At ₹8,076.84 crore, SBI’s dividend payout to Centre sees 16% rise in a year

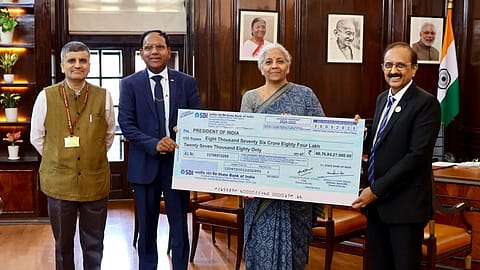

SBI chairman C. S. Setty handed over the dividend cheque to Finance Minister Nirmala Sitharaman on Monday

The country’s largest lender, State Bank of India (SBI), paid a dividend of ₹8,076.84 crore to the Centre for the financial year 2024-25 Monday. The dividend is a 16.06% rise over the previous financial year’s ₹6,959-crore payout.

SBI chairman C. S. Setty handed over the dividend cheque to Finance Minister Nirmala Sitharaman in the presence of Department of Economic Affairs Secretary Ajay Seth. Sharing a photo, the finance minister’s office posted on X, “Smt @nsitharaman receives a dividend cheque of Rs 8076.84 crore for FY 2024-25 from Shri CS Setty, Chairman - @TheOfficialSBI.”

The Centre has a 57.43% stake in the lender. Last month, the SBI board had approved a dividend of ₹15.90 per share for FY25.

Notably, from ₹4 per share in FY21 to ₹13.70 in FY24, and the current ₹15.90, the public sector bank’s dividend payout has seen a nearly fourfold jump in four years. Since July 4, 2003, SBI has declared 22 dividends, according to Trendlyne data.

At the time of writing, SBI shares were trading at ₹820.85, up 0.96% from the previous close of ₹813.05. The shares opened at ₹817.40 and reached an intraday high of ₹824.50, up 1.4% from the previous close. At the current share price, SBI’s dividend yield stands at 1.94%.

The government has recently witnessed a sharp rise in dividend payouts. In May, the Centre had also received a record ₹2.7-lakh crore dividend from the Reserve Bank of India, further boosting its revenues. The combined inflows from public sector undertakings and the central bank are expected to offer a strong fiscal cushion, allowing for increased capital expenditure without putting undue pressure on fiscal deficit targets.

In its fourth quarter results for FY25, SBI reported a 10% year-on-year decline in net profit to ₹18,642.59 crore, compared to ₹20,698.35 crore in the same period last year. Net interest income rose 2.7% to ₹42,774.55 crore, while operating profit grew 8.83% to ₹31,286 crore from ₹28,748 crore.

Recommended Stories

The domestic Net Interest Margin dropped 32 basis points (bps) to 3.15%. Loan loss provisions rose 20.35% to ₹3,964 crore, while total provisions surged to ₹6,442 crore from ₹1,608 crore a year earlier.

Asset quality improved, with the gross NPA ratio easing to 1.82% from 2.07% in the previous quarter, and the net NPA ratio declining to 0.47% from 0.53%. Year-on-year, gross and net NPAs improved by 42 bps and 10 bps, respectively. The provision coverage ratio stood at 74.42%, up 60 bps, and the coverage ratio on bad loans improved by 19 bps to 92.08%.

The slippage ratio for FY25 improved by 7 bps to 0.55%, while Q4FY25 slippage was 0.42%, down by 1 bps. The bank’s credit cost for FY25 stood at 0.38%, and its capital adequacy ratio was 14.25%.

The bank has also announced its plans to raise up to ₹25,000 crore in equity capital during FY26 through QIP, FPO, rights issue, preferential allotment or other approved methods, in one or more tranches.

(INR CR)