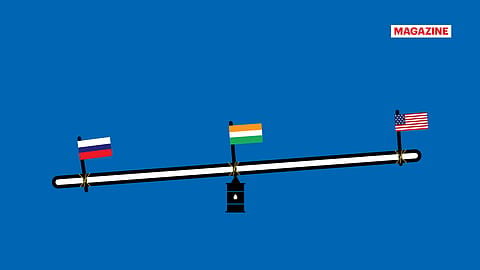

Russian oil and India’s double trouble

India faces twin problems — either risk U.S. ire by continuing to buy Russian oil or inflate its oil import bill by returning to traditional suppliers.

This story belongs to the Fortune India Magazine indias-best-ceos-november-2025 issue.

AS GLOBAL GEOPOLITICS reshapes energy trade routes, India finds itself walking a delicate tightrope — balancing its economic advantage from cheap Russian crude with the diplomatic demands of the West.

India’s energy partnership with Russia is not a new phenomenon. In 2019, a consortium of state oil firms made two major upstream investments in Siberia and the Arctic. ONGC Videsh Ltd (OVL), Indian Oil Corp. Ltd (IOC), Oil India Ltd, and BPCL’s Bharat PetroResources Ltd (BPRL) jointly bought a 49.9% stake in Vankorneft for $4.2 billion. Around the same time, Oil India, BPRL, and IOC invested $3.6 billion in Taas-Yuryakh Neftegazodobycha, subsidiaries of Russia’s Rosneft.

These followed OVL’s earlier stakes — $1.6 billion in Sakhalin-1 (2001) and $2.6 billion for Imperial Energy (2009). Collectively, India’s public sector upstream companies have invested over $12 billion in Russia’s oil and gas sector.

These ventures generated solid income. That was until the Russia–Ukraine war. Tightened sanctions and disrupted financial flow saw Indian companies struggling to repatriate profits. For many, the money has been stuck in Russian accounts for over two years, say sources.

The challenge grew sharper after the EU, the U.K., and the U.S. imposed sweeping sanctions on Russia’s energy sector. Following the U.S. sanctions, IOC, BPCL, HPCL, and private majors like Reliance Industries and Nayara Energy, began sourcing Russian barrels via intermediaries instead of directly from producers.

The stakes are high. Experts estimate that if India halts all Russian crude imports, the country could lose $3.2-6.4 million in daily benefits — a steep price for compliance.

Benefits of Russian oil

More Stories from this Issue

If India was importing less than 1% of its crude requirements from Russia before the Russia-Ukraine war, the figures leapfrogged to an average of 1.73 million barrels per day (bpd) — about 30–35% of total imports — between January and September 2025, the highest share from any single nation. In value terms, Russia accounts for 30.01% of India’s crude import bill, followed by the U.A.E. (15.21%), Iraq (13.62%) and Saudi Arabia (11.40%).

The attraction lies in price. Russia’s Urals blend, a heavier, sour crude benchmarked against Brent, typically trades at a discount. After the Ukraine war, Urals crude was sold $8–10 per barrel cheaper than Brent. The gap has narrowed to $2–4, but is still significant, say sources.

A Kotak Institutional Equities report estimates that since April 2022, Russian oil imports have saved Indian refiners nearly $16.7 billion, with average discounts of around $4.7 per barrel in FY26 alone.

Strategic tightrope

(INR CR)

U.S. President Donald Trump claimed that India has agreed to “stop” buying Russian oil and would cut imports to “almost nothing” by year-end. New Delhi, however, has avoided confirming any such move.

The ministry of external affairs maintains that “safeguarding the interests of Indian consumers in a volatile energy scenario remains the government’s consistent priority.” The policy, in essence, allows oil marketing companies to source crude based on commercial viability and national interest.

After Operation Sindoor and threats of U.S. trade sanctions, India has been increasing its bilateral trade with Russia. On the other hand, the Trump administration is using Russian oil as a tool to engage with India and reach a trade pact beneficial to the U.S., as negotiations are going on.

Refiners such as RIL and IOC have stated they will comply with any applicable sanctions while maintaining legitimate supply relationships. Energy analysts warn that if India stops buying Russian crude, the resulting supply realignment and rising regional demand, amid ongoing sanctions on Russian oil, could push global prices higher. That, in turn, would inflate India’s import bill and erode much of the savings achieved via Russian discounts in recent years.