Poonawalla Reaps Riches In Vaccine Rollouts

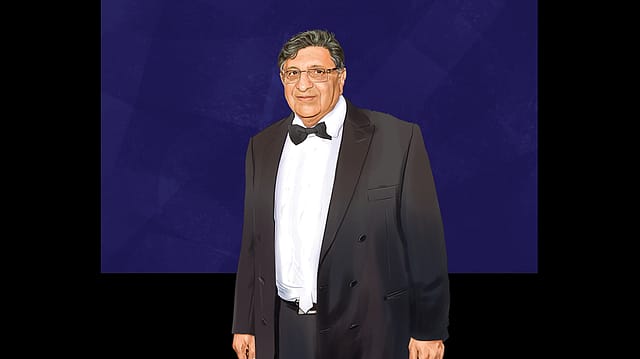

SON OF A HORSE breeder with a passion for cars — known for his custom-built limousines and sports cars — Cyrus Poonawalla founded Serum Institute of India in 1966 and built it into the world's largest manufacturer of vaccines in terms of doses (about 3.5-4 billion a year). Born in 1941 in a Pune-based family known for its interest in horses and the famous Poonawalla Stud Farms, Poonawalla Group chairman and MD Cyrus Poonawalla and family's wealth shot up from ₹1,62,848 crore ($20.42 billion) in FY22 to ₹2,70,725 crore ($32.95 billion) in FY23, an increase of ₹1,07,877 crore ($12.53 billion).

Serum Institute of India Pvt. Ltd. (SIIPL), led by Cyrus Poonawalla and his son and CEO Adar Poonawalla, was among the first companies in the world to launch a Covid-19 vaccine, Covishield. As a result of his efforts, Cyrus was honoured with the Padma Bhushan in March 2022.

Serum was also among the early partners of the University of Oxford for development and commercialisation of a Covid-19 vaccine. SIIPL teamed up with the university in April 2020 and by January 2021, the Drug Controller General of India granted an emergency-use approval for Covishield vaccine in India. Serum quickly upgraded its facilities at Hadapsar and Manjri in Pune, investing over ₹2,500 crore to help the government launch the world's largest mass vaccination drive. A new subsidiary, Serum Institute Life Sciences (SILS), undertook exclusive marketing and distribution of Covid-19 vaccines in the country, while another, Serum Life Sciences, U.K. (SLS U.K.), distributed the vaccines to the rest of the world.

It brought rich dividends to Cyrus Poonawalla and family. SIIPL's standalone revenues shot up from ₹7,201 crore in 2021 to ₹25,645 crore in 2022, while net profit rose from ₹3,891 crore to ₹11,116 crore. "As per provisional standalone financials, SIIPL generated revenue from operations of ₹5,513 crore and operating margin of 43.2% in the first half of fiscal 2023, against revenue from operations of ₹11,836 crore and operating margin of 65.1% in the corresponding period of the previous fiscal," Crisil Ratings said in a report in March.

Though Covid-19 vaccine sales saw a downward trend after 2021, Serum's future still remains bright. The company has built a revenue profile driven by a wide portfolio of vaccines sold in around 170 countries. It is among the largest sellers of vaccines for diphtheria, tetanus, pertussis, HIB, BCG, r-Hepatitis B, measles, mumps, and rubella. According to estimates, around 65% children globally are administered at least one vaccine manufactured by Serum Institute. Adar, who took charge of Serum's vaccine business in 2011, acquired the Netherland government's vaccine unit in 2012 and founded Bilthoven Biologicals, which makes vaccines for polio, diphtheria tetanus polio combination vaccine (DT-IPV), tetanus vaccines and BCG, used for the treatment of bladder cancer.

SIIPL also makes 'pneumosil,' the world's most affordable pneumococcal conjugate vaccine (PCV), and the first indigenous qHPV vaccine in India (used to prevent cervical cancer). Its MenFive, the first conjugate vaccine to offer protection against the five predominant causes of meningococcal meningitis in Africa, was recently given prequalification by the World Health Organization (WHO). The product was developed via a 13-year collaboration between SIIPL and PATH, with funding from the U.K. government.

Serum also recently received the first regulatory clearance for selling malaria vaccine in Ghana, developed by the University of Oxford.

SIIPL has sustained healthy operating profits — well above 50% — at the standalone level for years, supported by long-standing relationships with large clients such as UNICEF and PAHO (PAN American Health Organization), diversified product portfolio and economies of scale. It has sizeable cash and equivalents (including investments in mutual funds and bonds) worth ₹7,467 crore as on March 31, 2022, at a standalone level. SILS and SLS U.K. together had a sizeable liquid surplus of over ₹13,000 crore, according to Crisil.

Though the Poonawalla Group is synonymous with vaccines, it has six-seven other businesses as well, including the aviation vertical, which offers chartered flight services. Villoo Poonawalla Greenfield Farms (formerly Poonawalla Stud Farms) located at Theur in Pune has the highest stakes earnings — the amount received by the owner on account of the horse securing a position in the race — from over 760 horses, 15 champion breeder awards, and 371 classic winners (including winners of 10 Indian Derbies and 70 Indian Classics).

Poonawalla Fincorp Ltd., (formerly Magma Fincorp Ltd., a non-banking finance company that focuses on consumer and MSME financing) has ₹17,776 crore in assets under management as of Q1FY24. It recorded the highest-ever profit after tax of ₹585 crore in FY23, a 100% jump over the previous fiscal. The company divested its housing finance business to Perseus S.G., an entity affiliated to TPG Global, for ₹3,004 crore.

Among other businesses, the group's clean energy company, Noble Exchange Environment Solutions, founded in 2011, specialises in processing organic food waste into biogas and organic manure. The group also has a partnership with Pune's leading real estate developer, Panchshil Realty, and runs Ritz-Carlton hotel in Pune and Poonawalla Business Bay, a commercial real estate property.

With that kind of growth in the vaccine business and diversification into new areas, the Poonawalla Group could well bolster its riches further in the future.