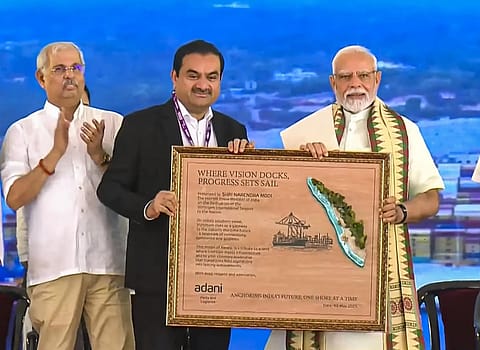

Adani Ports shares jump 6% as PM Modi inaugurates Vizhinjam Seaport in Kerala

PM Narendra Modi officially opened the Vizhinjam International Seaport in Kerala, developed by Adani Ports at a cost of around ₹8,900 crore.

Shares of Adani Ports and Special Economic Zone Ltd. (APSEZ), India’s largest private port operator, rallied over 6% on Friday after the Adani group firm reported strong earnings in the fourth quarter. The stock also got as Prime Minister Narendra Modi officially opened the Vizhinjam International Seaport in Kerala, developed by Adani Ports. Built at a cost of around ₹8,900 crore under public-private partnership (PPP) mode, the port is operated by Gautam Adani-led Adani Group, in which the Kerala government holds the majority stake.

At the time of reporting, Adani Ports shares were trading 4.6% higher at ₹1,273.40, with a market capitalisation of ₹2.75 lakh crore on the BSE. During the session so far, the ports heavyweight gained as much as 6.4% to hit a high of ₹1,294.85.

The Adani group stock witnessed surge in buying amid strong volume as 9.5 lakh shares changed hands over the counter in the first two hours trade so far, compared with two-week average of 1.8 lakh scrips.

At the current level, shares of Adani Ports trade 21% lower than its 52-week high of ₹1,607.95 touched on June 3, 2024, while it has risen 29% from its 52-week low of ₹993.85 hit on November 21, 2024. In the last one year, the counter has delivered a negative return of 5%, while it lost nearly 6% in six months. The counter gained 6.5% in a month and 4.5% year-to-date (YTD).

Q4 profit rises 49%, revenue grows 23%

Adani Ports and SEZ reported a 49.2% growth in consolidated net profit at ₹3,023 crore for Q4 FY25, driven by higher income and revenue growth. The country’s largest integrated logistics player had logged a profit of ₹2,025 crore in the year-ago period. The revenue from operations surged 23% YoY to ₹8,488 crore in the March quarter of FY25, while EBITDA rose 23.8% to ₹5,006 crore. The margin stood at 59% against 58.6% in the year ago period.

The company has also announced to pay a dividend to shareholders. The board has recommended a dividend of ₹7 per share, a 350% per unit of ₹2 each fully paid-up for the financial year 2024-25.

For the full financial year, the company clocked a record-breaking profit of ₹11,061 crore, marking a 37% year-on-year surge. The company attributed the growth to robust performance across ports, logistics, and marine services—key pillars of its ambition to evolve into the world’s largest ports and logistics platform. The full-year 2025 revenue touched ₹31,079 crore, up 16%, and EBITDA rose 20% to ₹19,025 crore.

APSEZ’s cargo volumes also hit an all-time high of 450 million metric tonnes (MMT), a 7% increase over last year. Its flagship Mundra port became the first in India to handle over 200 MMT in a single year. Meanwhile, the newly commissioned Vizhinjam port—the country’s first deep-sea transhipment hub—crossed 100,000 TEUs in a single month just four months after commencing operations.

(DISCLAIMER: The views and opinions expressed by investment experts on fortuneindia.com are either their own or of their organisations, but not necessarily that of fortuneindia.com and its editorial team. Readers are advised to consult certified experts before taking investment decisions.)