Macroeconomic turbulence back to haunt Budget 2025

With consumption, exports and private investment down, the government needs to act on war footing to boost economic growth.

This story belongs to the Fortune India Magazine January 2025 issue.

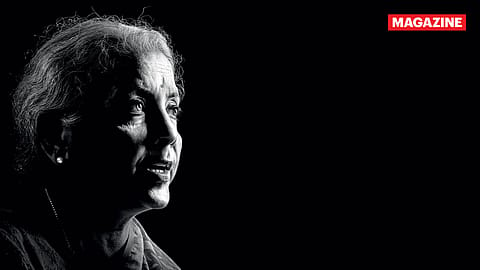

AFTER ALMOST FOUR YEARS, macroeconomic turbulence is back to haunt the finance ministry ahead of the Union Budget. Finance minister Nirmala Sitharaman and the mandarins at North Block will have to tread cautiously on the path of macroeconomic stability, ensuring a perfect balance between growth and fiscal prudence.

In Q2 FY25, India’s gross domestic product (GDP) growth slumped to a seven-quarter low of 5.4%, while inflation eased to 5.48% in November after going through the roof in October (6.21%), jettisoning the monetary policy headroom to spur economic growth. Consumption, exports and private investment, too, have taken a backseat. On inflation, the FM has already pointed out that global wars are stoking price rise and no country, despite best efforts, is successful in dousing the inflationary conflagration.

“Inflation does not respect borders. Inflation is so contagious. No country’s effort today is completely successful. Therefore, the primary cause I would think is the disruption, the war. And, as a result, the world is facing a challenge, which in many ways is reflecting in our economy,” Sitharaman said at the CII’s Global Economic Policy forum in New Delhi on December 12.

The regime change in the U.S. and the impending tariff war are only expected to add to the uncertainty. “While current global growth forecasts show stability, possible policy shifts in the U.S. starting January 20 cloud visibility. Uncertainty in global trade and financial markets may remain elevated; we also expect higher global rates and U.S. dollar/rupee volatility,” says Axis Bank’s 2025 Outlook report. The likely trade turbulence along with the flight of capital from equities have wilted India’s exchange rate, with the rupee touching an all-time low of 85.12 against the greenback on December 19, on the back of hawkish Fed outlook.

The current account deficit, meanwhile, came in at $9.7 billion (1.1% of GDP) in Q1 FY25, against a surplus of $4.6 billion in Q4 FY24, but analysts are not reading too much into the numbers. Bank of Baroda said in a recent report the current account deficit is likely to remain under “manageable levels” in the current and the next, owing to benign global crude oil prices.

That, in a nutshell, is the macroeconomic backdrop against which Budget-making is currently underway. The silver lining — there is a palpable sense of rebound in the coming quarters.

“The growth rebound we expect for India, with an above-consensus forecast of 7% in FY26, is primarily dependent on local policies. The H1 FY25 slowdown was driven by unintended fiscal and credit tightening. Fiscal spending is rising, and the CRR cut should ease growth headwinds due to shortage of money. Tailwinds from back-ended fiscal spending in FY25 and some further macro-prudential easing to aid credit growth should help,” the Axis report says.

More Stories from this Issue

While one would hope for a quick recovery, concerns are piling up. Beyond the headline numbers, the gradual decline of the share of consumption in GDP, higher rural food inflation over urban, decline in gross fixed capital formation’s share in GDP, low utilisation of the capital expenditure budget by key ministries such as highways and railways, tepid exports, and lacklustre private investment are some key macro factors that need immediate attention from the government. In fact, the government will have to take a calibrated approach towards mending the macros spread over a period of time, but with a definite timeline.

“One of India’s biggest challenges is navigating geopolitical uncertainties. These are likely to stay and will determine wealth and power differentials, realignment of supply chains, and the energy transition,” says Rumki Majumdar, economist, Deloitte India.

The Consumption Question

The second-quarter corporate results brought the consumption agony in focus. The equity market tanked and valuations corrected to some extent, particularly in large-caps and PSUs leading the bull charge. The consumption slump did not happen overnight though. It had been building over the past couple of years, data reveals. It only erupted in Q2 FY25.

(INR CR)

Private final consumption expenditure (PFCE), a measure of consumption in the economy and a major component of GDP from the expenditure side, has declined to 55.80% in FY24, from 58.10% in FY22. PFCE stood at 56.46% of GDP in H1 FY25.

“Historically, PFCE growth was closely aligned with GDP growth until FY23 when a notable divergence occurred. During FY24, PFCE growth slowed to 4%, down from 6.8% in the preceding year. Following a sharp recovery post-Covid, PFCE growth has progressively declined over the past two fiscals. This moderation was evident in essential categories such as food, clothing and footwear, transport, and housing, which collectively comprise a significant portion of household expenditure,” says a Punjab National Bank report, titled: Divergence between GDP growth and private consumption.

“Divergence in PFCE growth signals underlying challenges in consumer spending patterns. Addressing these challenges will be crucial for sustaining economic momentum, particularly through targeted policies to stimulate both rural and urban demand,” it adds.

In fact, the consumption trend may get further skewed if changing patterns in rural food inflation are not addressed immediately. In line with the last couple of months, November’s food inflation in the rural sector (9.10%) was higher in comparison with the urban sector (8.74%). In November, prices of cereals, pulses, fruits, vegetables, oils and fats grew at a faster rate in rural India. Vegetable prices grew 30.2% in rural areas, compared with 28.13% in urban areas, according to data from the Ministry of Statistics. Similarly, oil prices witnessed a higher price hike at 14.88% in the rural economy, compared with 10.27% in the urban sector. A persistent rise in rural prices will dent demand in the segment, which will impact consumption.

Capital Formation Slows

Yet another worrying trend creeping into the macro underbelly is the inversion in the capital formation trajectory. Capital formation, or spending on fixed assets in the economy, has been one of the key mainstays of the economy since the pandemic. It kept growth intact while economic engines remained tepid. In Q2 FY25, gross fixed capital formation (GFCF) growth more than halved to 5.4%, compared with 11.6% a year-ago. Besides, the share of GFCF in GDP is declining as well — from 34.3% in FY12 to 30.8% in FY24 — indicating that the private sector has largely been a fence-sitter when it comes to investments, while the government has been doing most of the heavy lifting in the last couple of years.

Capex Utilisation Loses Steam

Against the budget estimate (BE) of ₹11,11,111 crore towards capital expenditure for FY25, the actual expenditure till October stands at ₹4,66,545 crore, or 42% of BE, for FY25. Till October last year, capex utilisation by ministries was significantly higher at 54.7% of BE for FY24. Key ministries, including highways and railways, the flag bearers of the government’s capital expenditure programme for the last couple of years, have done lower utilisation of the funds allocated to them. Total capital spending by both has come down by about ₹27,500 crore till October this year.

According to government data, the Ministry of Road Transport and Highways spent ₹1,55,963 crore till October, compared with ₹1,71,593 crore during the corresponding period of the previous fiscal. The budget estimate for highway capex this year is ₹2,72,241 crore. Similarly, during the period, the railway ministry spent ₹1,55,963 crore, compared with ₹1,56,711 crore during April-October FY24. The railways has been allocated a budget of ₹2,52,000 crore for the current fiscal.

There are multi-layered rumblings in India’s macroeconomic firmament. Perhaps it is time for North Block mandarins to keep a close ear to the ground and use the upcoming Budget and off-Budget policies as a tool for just-in-time remedial measures.