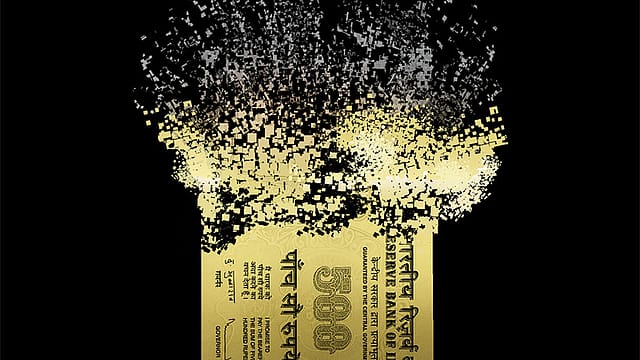

Why taxing the digital economy won't be easy for India

ADVERTISEMENT

BUYING HAS NEVER been easier—search, click, pay, download, or wait for the courier to show up bearing packages. Big businesses have been built upon this (as Mukesh Bansal has shown with Myntra’s blistering growth, or the other Bansals with Flipkart). Much money is changing hands, buyers and sellers are happy, so what’s not to like about e-retail? Ask the tax department—not just in India, but pretty much anywhere in the world.

When it comes to products or services that are part of the digital economy—whether it’s downloading software apps or e-books, buying storage space in the cloud or paperbacks from a digital store—how is the seller taxed?

The e-commerce business in India was estimated to be worth close to Rs 63,000 crore as of December 2013 (a 34% increase in one year). Add the Rs 1,750 crore digital advertising industry, and the government is getting precious little by way of tax from all this business. Baljit Singh Sodhi, former chief commissioner of income tax, says that the tax department’s intent is neither to tax everything, nor to grab unjustified revenues, but to merely tax a fair portion of the value that gets created in India.

Indian tax laws, like those in most parts of the world, are beyond complex, but they do cover almost all contingencies. The problem is that these laws are dated—the last set of amendments were in the late 1980s, well before the digital revolution. “Taxation laws and rules that were designed and worked well in the brick-and-mortar era have become irrelevant for modern digital companies. The answer lies in framing a new set of laws and rules,” says Rahul Garg, partner at global accounting firm PricewaterhouseCoopers.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

It’s not that all e-commerce companies escape the tax net. It’s easy for the authorities to tax Indian e-commerce players, most of which work on the marketplace model—where buyers, sellers, and service providers converge. The seller or vendor pays sales tax (sometimes excise duty as well if it is a manufacturer) on the goods sold, while the service provider who transacts the order, like Flipkart, pays a service tax. This works also when a company such as Amazon sells a physical product (say a paperback novel, or a gadget) online.

Even taking into account the fact that the Internet is not constrained by geography, as long as a physical product is bought or sold, there’s a tax that can be levied on it. Under the tax law that is now applicable, companies are taxed if they have a permanent establishment in India, or if they provide a taxable service, or if they earn income in any other way from India. Perfectly simple, then, to levy a tax—any or all of the following: corporate income tax, state sales tax, excise, and customs duties. Naveen Aggarwal, partner, international tax, KPMG, says locally registered companies that conduct their business within the country can be taxed like a brick-and-mortar firm.

The problem is when a company like Amazon or Microsoft sells a piece of software, or an e-book, or a song. Is the customer downloading a good or a service? Most software is licensed to the user (hence there are EULAs or end user licence agreements, rather than sale deeds every time software is downloaded or updated) rather than sold. Does this attract a royalty or fee for technical assistance?

When in doubt, the tax authorities often like to insist that a company has made a substantial portion of its revenue in the form of fees for technical assistance or royalty. That’s because the fee is seen as passive income, and that can be taxed even if the company does not have a permanent establishment in the country.

Moving out of the realm of e-commerce, what happens when a company advertises on a website? Unlike an ad in a newspaper or magazine, an online ad is hosted by a server that can be located anywhere in the world. How does any government tax that?

Google recently told the Delhi High Court that it is not liable to pay any tax for its Internet services “because it was not providing any taxable service, nor earning income from India, nor does it have a permanent establishment in India”. This, when the company generates huge income in India through online advertisements and sale of games and applications. (The existing Google offices here are research and development centres, which attract minimal tax.)

“The tax authorities now have to grapple with a host of questions like the location of servers, the presence of assets of the company, the origin and consumption of the service, and the issue of actual value addition in a digital product or service,’’ says Aggarwal.

Often, although the company may claim business income exemptions, the tax authorities may impose their own views—and the whole thing ends up in court. A few years ago, a bruising battle was fought between television channels and the tax authorities over the issue of downloading programmes into India, which were uploaded to a satellite located in a different country. The argument again was whether the income derived by the television channels was royalty or a business income. (If a company declares business income, it may be able to avoid paying tax under a Double Taxation Avoidance Agreement.) Finally, the government through an amendment to the Finance Act of 2012 made import of software and digital footprints of television content a “royalty”, and hence taxed.

This goes against the OECD (The Organisation for Economic Co-operation and Development) Model Tax Convention, which governs issues of double taxation, and which is followed by much of the developed world. Such government interventions result in a raft of court cases filed by companies against the Indian tax authorities.

The OECD Model Tax Convention says that only the profits from the permanent establishment may be taxed. To that extent, India is on the same page. In October 2012, the Mumbai Income Tax Appellate Tribunal ruled that eBay Inc., a company incorporated in Switzerland, does not need to pay any income tax on the profits earned from its Indian subsidiaries, eBay India and eBay Motors. It held that although the two Indian subsidiaries provided marketing support services to the Switzerland-based company, since neither eBay India nor eBay Motors had signed a contract on behalf of e-Bay Inc., they cannot be considered to have a permanent establishment in India.

But there are other complications in terms of taxation. Even if the country is able to prove the existence of a “permanent establishment’’—or the company’s physical presence—the country can only be taxed if it is carrying out “core functions’’ and not “peripheral or auxiliary functions’’. Core functions, according to the courts, are critical functions that contribute substantially to the company’s revenue, unlike advertising, or providing a connecting link between the customer and the company through a telephone, or even data gathering. So whether a company’s subsidiary is actually carrying out a core or auxiliary function becomes a subject of litigation.

India is considering several options for dealing with the issue of permanent establishments. The tax authorities have roped in experts such as Sondhi and Mukesh C. Joshi, the former chairperson of the Central Board of Direct Taxes. One of the suggestions is to expand the definition of permanent establishment to include websites, whether on computers or mobile devices. These virtual permanent establishments can then be taxed, depending on the amount of business that comes from the country.

Most companies do not declare revenue from individual countries, so this could prove to be a problem. However, the expert team has suggested that this can be tackled by tracking payments made with Indian credit or debit cards. This will give the tax authorities some idea of how much revenue has been generated in India.

“The permanent establishment is a big issue for most foreign companies because they want to know whether they can do business from outside India, or they necessarily need to have a presence in India. So India will need to have the concept of a virtual permanent establishment,” says Aggarwal. The other definition of permanent establishment as the place where the senior management sits and takes important decisions is no longer valid because of the developments in communications.

Cloud computing companies claim that they provide “software as a service’’, and hence should be taxed where the cloud computing company is located and where the servers are. These servers are mostly located in the U.S., where they are non-taxable. But the Indian tax authorities believe that since their services are consumed in India, which means they generate a good amount of income for the company, the country has a right to tax the service.

(There’s an even more fundamental problem: whether software is a service at all. In India packaged software is taxed either as a good and as a service, depending on the individual case, because there is still no clarity on the issue.)

Studies conducted by the Paris Commercial Court showed that some companies, including Google, Apple, Facebook, Amazon, and Microsoft, had only paid €37.5 million (Rs 316 crore) in corporate tax in France in 2011. That’s 22 times less than what they would have paid if their production activities were located and taxed in France.

VIRTUAL PERMANENT ESTABLISHMENTS will solve only one problem. Virtual digital transactions call for more fundamental changes in tax laws, including redefining some basic concepts like categorising goods and services and the income derived from these businesses, even redefining the concept of transfer pricing—the way global companies account for services provided by local subsidiaries—and so on.

To add a little more confusion to the mix, there are Double Taxation Avoidance Agreements (DTAAs) or treaties that countries sign to ensure that a company is not taxed in several countries for the same business. Companies take advantage of these treaties by reorganising their activities into various functions, treating them as separate companies, and locating their highest profit-earning activities in the most tax-friendly countries. Companies such as Amazon and eBay are making it almost impossible for tax authorities in other countries to levy any tax.

Here’s how Amazon does it. The e-retail behemoth has split its various functions—sales, website operations, customer support, warehousing—across different countries. So, it books all its sales through Amazon SARL, Luxembourg; advertising revenue through an affiliate in Ireland; and intellectual property rights in Bermuda—all low-tax jurisdictions. So, revenue officials in other countries are not able to tax the company even if they are the company’s biggest markets.

In January, the U.S. Revenue Service claimed that Amazon.com misreported $2.2 billion (Rs 13,424 crore) of taxable income outside of the U.S., primarily in Luxembourg, a lower tax jurisdiction. This is something that’s happening all over the world; countries that were hit hard by the global economic slowdown in 2008 claimed that companies such as Apple, Microsoft, and Google were making huge profits because they were not paying their “fair share” of taxes. On their part, the companies claim that they are not liable to pay taxes in most countries.

Valuation of digital products is another big challenge. If a country wants to charge value-added tax or VAT, it has to prove that the value addition took place in that country. But does maximum value addition happen where products are designed or has its R&D, or where branding and marketing happens, or where the intellectual property and organisational skills reside? Few companies file such detailed information with the tax authorities, making it impossible for any single country to tax specific functions.

Meanwhile, companies claim that taking advantage of tax loopholes is not wrong, and makes good business sense. “If Ireland and the U.S. have a DTAA, then where is the problem if the company decides to locate its offices in Ireland, a country of low-tax jurisdiction and does business in the U.S.? If the U.S. does not like the DTAA, it can go ahead and scrap it,” says a senior executive of a digital corporation.

He goes on to suggest that if tax authorities have problems with cross-border digital companies doing business in their countries, they can do what China has done—only allow those players to do business in China which have a tieup with a Chinese company. “It finally boils down to government policy and not a tax issue,” he claims.

But that begs another question: What do the low-tax jurisdictions get? After all, if, say Ireland, levies a corporate tax of 12.5% compared with France’s 33.3%, what does Ireland get? A Eurostat report may have the answer. “The reason is that the indirect benefits to its economy, like added value created by employees, indirect jobs related to the presence of Google in that country, and real estate investments, are more important than the shortfall due to its attractive taxation system,” it says.

Since there’s no official government position on cross-border digital companies, the tax authorities decide individual cases upon merit. “It is entirely up to the income-tax commissioner to decide whether a company needs to pay tax and also the amount,” says K. Sekar, partner at auditing firm Deloitte Haskins & Sells. This arbitrary way of taxing has led to the increasing number of cases against the tax authorities, especially by multinational companies. Delhi-based accounting services company BMR Legal estimates that nearly $32 billion is locked in tax disputes.

THE GOOD NEWS is that the tax authorities are not only aware of this loss, they have been making sporadic efforts to fix it. Way back in 1999, when dotcom was a word associated with boom, the Central Board of Direct Taxes (under the Ministry of Finance) set up a nine-member committee to look into all aspects of taxing the e-commerce industry.

The committee held 13 meetings over a year, and included inputs from global and domestic experts such as Richard L. Doernberg, emeritus professor of law, Emory University School of Law in Atlanta, U.S.; and N.L. Mitra, professor at National Law School of India University, Bangalore. In its report to the CBDT, presented in 2001, the panel spelled out the challenges that tax authorities will face in the coming years, and stated that the real challenge of taxation “will not come from domestic e-commerce companies, but from the cross-border players”.

The bad news is that the dotcom bust resulted in a number of companies going back to brick-and-mortar businesses—setting up offices, factories, and sales forces in different countries; paying corporate tax on their income; excise duty on goods; and service tax on the services consumed. Doernberg and Mitra’s report was left to gather dust, as it has been doing for the past 13 years. “And even when a few proposals were implemented later, they were not done properly,’’ laments Mukesh Butani, chairman, BMR Legal, and one of the members of the high-power committee.

But with the revival of the digital economy from around 2005, tax authorities have started hunting for some way in which to make the law relevant to the present day. Today, hundreds of cases are being fought in various courts, appellate tribunals, and tax offices simply because the tax authorities are trying to force-fit antiquated laws in the digital transaction space.

WITH NO LET-UP in recessionary conditions in the developed world, tax authorities are demanding immediate action in terms of taxing the digital behemoths. All kinds of ideas have been mooted, from taxing transactions only, to taxing the company in every market wherever it has any business. The Italian Parliament has already approved a controversial bill forcing tech giants like Google to sell advertising online only through Italian intermediaries—companies that pay tax in Italy—and not through companies that have intermediaries based in Ireland and Luxemburg.

A couple of French bureaucrats—Pierre Colin and Nicholas Colin—in White Paper on Digital Economy Taxation commissioned by the French government, even recommend that digital commerce should be taxed in the country of residence of the customer because the product is transformed when the customer uses it.“Tax laws ignore the fact that each time data is involved, users become a part of the operations,” the pair argue, adding that any definition of a permanent establishment must be grounded in the fact that users play a key role in digital value creation.

Countries like India that have adopted a source-based system of taxation (where only income from goods produced and services rendered within that country’s boundaries are taxed) are now struggling to find a way to get their due. It’s impossible for these companies to locate the place of transactions and the exact income generated by each affiliate, although most of the sales of these goods and services happen in this country.

“The lack of uniform rules for imposing value-added tax on cross border sale of digital goods and services has added to the confusion, as is the decision to tax goods and services differently in the absence of a general goods and service tax,” says Sekar.

Clearly, the solution cannot be from just one country. Taxation authorities of the world need to unite. Which is why last July, the OECD set up a task force to address the tax challenges of the digital economy. A request for comments from stakeholders was made in January this year from a diverse set of players such as Deloitte, International Bar Association, and the European Banking Federation.

Ultimately, perhaps, what will emerge is a world tax organisation on the lines of the World Trade Organisation to deal with issues of digital commerce. “It will involve hard-nosed negotiations among the countries on who should have the right to tax what part of the e-commerce income,” says Garg. That will give countries some share of the digital economy, and, perhaps, put an end to some of the ongoing litigations.