Tata Motors Accelerates with Big EV Bet

Tata Motors plans to invest ₹33,000-35,000 crore in the passenger vehicles business between FY26 and FY30. Of this, ₹16,000-18,000 crore is earmarked for expanding the EV portfolio.

This story belongs to the Fortune India Magazine september-2025-the-year-of-ev-launches issue.

WHEN N. CHANDRASEKARAN took charge as chairman of Tata Sons in 2017, the passenger vehicles (PV) business of Tata Motors was staring into the abyss. Losses had ballooned to nearly ₹4,000 crore annually, market share had slipped below 5% and bankers whispered a single piece of advice: shut it down.

Chandrasekaran, however, saw a different future. His argument was simple: while market leader Maruti Suzuki commanded over 50% of the Indian car market, the second player, Hyundai, held less than 20%. The gap between 5% and 20%, he reasoned, was not insurmountable — especially for a company that had once dominated Indian roads with models like Indica, Sumo, Estate, and Safari. He was equally convinced that the industry’s long-term destination was electric, as sustainability became a global rallying cry and pollution weighed heavily on Indian cities.

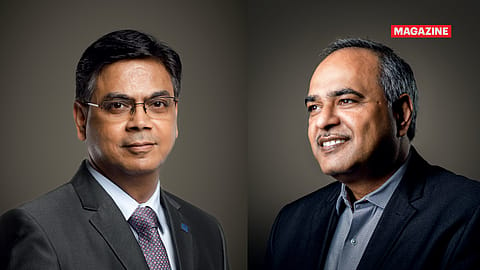

To fast-track this transition, he pulled together a crack team of 50 specialists drawn from across the Tata group—Tata Motors, TCS, Tata Power, Tata Elxsi, Tata Technologies, and Tata AutoComp—and stationed them in Sanand, Gujarat. He entrusted Shailesh Chandra, current MD of Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, with the task of building India’s first credible electric car. At the same time, Chandrasekaran pushed for a group-wide collaboration to build the charging ecosystem.

The bet paid off. Tata Motors emerged as the country’s largest electric four-wheeler maker, offering the broadest mass-market portfolio: the Nexon.ev, the Tigor.ev, the Tiago.ev, the Xpres-T for fleet buyers, the Punch.ev, and the recently launched Curvv.ev. In FY25, the company sold 57,581 EVs according to VAHAN data — an 11% drop from the previous year. Consequently, its market share fell sharply from 70% to 53%. The management acknowledges the rising competition, particularly from Mahindra & Mahindra’s newly launched XEV 9e and BE 6, and from JSW MG Motor, whose Windsor has become India’s best-selling EV.

Competition, however, is hardly new to the $180-billion Tata group. Shailesh Chandra is unfazed. “We have announced that we will be introducing seven new nameplates, including two ICE-powered cars and two EVs besides the ICE SUV Tata Sierra and premium EVs built on GEN 3 architecture — Avinya and Avinya X. Our existing models will also undergo 23 updates, including facelifts, powertrain upgrades and special editions,” he says. The plan is bold: expand the PV portfolio to 15 nameplates by 2030. “With this strategy, we aim to future-proof our line-up, elevate the ownership experience, and continue meeting the evolving aspirations of Indian customers through intelligent, tech-forward, and sustainable mobility solutions.”

The company has set ambitious goals: grow the PV market share to 18-20% with annual volumes of over one million units and ensure that EVs contribute more than 30% of total sales. Product innovation, ecosystem development, and business transformation form the three pillars of this strategy.

The investment is equally weighty. “Between FY26 and FY30, we plan to invest ₹33,000-35,000 crore in the PV business, including EVs. Of this, ₹16,000–18,000 crore is earmarked specifically for our EV portfolio, which has already achieved Ebitda-level profitability,” says Chandra.

More Stories from this Issue

But Tata Motors is not just a car company. Its commercial vehicles (CV) business continues to be a heavyweight, holding 37.1% market share in FY25, with dominance in heavy goods vehicles, though down from 41.7% three years ago. Girish Wagh, ED and head of CVs, explains the shift: “Over the past three years, we have pivoted from ‘market share at any cost’ to profitable growth. This enabled the CV business to deliver its highest ever profit of ₹6,649 crore in FY25.”

Meanwhile, British arm Jaguar Land Rover (JLR) has sharpened its luxury playbook under the “Reimagine” strategy. Jaguar will transition into a fully electric luxury marque from 2025, while six pure-electric Land Rovers are planned over the next five years, with the entire line-up going all-electric by 2030.

To bring sharper focus, Chandrasekaran has also pushed restructuring. “Each entity can now pursue tailored growth strategies aligned with its market dynamics. This positions each business to chart its own course with greater clarity and resilience, thereby supporting sustainable and profitable growth over the long term,” says group CFO P.B. Balaji, recently elevated to CEO of JLR.

By FY20, the PV business was in free fall. Market share had plunged to 4.5%, the company had slipped to sixth position in India, and customer perception had eroded, with Tata cars being dismissed as taxi fleet workhorses. Then came the pandemic, a crisis that Shailesh Chandra calls “a reset”.

(INR CR)

“During this period, we reimagined the brand and business fundamentals to accelerate growth and build resilience,” he recalls. “We reinforced our brand pillars — safety leadership, stylish design, and rich tech features — promoted actively through integrated marketing campaigns.”

Working with limited funds, Tata Motors maximised its portfolio by targeting micro-markets with curated variants, competitive pricing, and wider powertrain choices. It adopted the “New Forever” philosophy, constantly refreshing products. The turning point came with the Tata Punch, India’s first sub-compact SUV, which captured the imagination of mass buyers and, by 2024, became the country’s highest-selling car. Dealer profitability, once dismal, was revived. In 2020, only one-third of dealers made money. Tata Motors took a bold step — raising vehicle prices and passing on the increase to dealers. Combined with coordinated support, over 90% of the network is now profitable and deeply invested in the brand.

Financial discipline followed. Years of cash burn gave way to profitability through tight cost control, product mix management, and efficiency gains. The company also navigated the semiconductor crisis by re-engineering supply chains, collaborating closely with suppliers, and securing alternative sourcing.

EVs were the game-changer. Tata became the first mover with a mass-market EV in 2020, followed by twin-cylinder CNG technology. Market share climbed from 4.5% in FY20 to over 13% in FY25. Volumes grew from 130,000 units to 550,000 units, a 4.5-fold rise in revenue. Ebitda improved by ₹4,000 crore. The company now commands over 75% of India’s EV fleet.

Financial transformation has been just as dramatic. “Over the past five years, Tata Motors has executed a disciplined and strategic financial transformation, culminating in the company becoming net automotive debt-free in FY25, with a net cash position of ₹1,018 crore,” says Balaji.

India’s EV industry faced the classic chicken-and-egg problem — no charging or supply chain ecosystem because of low volumes, and low volumes because of the lack of ecosystem support. The Tata group cracked the puzzle with Tata UniEVerse, a collaborative model drawing on Tata Power for charging, Tata AutoComp for supply chains, and other group companies for development.

The product rollout reflected this strategy — from fleet-focussed Xpres-T to mass-market Nexon.ev, Tiago.ev, Punch.ev and Curvv.ev, and the flagship Harrier.ev with a 500-km real-world range. Tata also launched Mega Chargers at strategic highways and urban locations.

Cars are now software-centric. A decade ago, Tata models had barely 10 electronic control units; the Curvv has over 25, seamlessly integrated. Vehicles receive over-the-air updates, and the Harrier.ev is the company’s first software-defined vehicle (SDV), powered by the Tata Intelligent Digital Architecture Layer (t.idal). “The next generation of SDVs will transform the car from being primarily a mechanical machine to becoming software-on-wheels,” says Chandra.

India’s commercial transport market is changing rapidly as well. Customers demand efficiency, safety, and holistic solutions, not just trucks. Tata Motors responded with end-to-end fleet management, digital tools like Fleet Edge, and over 100 customer success centres. Its electric buses — over 3,600 deployed — have clocked 340 million km.

Green mobility is at the heart of CV investments, with over 40% of tech capex directed at alternative fuels, EVs, LNG, and hydrogen. “We are committed to net zero by 2045, backed by a robust multi-fuel roadmap. Hydrogen fuel cell technology is the destination for zero-emission, long-haul mobility,” says Wagh. CVs are becoming smarter, with ADAS features such as collision mitigation, driver monitoring, and hill-start assist, while cabins are designed for fatigue-free driving.

To simplify operations, Tata Motors merged its vehicle financing arm into Tata Capital and separated PVs/EVs from CVs. After the demerger, Tata Motors will exist as two independently listed entities — one for CVs and one for PVs, EVs and JLR. The accounting separation took effect in July 2025, with operational separation slated for October, and full demerger by December.

“The PV and CV businesses have developed distinct operating models, ecosystems, and technology roadmaps,” says Chandra. “This unlocks the ability to accelerate investments in electrification, software-defined architectures, and advanced safety.”

Meanwhile, Tata Motors has signed an agreement to acquire the CV and industrial powertrains business of Iveco N.V. “By combining Tata Motors’ expertise in frugal engineering and strong presence in emerging markets with Iveco’s premium positioning in Europe and Latin America, the partnership unlocks significant synergies,” says Wagh.

Tata Motors today is unrecognisable from the company Chandrasekaran inherited in 2017. Passenger vehicles are back in contention, EVs are a market leader, JLR is doubling down on luxury electrification, CVs are profitable and future-ready, and the balance sheet is debt-free.

Yet, there are challenges. Brokerage Jefferies is worried about the slowdown in the Indian CV market and rising competition in the electric PV space. Citi also expects some near-term headwinds for the PV business, particularly within the EV segment. Another brokerage CLSA said in its recent report that the luxury PV market will be affected by macroeconomic factors, including the U.S. tariffs. Incidentally, JLR has a large volume of products in the segment.

But the bigger battle lies ahead. Staying ahead in engineering, technology, design, and customer experience will decide if Tata Motors can not only compete but lead in the defining decade of global mobility.