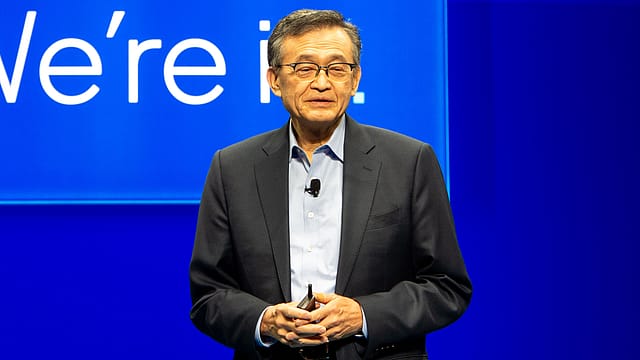

Intel’s Lip-Bu Tan hits the reset button: AI in, automotive out

ADVERTISEMENT

Intel’s new CEO Lip-Bu Tan is moving swiftly to reshape the chipmaker’s strategy. In a move that underscores his aggressive realignment of the company’s priorities, Intel has decided to shut down its internal automotive business—once touted as a key growth area—despite its sizable client base and participation in one of the fastest-growing semiconductor end markets.

Tan, who took over from interim CEO Frank D. Yeary earlier this year, is no stranger to hard choices. Having a hard task at hand, and maybe the last opportunity to revive the sinking company, back in April itself Tan shared his vision of ‘Building a New Intel’. He stated the Intel will have to be laser-focused on developing the best products, which will also involve making some painful decisions.

This is not a gradual transition or internal restructuring—it’s a full-scale exit from the automotive business.

“As we have said previously, we are refocusing on our core client and data center portfolio to strengthen our product offerings and meet the needs of our customers. As part of this work, we have decided to wind down the automotive business within our client computing group. We are committed to ensuring a smooth transition for our customers,” Intel told Fortune India.

Part of Intel’s Client Computing Group, the automotive division was built around the understanding that the car industry was undergoing a major transformation—from analog systems to fully digital architectures, from internal combustion engines to electric vehicles (EVs), and from fixed-function hardware to software-defined computing platforms. In response to this shift, Intel positioned itself as a key enabler, offering a scalable lineup of automotive processors supported by regionally diversified manufacturing capabilities.

Holding on to IP, not the business

Over the years, the company developed chipsets for in-car displays, driver monitoring, infotainment consoles and more, and its customers for automotive chips span all leading EU players, automotive players and US automotive players, say experts. Intel’s automotive chips have been deployed in over 50 million vehicles, spanning 18 leading global automakers. As part of its broader “AI into everything” strategy, Intel had even announced a new AI-centric chip for the auto sector last year, aimed at enhancing navigation, voice assistants, and smart vehicle functions.

“Under Pat Gelsinger’s leadership, automotive business was incubated as the next big thing under the client compute group, or what you call in the simple language as the PC compute group within Intel,” says Danish Faruqui, CEO at Fab Economics. The idea was to develop software defined AI products and that too in the System on Chip format, rather than in system in package format. The System on Chip format allows better system level co-optimisation, which is a critical success factor for software defined chips because software is going to be the real decision maker, adds Faruqui. Fab Economics is a US-based consultancy and investment advisory for new fabs and OSATs.

Intel’s bet on automotive solutions was well though. The company had even acquired Israeli autonomous vehicle technology firm Mobileye for $15.3 billion back in 2017-18 for developing driverless systems for global automakers.

So even the exit seems to be well planned. After all, when a company winds up a business vertical, it is often sold or is up for acquisition. But in Intel’s case, even with a substantial client base, it is only winding down the automotive business. Faruqui of Fab Economics explains, “Intel wants to keep its competitive edge its IP, architectural IP that enabled, or that was enabling AI driven automotive chips, rather than, selling it off for few $100 billions. For that it did not even trust it's prior acquired company, Mobileye, as it appears Intel wants to keep the competitive edge within Intel.”

Intel is no longer chasing every segment. Instead, it is focusing on the markets it believes it can dominate—or at least defend.

AI at the core: PCs and data centres

Tan, the former chairman of Cadence Design Systems and founding partner of venture capital firm Walden Catalyst Ventures, is known for backing deep tech bets and course-correcting companies mired in legacy bloat.

He inherited a sprawling Intel, which has been under pressure on multiple fronts: lagging process leadership, delayed foundry aspirations, and intensifying competition from Nvidia, AMD, and Qualcomm. The decision of shutting down the automotive business and refocusing on core client and data centre is Tan channelling resources into two high-growth battlegrounds—AI PCs and AI data centres.

“Unlike past Intel CEOs who pursued broad platform diversification across sectors like IoT, automotive, and networking, current CEO Lip-Bu Tan is adopting a sharply focused, private equity-style strategy. Rather than empire-building, Tan prioritises agility, profitability, and product-market alignment especially around AI, data centers, and advanced compute. He shows a greater willingness to cut losses, exit underperforming units, and streamline Intel’s operations,” says Manish Rawat, semiconductor analyst at TechInsights.

While earlier leadership aimed to preserve Intel’s wide technological reach, Tan is taking a more surgical approach, divesting slow-yield or misaligned ventures with a VC-like clarity. This marks a significant shift in Intel’s strategy—from maintaining a broad, diversified footprint from its previous “Intel Inside everything” approach to concentrating on a few high-impact, scalable pillars such as AI infrastructure, foundry services, and edge-to-cloud computing, adds Rawat.

Intel’s most immediate priority lies in redefining the personal computer space, which it once dominated. With the introduction of its Core Ultra chips and the Lunar Lake platform, the company is repositioning its client business around AI PCs—machines equipped with dedicated neural processing units to accelerate on-device AI tasks like summarisation, image generation, speech recognition, and more. It’s a market Intel believes could reach 100 million units by 2026, with use cases proliferating in productivity, content creation, and enterprise workflows.

“The AI PC wave, where devices handle more inference workloads on-device, represents a real inflection point. Intel’s Lunar Lake chips and Gaudi accelerators are a step in the right direction,” says Devroop Dhar, MD and Co-Founder at Primus Partners. By embedding AI accelerators directly into the CPU package, Intel is aiming to win back share lost to Apple Silicon and compete with Qualcomm’s Snapdragon X chips, which are already gaining traction among Windows-on-ARM vendors. “But the revival may not come from hardware alone. It will depend a lot on software ecosystems, developer support and execution. The demand is strong, but Intel must land its product roadmap on time,” explains Dhar.

Considering AI PCs emerge as the short-term growth lever, AI data centres will be the long game for Intel. After all, Intel is acutely aware of missing the initial wave of GPU-dominated AI compute, which Nvidia rode to dominance. But with its Gaudi AI accelerators—especially the Gaudi 3—and next-generation Xeon chips, Intel is looking to offer cloud providers and enterprises a credible, lower-cost alternative to Nvidia's compute stack.

To this end, Tan is accelerating investment in heterogeneous compute—mixing CPUs, GPUs, NPUs, and memory on advanced packaging substrates—and pushing the open ecosystem narrative. Unlike Nvidia’s vertically integrated model, Intel is promoting an open standards-based approach that gives hyperscalers more control over their AI infrastructure.

Dhar explains, “The biggest risk is execution lag. Nvidia is way ahead in silicon, as it has built an unassailable ecosystem around CUDA. Qualcomm dominates edge AI and mobile. Intel will have to fight these front runners, in this space. Intel does have the tools, but now needs flawless timing, aggressive developer engagement and pricing strategies to regain ground.”

Foundry ambitions still on the table

While Tan is cutting underperforming verticals, he is doubling down on one of Intel’s boldest bets: Intel Foundry.

Intel Foundry was carved out as a separate business unit under then-CEO Pat Gelsinger, which was supposed to open up Intel’s fabs to external customers and leverage advanced packaging and process nodes for global clients. However, delays in process readiness, client onboarding hurdles, and swelling capital requirements cast doubt on the model’s viability.

“Intel's restructuring, particularly the shift to an internal foundry model, is a bold attempt to separate design and manufacturing with clear profit-and-loss accountability mirroring the fabless-foundry model used by TSMC and its partners. If successful, this move could improve capital discipline by treating Intel Foundry Services (IFS) as a cost center with external-like accountability, helping prioritise high-return projects. It may also lead to better margins through more efficient resource allocation and streamlined operations, reducing bottlenecks between design and fabrication,” adds Rawat of TechInsights.

The transformation is still in its early days, with high execution risks. Experts believe Intel Foundry will be aligned to support the AI roadmap, fabricating high-performance parts not just for Intel, but for external fabless customers seeking alternatives to TSMC. However, misalignment between Intel Foundry and product teams could undermine the strategy, and meaningful margin gains may only emerge once it secures external revenue and internal competitiveness improves.

All in all, by shutting down a client-backed automotive business, Tan has signalled that Intel’s turnaround won’t be polite—it will be pragmatic. His bold choices could redefine Intel’s future, though they come with significant execution risk. But if Tan’s instincts prove right, these may be the only bets that truly move the needle.