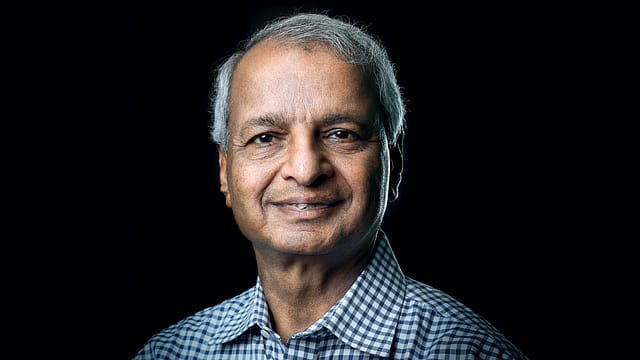

The Conversation: Gururaj Deshpande, Entrepreneur & Venture Capitalist

Who is the poster-boy of Indian technology is a question that can elicit arguably different names. But the one person who surely fits the epithet is Gururaj Deshpande. Starting out with Codex Corporation in the 80s, Deshpande co-founded Coral Neworks that made routers, which got sold to SunOptics for $15 million. But the brother-in-law of Infosys co-founder N.R. Narayana Murthy's wife Sudha Murthy made headlines when he sold Cascade Communications, a firm he founded in 1990, to Ascend Communications for $3.7 billion in 1997. Today, Deshpande invests in creating social and economic impact through entrepreneurship and innovation. Talking to V. Keshavdev of Fortune India, he shares his entrepreneurial insights and why he believes India's untapped billions need start-ups with a purpose and not just unicorns. (This edited Q&A has been condensed for space and clarity.)

TECH'S BOOM-BUST CYCLE

Given a business as disruptive as technology, are we in an era where tech start-ups are increasingly being "built-to-flip", or has it always been the case, even during the dotcom days?

Actually, I'm not sure if it has truly changed over the past 200 years! Of course, there is a lot more money available now, along with numerous ways to access capital, which amplifies the dynamics of the game. Centuries ago, we witnessed a similar scenario in the railroads sector. At one point, the U.S. had a staggering 1,200 railroad companies with immense valuations. Unfortunately, many of these companies collapsed, resulting in substantial losses for numerous individuals. Despite the setback, the industry thrived for the next 150 years before, eventually, fading away. Thus, every business goes through a natural boom-bust cycle. The same thing occurred during the Tulip mania and played out again during the rise of computing. So, every time a big bubble happens it is because people see a big promise and then it gets to be like a mad rush. But within that mad rush, there are a few founders who focus on fundamentals and don't get carried away. It's a tricky game. You do have to play the valuation game because that's what gets you the resources. But at the same time, if you start believing in it, you can get carried away and if you don't manage your cash flow, you will get into trouble. Google, for example, has become a substantial cash-generating machine today. But, at its inception, it was difficult to believe that a business offering free access would make money from ads and survive. So, every time there's a bubble, right now it is AI, it's, usually, a graveyard along the way as a lot of companies will not make it. Some of them will go bankrupt, some of them will get merged, some of them will get acquired, but a few will emerge, and those that emerge are the ones built on fundamental values and strong technologies.

So, is this a good time to build a business from what it was in the past?

A few decades ago, venture capital was virtually non-existent, and entrepreneurs had to be bootstrapped. When I started my first company in Massachusetts in the '80s, there were only a handful of companies such as Digital Equipment Corporation that had successfully built their businesses. During that time, the largest venture capital in Boston would have been around $10 million! As a result, before funding, investors conducted a thorough due diligence. In fact, the scrutiny was sometimes excessive. For instance, founders had to forgo their salary for a year, as the idea was that if the business failed, the founder would hurt a lot more than investors did. This discouraged many entrepreneurs, though a few of us managed to navigate through the challenges. Later, when I built Cascade, it did quite well. The concept behind the company was to connect every computer in the world to each other, which seemed revolutionary at that time! That was also when the internet emerged, and by the time Cascade merged with Ascend Communications, and later with Lucent Technologies, it was handling approximately 80% of the backbone traffic. So, that turned out to be a successful outing. However, with Sycamore, the fibre optic company, the excitement was overwhelming, and the revenue growth was exceptionally rapid, attracting the attention of every venture capitalist. Established players such as Nortel and Siemens, who had been in the industry for a long time, started wondering why they couldn’t replicate Sycamore’s success.

What happens in such a case is that sometimes you get overinvested for the value that you get. In telecommunications, at one point technology struggled to keep up with demand. And when a technology comes along that meets the demand, that’s when companies can rake in huge profit margins of 80-90%. Then it becomes easier to build such companies and invest in research and development. However, when there is overinvestment and technology overshoots, then it becomes a commodity. While it remains expensive to develop the technology, the tech itself no longer offers any value, and so the whole thing collapses. Nowadays, venture capitalists tend to get impatient and push entrepreneurs into spending large amounts of money quickly without enough consideration. But it’s the entrepreneur’s responsibility to balance the pressure and make sure that he says, “No, I’m not ready for it.”

On the positive side, there is significant capital, allowing entrepreneurs time to build profitable businesses and even make a few more mistakes. Whether there is a surplus or scarcity of money, entrepreneurship is always challenging. It requires navigating through obstacles. If it’s hard for everybody to get money, and when you get money, it’s a piece of cake, right? Because there’s not that much competition. Conversely, when there is intense competition, entrepreneurs must find their way through and identify the true value — that killer app — which offers real benefits to customers. Ultimately, businesses cannot thrive unless customers are willing to pay ‘x’ and receive a benefit of 2x-3x or more. Without clarity on this value proposition, building a successful business is a challenge.

On technology getting commoditised, is the trend playing out in certain pockets, for example in SaaS, where increasingly the narrative is around usage-based pricing. Is SaaS seeing a race to the bottom?

At the end of the day, the beneficiary is the consumer. So, it’s hard to figure out who will survive unless you delve into the details, even companies that fail contribute to advancing technology and in introducing new ideas. Ultimately, it is the consumer who reaps the benefits of it all. When I started out in the telecom industry, making a phone call was almost more expensive than flying. For example, it would have been cheaper for me to fly to Mumbai than to have a 30-minute to an hour call from Boston to Mumbai. So, look how far we have come, thanks to the hundreds of companies that pushed those technologies forward, even though not all of them succeeded. There will be venture capitalists who win and lose, and entrepreneurs who experience success and failure. However, the value will remain. Take e-commerce as an example. It began with Amazon, and many individuals became excited and started their own companies, but a lot of them incurred losses. Yet, in the end, it’s amazing how we can now find and purchase almost anything. The value to the consumer is real and that’s what matters. Venture capitalists and entrepreneurs, who understand this value and build a model that accounts for eventual commoditisation, will thrive. It’s crucial to be prepared for this, as increased investment in any sector will lead to commoditisation because before companies die, they will lower prices. Therefore, building efficiency into your business and monitoring costs is essential.

THE AI BOOM

Talking of fads, how do you see the growing chatter around artificial intelligence (AI)? Is this the story of the next decade?

I have not seen ChatGPT give me answers that are any better than what I could do by just Google search. So, I haven’t found anything unique yet. But we are witnessing a trend where various industries are embracing and tailoring AI to suit their specific needs. The next wave of start-ups will likely need to incorporate AI into their pitches, else they won’t get funded. In telecommunications, I recall a time when it was tough to identify who called you. However, the introduction of ISDN (Integrated Services Digital Network) offered a solution by allowing voice transmission alongside control data, enabling features such as caller ID and conference calls. ISDN gained significant attention, with even plastic manufacturers advertising their products as “ISDN compatible.” However, ISDN did not manifest as envisioned because Internet emerged as a transformative force. Today, we are in an era where voice communication is digitised, rendering traditional voice calls obsolete. Trends take unprecedented shapes and forms. Hence, it is challenging to predict the specific trajectory of AI over the next five or ten years. Nevertheless, there will undoubtedly be “killer apps” that will emerge from AI. Every entrepreneur or company is taking calculated risks, placing bets on where they believe the next ground-breaking application of AI will emerge.

So, what is Deshpande Start-ups’ guiding philosophy around Bharat-focused start-ups?

If you go all the way down to the bottom of the pyramid, there’s no fortune, it’s a little bit more charity. But you can do charity in a way so that you can scale it and bring these people into the free market economy. Once they participate in the free market economy, it creates a lot of opportunities for these for-profit start-ups. They can make money, but it’s not like a Unicorn (2). For example, our foundation works in the agriculture space. Look, there’s a lot of rainfall in India, but farmers don’t have enough water when they need it. So, when Ratan Tata had come to Hubli in 2013, I spoke to him about developing this concept of private farm ponds (3) (hundred feet by a hundred feet by 12 feet) and that’s enough water to irrigate five acres of land and enough to double or triple a farmer’s income. So, Tata gave us five machines. In the first two years, we built 150 ponds for free and made sure the farmer doubles or triples his income. Later, we built 5,000 ponds, where the farmer paid 75%, and we paid 25%. It’s roughly ₹1 lakh for building a farm pond. Now we are doing a hundred thousand ponds where the farmer pays 20% and the remainder comes from SBI and HDFC. So, when you are building farm ponds at scale, these farmers will need a lot of services, including farming equipment. So, you can have an Uber of farming equipment. Similarly, we helped a company in soil testing, whose services are now being used across India. Then there is a successful company that helps in automating the process of sorting cashew nuts. Today, it’s a `50 crore business. The founder never raised a penny of equity, and it took him eight years to reach here. If he had raised some equity, maybe, he would have fast-tracked his growth four years earlier. So there are good opportunities, but the mindset needs to be a little different as these are not businesses where you can put a lot of money and make big bucks. But investors still need to be disciplined about due diligence. Make sure the business is sustainable because easy money is the worst thing for entrepreneurship.

LESSONS IN ENTREPRENEURSHIP

Can you share some key entrepreneurial learnings from your journey?

Today, entrepreneurship is a career as opposed to a one-time shot in the past. When we were starting our companies, the price you paid for failure was huge. But today if you fail for reasons beyond your control, the investing world looks at you as a veteran and is willing to fund you again (4). So long as you develop skills to make sure that you worry about things in your control and do the right thing, it will make you powerful. Successful entrepreneurs always have these two qualities. One, they’re naïve and always believe that things can be done and, second, they’re very optimistic. So, naivety, optimism, and clarity of thought in terms of what you can control and what you don’t, are all good qualities for an entrepreneur to have. The thing to avoid is getting carried away. When something is going well, don’t let it get to your head that it’s you who are making things happen. Ego will prevent you from foreseeing problems ahead of you.