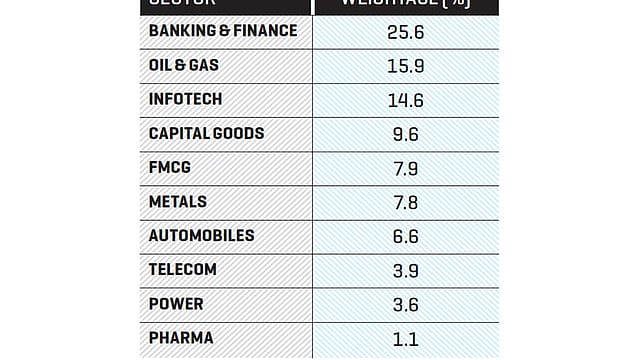

Rethinking the sensex spread

ADVERTISEMENT

India being a splurge economy, the obvious get-rich-quick strategy would be to cash in on the consumer boom on the bourses. The bummer: Consumer goods firms have a mere 7.9% share on the BSE Sensex. Ashish Chauhan, deputy CEO, BSE, says that the index wasn’t able to include more FMCG players “because they either have a small market capitalisation or aren’t liquid enough”.

But that doesn’t wash with Parag Parikh, one of Mumbai’s leading brokers. He says that such misrepresentation on the Sensex (and the Nifty) actually misguides investors. “The investors who ignored these indices and went beyond index stocks beat the market by a handsome margin in the past one year,” he adds. Clearly, the Sensex needs a quick and thorough overhaul in order to better represent the India growth story.