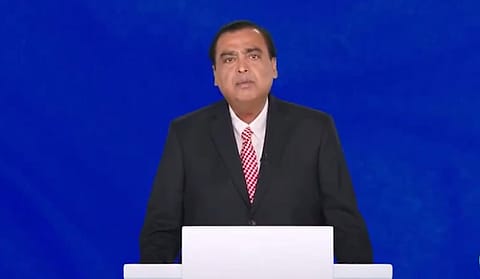

Reliance AGM 2025: Here’s what Jefferies, CLSA, and JP Morgan expect from Mukesh Ambani

Analysts expect Mukesh Ambani to provide updates on the Jio IPO, unveil advancements in AI, and outline plans for FMCG expansion.

Business tycoon Mukesh Ambani will address over 44 lakh shareholders at Reliance Industries’ 48th AGM at 2:00 PM on August 29, 2025. Ahead of the much-anticipated meeting, global brokerages Jefferies, CLSA, and JP Morgan have highlighted key segments, like Jio, Retail, Oil-to-Chemicals (O2C), and new energy value chains, that investors will be closely monitoring. Analysts expect Ambani to provide updates on the Jio IPO, unveil advancements in artificial intelligence (AI), and outline plans for FMCG expansion, offering shareholders a clear view of Reliance’s strategic growth roadmap.

In the last RIL AGM 2024, Ambani unveiled a series of strategic initiatives spanning technology, green energy, and retail. Key highlights included the consideration of a 1:1 bonus share issue to reward shareholders, the launch of “Jio Brain”, a comprehensive AI platform aimed at accelerating adoption across Reliance’s businesses, and the “AI Everywhere For Everyone” initiative to make AI accessible and affordable for all Indians. RIL also announced the creation of gigawatt-scale, AI-ready data centres powered by green energy in Jamnagar, alongside plans to transform the city into a global energy hub.

RIL stock performance ahead of AGM

Ahead of its highly anticipated AGM, Reliance Industries (RIL) shares were trading flat at ₹1,385, with a market capitalisation of ₹18.73 lakh crore, as investors remained largely on the sidelines.

The country’s most valued stock has delivered a negative return of 8% over the past year, though it gained over 15% in the past six months and has risen 13% in calendar year 2025, while remaining flat over the past month.

RIL touched a 52-week high of ₹1,551 on July 9, 2025, and a 52-week low of ₹1,115.55 on April 7, 2025.

Here’s what brokerages expect from RIL AGM 2025

Recommended Stories

Jefferies

The global brokerage has maintained a ‘Buy’ rating on Reliance Industries with a target price of ₹1,670. The brokerage expects updates on the Jio IPO, AI initiatives, and FMCG expansion, noting that growth in these areas could act as significant catalysts for the stock.

The brokerage noted that Reliance Industries has identified energy transition, greenhouse gas (GHG) emissions, and governance as its top material sustainability issues. As India’s energy mix shifts, RIL is working to reduce reliance on fossil fuels and transition toward a low-carbon future, having already reported a 6% year-on-year decline in GHG emissions in FY21.

The company has set ambitious targets, including achieving Net Zero Carbon by 2035, investing $10 billion over the next three years in the renewable energy production chain—covering solar PV, energy storage, green hydrogen electrolyzers, and fuel cells—and reaching a cumulative solar installation of 100 GW by 2030, while replacing fossil fuel–based captive power with solar across operations, it said.

(INR CR)

CLSA

The brokerage house has reiterated its ‘Outperform’ rating with a target price of ₹1,650. The firm highlights a substantial rise in free cash flow and operating cash flow, driven by a $5 billion increase in advances from oil and gas customers. However, CLSA cautions that high operating expenditure and interest cost capitalisation—around 33% of reported PBT—may reduce future operating leverage.

The brokerage also underscores RIL’s AI initiatives via Jio, media and consumer business expansion, and integration of new energy value chains as long-term growth drivers.

“AI offerings via Jio, expansion of media and consumer businesses and integration of new energy value chains are strategic areas highlighted in the annual report. We will watch for any announcements on the Jio IPO, clarity on AI plans and FMCG expansion details at next week’s AGM,” it said.

JP Morgan

The U.S.-based rating agency has maintained an ‘Overweight’ rating with a target price of ₹1,695. RIL’s relative valuations appear reasonable to us despite its YTD outperformance. The implied holding company discount available on Jio/Retail (measured at Bharti/ DMART EV/EBITDA) remains elevated, as these stocks have also done well. Better O2C margins, potential tariff increases and improved retail growth could help, it said.

“With comfortable relative valuations, this could help the stock perform. Some of the recent correction is possibly on account of its Russian oil purchases and risks of US/European action. The stock could recover if these issues abate,” it said.

(DISCLAIMER: The views and opinions expressed by investment experts on fortuneindia.com are either their own or of their organisations, but not necessarily that of fortuneindia.com and its editorial team. Readers are advised to consult certified experts before taking investment decisions.)