Coming up next, India’s third-largest bank

ADVERTISEMENT

Consolidation amongst India’s public sector banks was the holy grail of policy makers in the post-liberalisation era. Many a committee report has debated and discussed the pros and cons of such mergers, but in more than 25 years, there have only been two cases. The first was in 1993, when Punjab National Bank merged with New Bank of India to bail out the latter, and the second in 2017, when State Bank of India amalgamated its five associates.

On Monday, the Ministry of Finance unveiled the candidates for the third mega-merger of Indian public sector banks since 1992. The Alternative Mechanism (AM), a high-level committee of ministers, has suggested an amalgamation to the boards of Bank of Baroda, Vijaya Bank and Dena Bank in a move expected to create India’s third largest bank.

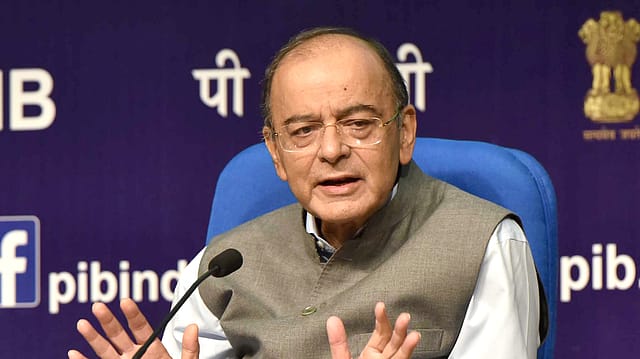

“This amalgamated entity will increase banking operations. It’s ability to increase [banking operations] and expand will be inevitable,” said Arun Jaitley, Minister for Finance and Corporate Affairs at a press conference.

He added that the AM, which was created last year to identify possible public sector bank mergers, did not want a merger of relatively weak banks. “You can have two well-performing banks absorbing a weak one in the amalgamation process and hopefully create a mega bank which will be sustainable and whose lending ability will be far higher,” Jaitley explained.

The weak bank in this equation is undoubtedly Dena Bank, which is under prompt corrective action (PCA) with a net non-performing asset (NPA) ratio of 11.04%. Vijaya Bank’s net NPA ratio is the best of the lot at 4.1%, but its gross advances at Rs 1.22 lakh crore are a quarter of Bank of Baroda’s. Vijaya Bank’s total business of Rs 2.79 crore is a fifth of largest bank in the trio, Bank of Baroda.

The amalgamated entity will have total business of Rs 14.82 lakh crore, gross advances of Rs 6.40 lakh crore and 9,489 branches in India. It’s total net non-performing asset (NPA) ratio will be 5.71%, nearly 30 basis points higher than Bank of Baroda’s current net NPA ratio of 5.40%.

“It [amalgamated entity] would be a strong competitive bank, with economies of scale, synergies for network, low cost deposits and subsidiaries and possibility of greater outreach and expansion,” said Rajiv Kumar, secretary, Department of Financial Services at the Ministry of Finance.

The amalgamated entity will have 85,675 employees. Jaitley has assured all of them that ‘no employee will face a service condition that is in anyway adverse in nature’.

When asked about the timing of the announcement given the recent headwinds in the form of a weaker rupee and higher crude prices, the finance minster said that global macroeconomic challenges do not bring other areas of governance to a standstill. “In fact that’s a sign of confidence in the system,” he said, adding that the government is committed to saving vulnerable public sector banks.

While the Ministry of Finance did not announce any timelines for the completion of the merger, sources indicated that the boards of the banks will meet over the next 10 days to discuss the amalgamation proposal. The modalities of the merger including the share swap ratio will be decided by the banks.

There has been a mixed reaction towards the announcement from experts and analysts. “This is progressive move and signifies the government’s determination to strengthen the banking sector in the country,” said Rashesh Shah, chairman and CEO of the Edelweiss Group and president of industry body Federation of Indian Chambers of Commerce and Industry (FICCI). He added that the merger will lead to greater operational efficiencies and the entities involved would benefit through a synergistic relationship.

Market expert Prakash Diwan called it a bold move saying it was a positive step forward in the government’s overall agenda to strengthen PSU banks.

“I’m impressed with the selection of the banks for the process. Here the situation is like a back-bencher coming forward and sitting with two toppers of the class. Had it been the reverse, Bank of Baroda with say a Dena Bank and an Indian Overseas Bank, that would have been much worse,” he said.

Diwan added that the markets are likely to have a knee-jerk negative reaction to the move, but foreign investors will see it favourably as they look for long-termreform.

However, banking expert Ananth Narayan had a different opinion. “PSU banks are in need of deep reform. Unfortunately, we’ve been skirting around the core issues for a while now. In the meantime, the distress in the entire financial services ecosystem remains,” he said. Narayan also added that this merger is one that will occupy a lot of time and space, but will achieve very little compared to the kind of reform that’s required.

Narayan suggested that implementing the recommendations of the P.J. Nayak Committee and strengthening the bank boards, reducing direct government involvement in bank functioning, and transferring government’s shares to a Bank Investment Company would go a long way towards meaningful reform.