!”

His heart remains in Kolkata, where many of his closest friends still live. “Twelve of us were planning to visit for Durga Puja this year,” he says, “but we had to cancel because of the weather. Hopefully next year.”

This blend of discipline, loyalty, and simplicity — whether in business or friendship — best captures the essence of Dilip Shanghvi: a man who built one of India’s greatest pharma empires not through noise, but through quiet conviction and enduring focus.