RuPay's Rise Heats Up Payments

FIRST ENVISAGED BY the Reserve Bank of India (RBI) in 2005, the indigenous debit card payment network, RuPay, came to life in 2012. At the launch, there were 2 lakh cards under the RuPay brand with the not-for-profit National Payment Corporation of India (NPCI) targeting 10 million (1 crore) debit cards under its banner by March 2013.

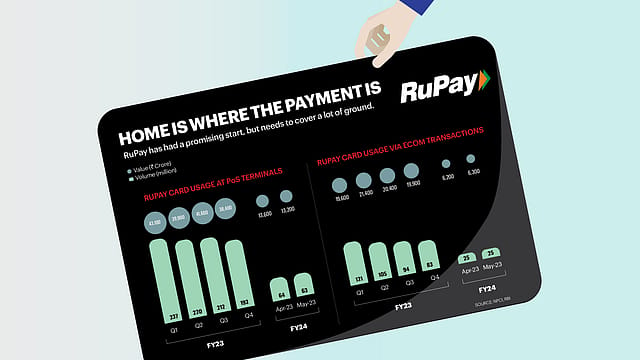

More than a decade later, RuPay has made significant inroads, with close to 700 million debit cards. Though the NPCI has not revealed the official figures, RuPay, as per industry sources, accounts for 20% of the over 86 million credit cards in circulation. As per a report by Pine Labs, transaction volumes are expected to hit 3.2 billion by 2025-26 from 1.8 billion in FY23. In a bid to widen the acceptance of RuPay beyond Indian shores, the central bank has paved the way for RuPay prepaid forex cards by banks in India, following up on its move to allow RuPay credit cards to be linked for India payment network (UPI) payments.

The-then NPCI CEO A.P. Hoota had sounded out foreign payment processors Visa and MasterCard by stating that the NPCI would charge 10-15 basis points (bps) of the transaction value as fees per transaction, almost half of what multinational payment firms charge. Though the RBI left it to market forces to determine whose network would be favourable, the-then RBI ED G. Padmanabhan said if costs were substantially lower it would eventually mean higher savings for card issuers who had to pay charges in dollars to Visa and MasterCard. Powering the initiative was a ₹2,600 crore incentive scheme from the Centre to promote RuPay debit cards and low-value Bharat Interface for Money-Unified Payments Interface (BHIM-UPI) transactions.

Now the central bank is going in for the kill with RuPay credit cards as Indians last spent ₹1.41 lakh crore via credit across PoS terminals (36%) and e-commerce transactions (64%). Though RuPay has a sizable debit market share, it lags in credit card transactions, which is dominated by Visa with a share of over 40%, followed by MasterCard. Though NPCI chose not to participate in the feature, COO Praveena Rai had said at an event recently that 25% of all new credit card issuances are happening on the RuPay network. There are currently over 260 million users on the UPI network. It has processed over 62.9 million transactions worth ₹139 lakh crore in FY23 through point-of-sale (PoS) terminals and through ecommerce network. The central banks now wants to bring smaller merchants within the ambit of UPI. For users, the availability of RuPay credit cards on UPI will ensure they do not have to dip into their savings.

Punjab National Bank, Union Bank of India, and Indian Bank were the first among public sector banks to go live with RuPay credit cards on the UPI. While RuPay debit cards attract zero fee, the merchant discount rate (MDR) — a fee charged to merchants for processing payments — has been capped at 0.9% for other debit card payment processors such as Visa and MasterCard, while there is currently nil MDR on UPI transactions via credit cards.

Taufique Alam, MD & CEO of PNB Cards & Services, says, "Since the MDR on UPI is almost negligible, it hasn't created enough interest for other players (Visa and MasterCard) to onboard the network." The IBA has asked the Centre to increase the MDR on RuPay cards in a bid to boost its usage among traders and create a level-playing field with international competitors. Before the advent of RuPay, the MDR charged on PoS terminals was in the range of 3-3.5% which has now come down to around 2%. "We have close to 3 lakh RuPay credit cards, and all fresh issuance are now RuPay cards," says Alam.

Of the over 86 million credit cards in circulation, HDFC Bank is the leader with 20.7% market share, followed by SBI Cards with 19.5%. However, "Given that most card holders have more than one card, the number of unique card holders might be just 30 million," says Naushad Contractor, founder-CEO, Fable Fintech, a cross-border payment solutions provider.

For RuPay, it's a question of when — not if — it will emerge as the country's number one payment card network processor. But how soon it will be able to dislodge Visa and MasterCard depends on how fast the card issuers, the banks in question, warm up to RuPay. The banks, for now, are pampered by the foreign card networks with their billion-dollar marketing budgets. On the other hand, the NPCI runs as a non-profit entity which limits its ability to spend, and with a practically non-existent MDR, the road ahead for RuPay is an arduous one.