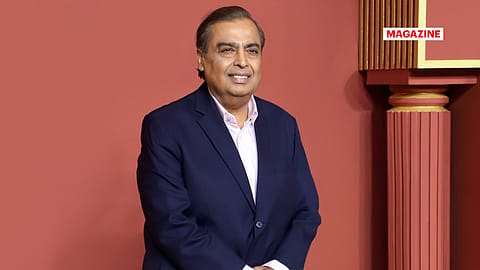

India’s Best CEOs 2025: The Incredible Vision of Mukesh Ambani

Winner- BEST OF THE BEST: Reliance Industries is fuelling India’s future with conviction, innovation, AI, and renewables.

This story belongs to the Fortune India Magazine indias-best-ceos-november-2025 issue.

PEOPLE OFTEN ASK Mukesh Ambani, “How does Reliance keep doing so much?” His answer is elaborate, yet grounded in conviction. “We have a formula that is better than caffeine,” he says with a smile.

At the heart of that formula lies one powerful element. “Our own internal conviction that we can do it,” he explains. “We have leaders who handle refinery shutdowns, 5G rollouts, and [groom] teenage kids, all in the same week,” Ambani told the families of Reliance employees during the Diwali celebration at the Jio World Convention Centre in Mumbai. “We don’t say impossible. We just say, give me two weeks and I will make it possible.”

It was Ambani’s conviction that helped an oil refining and petrochemicals company (B2B) transition into a consumer-facing giant. Since the launch of Jio’s telecom services in 2016, he has picked up the pace — recasting Reliance Retail, bringing in global investors in telecom and retail, launching and listing the financial services business, and beginning work on five Giga factories for renewable energy and battery manufacturing. Other projects taking shape include Reliance Intelligence and humanoid robotics. The biggest of the lot, however, is the initial public offering (IPO) of Jio.

It’s no surprise that RIL’s revenue multiplied 14 times in the last 20 years. The conglomerate reported a net profit of ₹69,648 crore in FY25, a three-year CAGR of 4.7%, and net sales of ₹9.6 lakh crore, a growth of 11.50%, according to Capitaline data. Consumer businesses (retail and telecom) contributed over 50% to the company’s total Ebitda (earnings before interest, taxes, depreciation and amortisation) in FY25.

Artificial intelligence (AI) will be the key to RIL’s future. Reliance Intelligence has already partnered with Meta and Google for AI services. “Our goal in the coming years is absolutely clear — to make Reliance a deep-tech, AI-first digital company, a leader not only in India, but in the world,” Ambani said. He told employees to learn, unlearn, and relearn in the AI era. “AI will not replace people, but people who use AI will replace those who don’t.”

“We are building the next generation of Reliance, where our factories learn from data, our networks think faster than ever before, and every employee — from refinery to retail — works with technology as naturally as breathing,” he elaborated.

Ambani has also set in place the future leadership. His children — Akash, Isha, and Anant — form the leadership team. “They are three bodies but one soul, who now take on the mantle of leading Reliance, and are the first among equals with the young people to take Reliance to greater heights.”

More Stories from this Issue

THE YEAR GONE BY

According to Ambani, Reliance is a “company of engineers.” “From pure textile engineering, I have seen the best chemical engineers, the best energy specialists, [and] the best material specialists in the world work for us,” he said. “We have the best technologists in data and intelligence,” he added. RIL employs over 600,000 people from over 60 nationalities.

He believes Reliance has a once-in-a-lifetime opportunity to be among the Top 20 companies globally — not just by size, but by innovation and impact as well. “We have made our refinery operations even more sustainable and are becoming one of the largest players in recycling,” he told senior employees and their families. Reliance is building the world’s largest Giga factory — over 10,000 acres at a single location in Jamnagar, four times the size of Tesla’s, he said. Among other achievements, Jio crossed 500 million subscribers in less than nine years of operations. It serves broadband to over 25 million households. “By next Diwali, it will be 50, and two years from now, we will [serve] 100 million homes,” he said. With average revenue per user (ARPU) of ₹211.4 and average data consumption of 38.7 GB per user per month, Jio is embedding itself deeper into India’s digital fabric.

Jio is now ahead of China Mobile (China) and T-Mobile (the U.S.) — and that, Ambani said, “is what Dhirubhai would have wanted.” The telecom giant, led by Akash Ambani, is slated to list by mid-2026, with analysts valuing the company at $125–150 billion. Jio Platforms Ltd (JPL), the holding company for the telecom and software businesses, posted a profit of ₹26,120 crore on a gross revenue of ₹1.50 lakh crore in FY25.

(INR CR)

Though the IPO of Reliance Retail has not been announced, there are plans to take it public soon after Jio. “Our stores, brands, and partners have made Reliance Retail the most trusted name in Indian homes, with 1.5 billion transactions in a year,” said Ambani.

The holding company of the retail business, Reliance Retail Ventures Ltd (RRVL), posted a profit of ₹12,388 crore and a gross revenue of ₹3.31 lakh crore in FY25. Ambani’s daughter Isha leads the business. RRVL, which expanded to 19,821 stores from just over 2,600 in the last 10 years, has embarked on a clean-up journey since the last year. It shut down 2,155 unprofitable stores while opening 2,659 new ones with larger spaces and improved offerings in FY25. Insiders say Ambani looks for improvement every single day.

The FMCG vertical, a recent addition, has already crossed ₹11,450 crore in revenue, with the introduction of brands such as Spinner (sports drinks) and Velvette (personal care). Digital platforms such as JioMart now span over 4,000 pin codes, driving hyperlocal delivery and online sales.

The oil-to-chemicals (O2C) business posted a resilient performance despite considerable volatility in energy markets during the last fiscal. Significant demand-supply imbalances in downstream chemical markets led to multi-year low margins. “Our business teams ensured optimisation of integrated operations and feedstock costs to enhance margin capture across value chains,” said Ambani in the FY25 results statement. The oil and gas business recorded its highest-ever annual Ebitda last fiscal, led by higher production from KG-D6 and CBM (coal bed methane) blocks.

Global macroeconomic headwinds and volatility in energy markets affected RIL’s refining and petrochemical margins, dragging its share price. Despite these hurdles, the company’s consumer-facing businesses cushioned the impact, reaffirming its strategic pivot from fossil fuel dependency.

GREEN AND DIGITAL DRIVE

Ambani’s growth plan has always been audacious, yet calculated — doubling the size every four to five years. RIL is not just scaling existing businesses; it is also seeding new growth engines in renewables, FMCG, and financial services.

In Jamnagar, RIL is constructing five Giga factories focussed on solar PV modules, fuel cells, green hydrogen, batteries, and power electronics. A ₹75,000-crore investment backs this AI- and robotics-enabled ecosystem.

The merger of JioCinema and Disney+Hotstar into JioHotstar — where Reliance holds a 63.16% stake — marks a decisive play in India’s OTT space. In the first half of FY26, the platform posted ₹18,454 crore in revenue and ₹1,903 crore in net profit, underscoring the monetisation potential of digital entertainment.

CAPEX ACCELERATION

Ambani plans to channel vast capital into the next wave of structural growth drivers — renewables, FMCG, and AI. In Q2FY26 alone, the company invested ₹40,000 crore, compared with ₹29,875 crore in the previous quarter, backed by a strong balance sheet, robust operating cash flows, and substantial cash and cash equivalents.

RIL’s net debt stood at ₹1.19 lakh crore as of September 30, 2025, translating into a conservative leverage ratio comfortably serviced by the group’s steady operational profits. Gross debt was around ₹3.48 lakh crore, offset by high cash and cash equivalents of ₹2.30 lakh crore, resulting in a healthy net debt position.

This financial discipline has aided capital spend. In the first half of FY26, RIL posted an Ebitda of ₹1.08 lakh crore and a net profit of ₹52,827 crore. The numbers fuel Ambani’s ambition to cross ₹1 lakh crore in net profit in FY26.

The most capital-intensive component of the capex cycle is the Dhirubhai Ambani Green Energy Giga Complex in Jamnagar — the heart of RIL’s net-zero emission strategy. The company has already commissioned four PV module lines, with the first cell line expected to go live soon. Work on the battery energy storage Giga factory is progressing rapidly, with significant on-site progress for a 40-GWh manufacturing capacity and production line equipment installation already underway.

Solar project development across the 550,000-acre site in Kutch is also advancing steadily, with engineering, feasibility studies, and land development in progress. RIL expects to begin commissioning solar power generation during the first half of next year, primarily for captive use and green fuel production. It is building an end-to-end energy ecosystem encompassing round-the-clock power supply and green chemicals, which is expected to be fully operational within the next four to five quarters.

The conglomerate began rolling out PV modules seven months ago from its new facility in Jamnagar, Gujarat. The first phase of its integrated solar manufacturing plant is on track for completion in the coming quarters, targeting 10 GW of renewable energy output for internal use. Within the Jamnagar complex, RIL is also developing facilities for green hydrogen and power electronics. The solar initiative forms part of RIL’s renewable strategy that includes energy storage and green hydrogen. It is also constructing a 30-GWh battery plant in Jamnagar.

The company is also developing an AI ecosystem under Reliance Intelligence, which will create AI products and services for consumers, enterprises, and small- and medium-sized businesses. The FMCG portfolio is expected to grow on the back of new product launches and acquisitions.

Ambani’s strategy rests on four timeless principles inherited from his father, Dhirubhai Ambani: think big, challenge norms, innovate relentlessly, and play the long game. From hydrocarbons to hyperconnectivity, and now from retail dominance to renewable leadership, RIL’s journey mirrors India’s economic transformation.