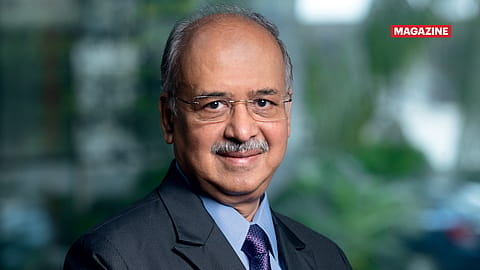

India’s Top 100 Billionaires: Dilip Shanghvi’s big bet on specialty medicines

With specialty medicines contributing 20% to its overall revenues in FY25, Sun Pharma doubles down on innovation as Shanghvi shifts roles.

This story belongs to the Fortune India Magazine August 2025 issue.

DILIP SHANGHVI, often referred to as the ‘The Reluctant Billionaire’, in his biography by the same name, prefers to avoid the spotlight, especially if the conversation pivots around his wealth. Though the soft-spoken entrepreneur — who steps down as MD of Sun Pharmaceutical Industries Ltd on September 1 as part of a structured and forward-looking succession planning process — has left no stone unturned while pursuing his company’s growth since he founded it four decades ago.

Today, Sun is India’s biggest pharma manufacturer and the 12th largest generics company in the U.S. With ₹54,543 crore in annual revenues in FY25, Shanghvi’s specialty generics powerhouse is present in 100 countries, with 40 manufacturing facilities spanning six continents and a global employee strength of over 43,000. Given this, it’s no surprise that Shanghvi ranks as the eighth-richest Indian with a wealth of ₹2,18,963 crore ($25.53 billion) as on June 30, 2025, according to the 2025 Fortune India-Waterfield Advisors study of India’s Top 100 Billionaires.

Though relinquishing the MD’s post marks a shift away from day-to-day operations, in his new role as executive chairman, Shanghvi will continue to focus on strengthening Sun’s specialty portfolio and offer strategic oversights. “As we navigate the evolving landscape of the global pharmaceutical industry, we remain firm in our commitment to growth and profitability, while proactively addressing the increasing risks faced by our company and the industry,” Shanghvi said in his latest message to shareholders.

Shanghvi’s journey as a pharma entrepreneur started off with five psychiatric products and a two-person marketing team in 1983. As the son of a wholesale drugs distributor in Kolkata, medicine marketing was a familiar terrain to start with, though it was his astute business sense and farsightedness that led to the construction of manufacturing facilities and development of drug research capabilities during Sun’s early growth phase in the 1990s. In fact, the first manufacturing unit for tablets and capsules came up in Gujarat in the very first year of the company’s existence. Once Sun established its presence, and went public in 1994, Shanghvi scripted a quick growth story within the country and outside, via a chain of acquisitions, beginning with the U.S.-based Caraco Pharmaceutical Laboratories in 1997.

In fact, Shanghvi’s eye for troubled companies with high potential, and the ability to turn around such businesses made him a poster boy of the Indian pharmaceutical industry. The drug maker’s marquee acquisitions include a controlling stake in Israel-based Taro Pharmaceuticals (a company headquartered in the U.S.) in 2010, and a $4-billion deal which saw Sun acquiring Ranbaxy to become the world’s fifth-largest specialty generic pharma company in 2014.

But then, not all acquisitions were smooth. Sun’s legal fight with Taro’s promoter family was a prolonged one. Fourteen years after Sun acquired a majority stake in Taro, in June 2024, a persistent Shanghvi saw Sun acquiring all the outstanding shares to complete the merger and make the Israeli company a wholly owned subsidiary. “This milestone marks a significant step forward for both organisations, allowing us to effectively leverage each other’s strengths and capabilities,” Shanghvi said at that time.

With over a dozen acquisitions, in-licensing and out-licensing of products, and brand deals, Shanghvi saw the company’s product portfolio spread across therapeutic areas, including neuropsychiatry, cardiology, dermatology, ophthalmology, oncology, diabetology, pain, anti-infectives, and respiratory. Revenue share across key geographies — India (33%), the U.S. (31%) and emerging markets (18%) — illustrates Shanghvi’s strategy of avoiding over-dependence on a single geography, thereby minimising risks.

More Stories from this Issue

Another significant differentiator for Sun has been Shanghvi’s ability to see his company evolve in line with the shifting dynamics of its operating environment. “Early in the decade, the Covid-19 pandemic disrupted medicine availability during a time of critical need, which led us to redesign our supply chains and strengthen local sourcing,” Shanghvi said in the company’s FY25 annual report. “...As healthcare budgets continue to soar... pharma buyers are seeking greater value for their medicine purchases.”

“In response, we are fortifying our branded portfolio with products that enhance the ‘standard of care’, while remaining strongly cost-competitive in the generics business,” he added.

Eye on the future

A key shift has been the growing focus on specialty medicine — a segment central to Sun’s growth plans. This is underscored by Shanghvi’s decision to dedicate himself fully to it after stepping down as MD in September.

(INR CR)

The numbers speak for themselves. The global specialty business contributed 20% to Sun’s overall revenues in FY25, more than double the 8.2% in FY19. While the company’s overall revenue growth stood at 9% in FY25, its global specialty sales were around $1.22 billion, up 17.1% year-on-year.

“Over the last few years, we have made substantial investments to enhance our capabilities in the global specialty business. This includes senior-level hires across functions and the strengthening of our in-house clinical development capabilities. Our specialty R&D spend increased to $154 million in FY25, reflecting our commitment to innovation. Having reached a critical mass, we are poised to increase our investments to scale up in the innovative therapies segment,” Shanghvi said in the annual report.

For clarity, specialty medicines aren’t limited to a specific therapy area — they target chronic, complex, and rare conditions. They made up about 40% of global pharma spending in 2023, rising to 50% in top developed markets, and are projected to hit 55% by 2028. It’s this strong growth that Shanghvi aims to tap with Sun’s specialty push.

Sun’s first major foray into this segment happened in 2012 with the acquisition of U.S.-based DUSA Pharmaceuticals, a dermatology company focussed on developing and marketing its Levulan (aminolevulinic acid HCl) photodynamic therapy (PDT) platform. Today Levulan Kerastick + BLU-U, marketed only in the U.S., is the first and only PDT-approved medicine to treat the face and scalp as well as the upper arms, forearms and hands for minimally-to-moderately thick actinic keratoses (a skin condition). Psoriasis medicine Ilumya, a product whose worldwide rights were acquired by Sun in 2014 from Merck & Co. for an upfront payment of $80 million, is another product in this category. Psoriasis is a chronic skin condition. The rights to commercialise acne medicine Winlevi, a third product, was acquired by Sun through an agreement with Italian firm Cassiopea in 2021.

In June 2024, the European Medicines Agency (EMA) validated Italian-Swiss firm Philogen and Sun’s Marketing Authorisation Application for Nidlegy (a treatment for melanoma and non-melanoma skin cancers). In October 2024, Sun announced a globally exclusive agreement with Philogen for the commercialisation, licensing, and supply of Fibromun, an innovative anti-cancer immunotherapy.

In March 2025, Sun acquired U.S.-based immunotherapy and targeted oncology firm Checkpoint Therapeutics Inc. to gain the rights over UNLOXCYT, the first and the only U.S. FDA approved anti-PD-L1 treatment for metastatic, or locally advanced, cutaneous squamous cell carcinoma (a type of cancer). Last month, it launched anti-baldness drug LEQSELVI in the U.S., following the settlement of a patent dispute with Incyte Corp.

For Sun, “FY26 would be an eventful year filled with launch activities and critical milestones for products under development in the global specialty portfolio,” says Tushar Manudhane, research analyst, Motilal Oswal.

Of the total R&D spend, Sun spent 40% on specialty R&D in FY25. The pipeline comprises seven candidates in various stages of clinical trials. Brokerage firm Prabhudas Lilladher (PL Capital) expects Sun to register mid-to-high single-digit revenue growth in FY26. It factors in $100 million as additional investment planned in FY26 for new specialty launches.

Shanghvi’s primary focus will clearly be to accelerate Sun’s push into the specialty segment. The company’s robust balance sheet, with a strong net cash position of around $3.1 billion as of March 31, 2025, is likely to act as a catalyst. This solid financial footing positions Sun to pursue inorganic growth opportunities, including expanding its global specialty portfolio.

In his recent message to shareholders, Shanghvi outlined the company’s key priorities — at least two of which are directly tied to the specialty business. Firstly, ensuring preparedness for the launches of LEQSELVI and UNLOXCYT, and secondly, advancing the global specialty pipeline. Both priorities align closely with Sun’s long-term growth strategy — a vision Shanghvi plans to shape further with renewed energy in his role beyond MD.

Shanghvi is also part of the Maharashtra government’s Economic Advisory Council, and the chairman of the Gujarat Biotechnology University.

As executive chairman, Shanghvi will continue to provide insights towards shaping Sun’s long-term strategy, but, as a recipient of the prestigious Padma Shri in 2016 for his contributions to Indian trade and industry, he will continue to inspire generations of entrepreneurs through the role he has played in the globalisation of Indian pharma.