Lower taxes, bigger wallets: Sitharaman urges industry to step up and engage more with govt

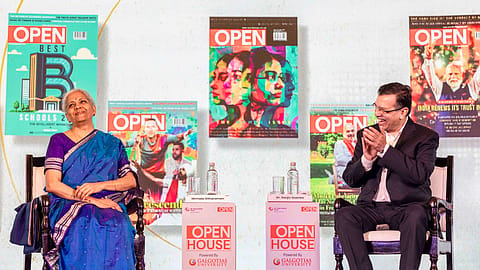

Addressing industry leaders at the Open House with FM event in Delhi, Sitharaman outlined three key requests to corporate leaders.

Finance Minister Nirmala Sitharaman on Monday said that tax rates have been reduced for every category of taxpayers, including those in the highest tax slab, with the aim of putting more money in people’s hands. Addressing industry leaders at the Open House with FM event in Delhi, she also outlined three key requests to corporate leaders, including informing the government about the challenges they are facing.

“We have changed the tax rates for everyone. We have lowered tax rates across all slabs. Of course, the highest tax slab has also come down. If one does the calculations, I am confident that what you are paying today is far higher than what you will pay from April 1,” Sitharaman said during a session with RPSG Group Chairman Dr. Sanjiv Goenka at the event.

“I am absolutely sure that for every income band, tax rates have been reduced and are now more predictable. I have brought income categories into a lower bracket that were previously in a higher band,” she added.

It is worth noting that Budget 2025-26 has made annual income up to ₹12 lakh tax-free, providing significant relief to the middle class, with the expectation that the resulting savings will boost consumption and demand.

FM’s three requests to industry

Sitharaman outlined three key requests that she had for the private sector.

“Indian industry has experienced the socialist era. You have also witnessed the period after 1991 when India apparently opened up. It did open up, but you also saw the government’s approach during that time,” she said.

Recommended Stories

“We can see today how the Indian government wants to work alongside the industry. It has repeatedly demonstrated that it listens to industry concerns. However, unique global challenges are increasingly becoming the norm. Keeping this in mind, when I speak about Indian industry, I do so with full awareness that you have endured through the years. I am not suggesting that you are new to this. I fully acknowledge that you have not only survived but have also demonstrated strong growth,” she added.

Keep engaging with the Government

“First, I urge the industry to keep engaging with us. Inform us when you face difficulties. Based on industry feedback, we reduced corporate tax rates in 2019, which has led to positive outcomes,” she said.

“Secondly, you should share your perception of global trends and what role the government should play. Businesses thrive under various types of governments, but each government brings a different approach. You have insights into what more the government can do for you,” she added.

(INR CR)

Industry associations must be more proactive

“Thirdly, your associations need to actively engage across the country and communicate what has been done and what remains unaddressed. This applies to GST, customs policies, regulations, or any other policy-related issues. I often find a significant lag in how these messages are conveyed to members. In this digital age, such communication gaps are simply unacceptable,” Sitharaman remarked.