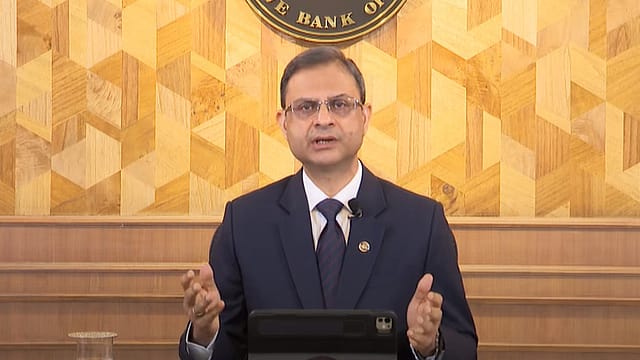

Decline in inflation source of macroeconomic stability: RBI Governor Sanjay Malhotra

ADVERTISEMENT

Sanjay Malhotra, Governor, Reserve Bank of India, said that India is at a critical juncture of navigating through a choppy global economic environment characterised by heightened trade uncertainty and persisting geopolitical tensions, in a FIBAC event hosted in Mumbai.

This comment comes in as U.S. President Donald Trump is imposing 25% tariffs on Indian imports and slapping an extra 25% penalty on India for purchasing crude oil and firearms from Russia, which is supposed to be implemented from this Wednesday. “We all must step up our efforts to address the emerging challenges and capitalise on the opportunities ahead,” he said at the inaugural address of the event.

Malhotra highlighted the importance of the monetary policy’s role in India’s economic growth. “One of the major conduits of macroeconomic stability in India during recent years, despite multiple shocks, has been the decline of inflation.” He talked about how sharp spikes in food prices, volatile oil prices, global supply chain disruptions, and geopolitical tensions could have significantly stoked inflation, but proactive policy measures by the Reserve Bank, including timely interest rate adjustments and liquidity management, alongside prudent supply-side measures by the government, have helped contain generalisation of price pressures.

Malhotra spoke on anchoring inflation expectations, which have supported stable consumption patterns and improved investor confidence. “The Reserve Bank has not lost sight of the objective of growth,” he said while citing how the Monetary Policy Committee (MPC) reduced the policy repo rate to promote growth during the times of the Covid-19 pandemic and in recent months, when inflation was benign. In 2025, the MPC cut down the repo rate by a total of 100 bps, while maintaining a 5.5% repo rate in the recent MPC meeting. “We will continue to conduct monetary policy with the primary objective of maintaining price stability,” he said.

Malhotra also drew attention to increasing sources of credit. “NBFCs, HFCs and AIFIs regulated by RBI still provide about 73 per cent of the credit needs of the real economy, with banks providing about 53 per cent. This shows the continued importance of RBI-regulated entities in meeting the credit needs of the economy.” He talked about how regulations are needed as a necessary friction to promote financial stability and the safety of depositors' hard-earned money. “However, stringent regulations may impede the growth of the economy. The art of regulation-making lies in finding the right balance between safety and growth and is indeed our constant endeavour in the RBI,” said Malhotra.

Malhotra urged the industry representing the demand side to invest boldly and champion the entrepreneurial spirit that defines our nation. “At a time, when the balance sheets of banks and corporates are at their best, they should come together and drive the animal spirits to create an investment cycle which is so important at this juncture,” said Malhotra at the FIBAC event.