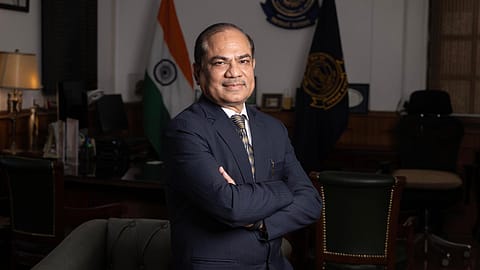

'We have to protect our farmers': CBIC Chairman Sanjay Kumar Agarwal on India’s tariff revamp and India-U.S. trade relationship

CBIC Chairman Sanjay Kumar Agarwal shares progress on the rate rationalisation exercise and the way forward.

India’s customs duty landscape on industrial goods is undergoing a sea change. Over the last two years the Ministry of Finance has overhauled majority of tariff lines. In Budget 2025, Finance Minister Nirmala Sitharaman announced doing away with seven additional tariff rates. In an exclusive interaction with Fortune India, Central Board of Indirect Taxes and Customs (CBIC) Chairman Sanjay Kumar Agarwal shares progress on the rate rationalisation exercise and the way forward, along with the measures announced in the budget towards ease of doing business.

Q. In the budget, Finance Minister referred to the comprehensive review of the basic customs duty structure being done in the last two years, and announced removing seven more tariff rates. What has been the progress so far on customs duty rationalisation exercise?

Ans. We have restricted our exercise to industrial goods, which comprises 8,500 tariff lines. Duty rationalisation has not been in food and textile items because they are very sensitive areas. On food items, we have to keep the rates very high so that we could rejig the effective rates at short call depending upon the harvest in the country. Textile, again, is a very sensitive area, as a lot of employment is provided in the sector. So we have to raise the tariff carefully so that the domestic MSME sector is not affected.

Q. What are the changes in the industrial tariffs, post the rationalisation exercise?

Ans. Under the 8,500 industrial tariff lines, fifteen tariff rates between 0% and 150% existed. A majority of the 8,500, about 6,500 are between 0 to 10%, are either exempted or at 2.5%, 5%, 7.5% and 10%. Raw materials and minerals are at 0 or 2.5%, intermediate goods are at 5% or 7.5%, capital goods at 7.5%, finished goods at 10%. Items under PLI schemes are under 15% and 20% as rates have been kept slightly higher to promote make in India for specific purposes.

Natural rubber and toys are under 70%. Post-rationalisation, rates of 25%, 30%, 35%, and 40% have been brought down to 20%. Similarly, 100%, 125%, 150%, have been brought down to 70%. But, to avoid any major shock to the industry due to the change, we have levied equivalent amount or slightly lower amount of Agricultural Infrastructure Development Cess (AIDC).

Q. How has the rationalisation impacted the overall tariff rates?

Recommended Stories

Ans. The average customs duty rate has come down from 11.66% to 10.65% on industrial goods. If we calculate food and textile, it may be higher. But on the industrial goods, that is the average rate now.

Q. But AIDC or the cess is in place keeping the overall incidence of tax at about the same level. How the final rate will be decided?

Ans. We will be hold stakeholder consultation with the line ministry on how much it (AIDC) can be tapered. For example, in case of cars which attract 70% tariff rate now, and AIDC of 40% is applicable on certain value, say upto $40,000, we will hold consultation with the ministry of heavy industries. Based on their recommendation, we will take further steps.

Solar modules were at 44%, including social welfare surcharge of 4%. Now the rate is 20% and 20% AIDC. We will consult ministry of new and renewable energy on whether there is a case for reduction of 20% AIDC on solar modules. On say buses and trucks, again the rate is 40%. So we will approach ministry of heavy industries. It is a consultative process and sometimes iterative to take a final view on how much can be reduced.

(INR CR)

Q. When other nations blame India of high tariffs, are they looking only at industrial tariffs or the overall rate spectrum across lines?

Ans. Normally, only industrial goods is talked about. Countries keep agriculture out of these exercises. We also have to protect the farming sector. All countries do that. Most developed countries also provide effective protection to agriculture.

Q. Is this a pre-emptive step in context of likely trade friction with the US? Have we looked at the tariff lines where issues could arise with the US?

Ans. No, rate rationalisation exercise has been done in line with the budget announcement made by the Hon’ble finance minister in July budget last year. So, that was the objective of the exercise. But, we conducted a study of the top commodities imported from the USA, not as a part of this exercise, though.

Q What were the findings of the study?

Ans. So, in the context of certain announcements made by the US, we conducted a study of the top 30 US imports to India. First is crude oil. There is a drastic reduction of crude oil imports from the USA in the last two to three years, as we started importing form Russia. The rate on crude is just ₹1 per metric tonne. It is negligible and hardly anything.

Similarly, tariff on import of coal – steam coal and coking coal from USA – is 2.5%, which is not too high. LNG is imported in huge quantity from the USA and attracts a tariff of 5%.

Diamonds – other than industrial diamonds -- are imported either in cut and polish form or rough form from the US. Rate on diamond (rough form) is zero and in cut and polish form, it is 5%. Duty on airplanes imported from the US by scheduled operators is nil, while 3% tariff is levied on imports by non-scheduled operators. Likewise, chemicals and petrochemicals are at 5%. So, the rates on the US imports are not high.

Q. But the Budget 2025 has reduced tariff on high engine capacity motorcycles.

Ans. Yes, on certain items, which are not imported in large numbers or not manufactured in the country. Take for example, high-end motorcycles. On motorcycles having engine capacity of 1600 cc and more, which are not manufactured in the country, rate has been brought down to 30% from 50%. On motorcycles with engine capacity not exceeding 1,600 cc, the rates have been kept slightly higher at 40% since they are being manufactured in the country too.

Q. What could be the average tariff on the top 30 U.S. imports to India?

Ans. We have not calculated it.

Q. What is the revenue impact of the measures announced in the Budget?

Ans. Rate on some items rates have been reduced, resulting in revenue loss of ₹1900 crore as we have imposed equivalent amount of AIDC to keep the effective duty incidence on the same level. So, the impact is less. But once we start tapering the AIDC after the stakeholder consultation and interaction with the line ministries, the impact will be visible more.

Q. What are the major trade facilitation measures you have undertaken?

Ans. Amendments have been carried out in the Customs Act. A time limit of two years has been fixed for provisional assessment. For example, demand raised against Skoda Auto Volkswagen India is for 12 years period. The time limit in Customs Act is five years in case of suppression of facts. Then how could it reach to twelve years? Because these assessments were kept provisional as imports were made by these companies through related entities. And since there were no time limits to finalise the provisional assessment, for some reason these assessments were not finalized.

So, they were issued a notice for a period from 2012 to this period. The uncertainty that the assessment is provisional remained with the businesses. If the limit of two years existed, assessments till 2022 would have been finalized and department could have raised the demand for only five years – 2019 onwards. So, look at the implication. Earlier, since the provision did not exist, and it led to uncertainty. So, as trade facilitation, and as an ease of doing business measure, this is the kind of certainty that is required for setting up the shop in India.

Q. Can it be retrospective?

Ans. It cannot be because otherwise, the things which are not decided will become closed. But another notable feature is that for past, the time limit will start from the Finance Act. (is passed) and within two years past cases will also have to be finalized. But future cases will be finalized from the date of original assessment and within two years or that.

Q. What is the number of such cases and the amount involved?

Ans. There are very large number of (pending) cases. I don’t want to give you a number. The quantum is also provisional, so we don’t know if there will be additional demand.

Q. According to Budget, the exemptions in duties and all will result in total revenue loss of around ₹2600 crores. Out of the revenue forgone, how of this much have flown in into the EV sector which saw lot of tariff concessions?

Ans. Out of this ₹2,600 crore, ₹1,900 crore pertains to tax rationalization, and ₹700 crores to the exemptions which have been provided to specific goods like medicines, sub parts of mobiles etc and also on capital goods (hence one time exemption) for manufacture of lithium ion cells for EV batteries, mobile phones, etc.