Mahindra & Mahindra’s makeover, powered by EVs

Mahindra Group lines up 12 SUV launches by 2030, looks to scale up ev portfolio for growth.

This story belongs to the Fortune India Magazine september-2025-the-year-of-ev-launches issue.

TRUCKS CARRYING two-wheelers and cars crisscross the industrial township of Chakan in Pune, stirring up dust and clogging approach roads to manufacturing plants during the busy morning hours. Mahindra & Mahindra’s (M&M) sprawling auto hub here is one of the nerve centres of India’s automobile production. A new plant on the campus now rolls out the company’s latest electric vehicles — the BE 6 and XEV 9e.

Inside the EV facility, heavy-duty manufacturing lines hum and whir with mechanised precision. Every stage — from the paint shop to the body shop to the electric powertrain unit — is fully automated. Japanese Fanuc and German KUKA robots are lined up in neat rows, spot-welding, handling materials, and joining parts with unerring accuracy. Built in a record 11 months and commissioned in January 2025, the plant is designed to produce electric SUVs on a fully integrated, highly automated system with over 1,000 robots and advanced transfer systems. The complex includes a press shop, an AI-driven body shop, and a robotic paint shop.

Auto major M&M, the flagship company of the Mahindra Group, has set up its own battery assembly unit within the Chakan campus, integrating it with the SUV production line. Blade cells are sourced from China’s BYD; M&M’s in-house battery packaging ensures resistance to crash impact, fire, and water damage.

Cut to Chengalpattu — a town about 60 km from Chennai with serene, village-like charm. The road to Mahindra Research Valley (MRV) ends at a huge arched gate that opens into a lush, tree-lined 125-acre campus. R. Velusamy, the newly appointed president, automotive business, M&M, is already caught up in morning meetings. “Every future Mahindra SUV takes shape here,” he says with a smile. “I can’t reveal much — that would be telling my rivals exactly what I’m going to do.”

Established in 2012 after the in-house success of the Scorpio, at MRV, Mahindra’s teams sketch the engineering blueprint of future vehicles. The company’s latest EVs, built on its INGLO platform, were largely engineered at MRV. The Chennai connection even extends to the aesthetics — music maestro A.R. Rahman designed the soundscapes for both the XEV 9e and BE 6.

At the Mahindra headquarters in Worli, South Mumbai, Anish Shah swiftly moves from one meeting to another, racing against time. In nearly four-and-a-half years as group CEO & MD of the Mahindra Group, Shah has burnt the midnight oil to turn around smaller businesses such as Lifespaces, Holidays and Logistics, reshape Tech Mahindra and Mahindra Financial Services, and pivot the auto and farm businesses.

The auto and farm divisions, led by Rajesh Jejurikar as ED & CEO, are on a strong footing and are set to transition to electric vehicles with an additional investment of ₹12,000 crore and the planned launch of five new electric SUVs. Two more models built on the INGLO platform will be launched by early 2026. The company also plans to launch another seven ICE SUVs and five light commercial vehicles (LCVs) by 2030.

More Stories from this Issue

In addition, on August 15, Mahindra unveiled another modular, multi-energy NU.IQ platform that will underpin a range of disruptive SUVs. The company showcased four new concepts — Vision S, Vision T, Vision SXT and Vision X. Developed by Mahindra India Design Studio (MIDS) in Mumbai and Mahindra Advanced Design Europe (MADE) in Banbury, the U.K., these concepts, engineered at MRV, will go into production from 2027.

In total, M&M plans to launch 12 SUVs by 2030. Scaling up the EV portfolio is the next step. Jejurikar says with the dedicated ramp-up and new launches, the company targets to achieve 20-30% EV sales share by 2027. The SUV giant is in the ₹27,000-crore investment cycle for three years (FY25-27). Of this, ₹12,000 crore has been allocated for EVs, and ₹8,000 crore for ICE vehicles. The remaining ₹7,000 crore is being used in CV and other auto businesses.

M&M’s trophy utility vehicles have increased revenue market share to 23% from 10% a few years ago. Its tractor business (Mahindra and Swaraj) has stuck to its leadership position with a 43% market share. The LCV (< 3.5T) business maintains its dominance with 52% share, though the heavy commercial vehicles (HCV, >3.5T) business lags Tata Motors and Ashok Leyland. To bridge that gap, Mahindra acquired a controlling stake — approximately 59% — in SML ISUZU Ltd for ₹555 crore in April 2025.

Shah says the launch of the XEV 9e and BE 6 marks a decisive shift in the company’s eSUV journey. His initial focus was on driving returns across all group businesses; now, it has shifted to delivering scale. Launched in mid-March, the BE 6 and XEV 9e models sold 10,000 units in the first 70 days.

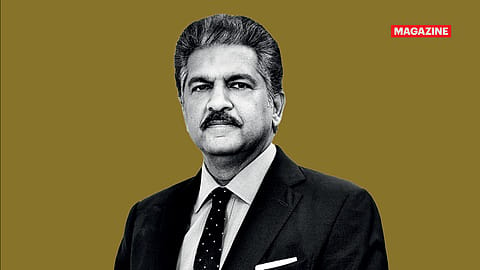

(INR CR)

While expanding its EV footprint, M&M’s ICE SUVs — Thar Roxx, Scorpio, XUV3XO, XUV700, Thar, and Bolero — continue to dominate the Indian market. SUV volumes grew 20% to 5.51 lakh units in FY25. The company reported standalone revenues of ₹1,18,625 crore (a 17% increase YoY) and a profit after tax (PAT) of ₹11,855 crore (up 11.39%) for FY25. Chairman Anand Mahindra said in the annual report the group always aligned national interest with business interest. “Our current thrusts into EVs, defence, renewable energy, and logistics continue that tradition.”

But the road ahead will be challenging as global EV giants, including Tesla, MG Motor, and VinFast, eye a major share in India. Mahindra’s task will be to defend its turf in an increasingly competitive landscape.

The group is driving into the next decade with a balanced, two-pronged strategy — keeping its internal combustion engine (ICE) line-up strong while accelerating into the EV era. While it expects EVs to account for 20–30% of its SUV portfolio within the next two years, leaving much of the line-up still ICE, it also means parallel innovation on both fronts. “It’s about keeping both streams running for some time,” says Jejurikar. “The next few years will show how we can push EV share beyond 30%, depending largely on how charging infrastructure develops in India.”

Mahindra’s EV strategy revolves around solving customer pain points. A key milestone: launching a 79-kilowatt-hour (kWh) battery pack delivering over 500 km of real-world range — cutting charging frequency to roughly once a week for most urban users. Battery longevity is addressed via a lifetime battery warranty. Beyond engineering, Mahindra positions its EVs as ‘lifestyle vehicles’ — quiet, connected, and tech-loaded, with features such as video streaming, premium audio, and auto-park assist. “EVs deliver a transformational driving experience. They bring a lot of positivity,” adds Jejurikar.

Preparation for the EV push rests on three pillars — world-class product experience, service excellence at dealerships, and customer access to charging infrastructure. To ensure access, Mahindra created Charge.in, tapping into its Powerol genset business (which powers telecom towers) and redeploying its electricians to install charging equipment at homes, residential complexes, and offices. Additionally, through its in-house Me4U aggregator app, the company onboarded more than 34,000 charge points across the country.

M&M is ramping up production at Chakan to meet surging EV demand. From the current annual capacity of around 90,000 units, production will rise to 200,000 units by 2027. It has already invested ₹4,000 crore for EV development between FY22 and FY24, and has committed another ₹12,000 crore during FY25–27.

Despite global uncertainties, including U.S. tariffs and economic headwinds, M&M remains bullish on India’s EV transition. “We will have a full portfolio of electric products over the next five years. That will be our primary focus,” says Jejurikar.

The company will focus on building Born Electric SUVs on the INGLO as well as NU.IQ skateboard chassis. “All our new EV products will be electric-origin,” says Jejurikar. However, there will be the visual connects. For example, the XEV 9e has visual links to the XUV series but is fundamentally different, while the upcoming electric Thar will retain its rugged essence yet be ground-up new.

Critics may point to Mahindra’s relatively late entry into EVs, but Jejurikar insists the timing has been deliberate. “The right product at the right time matters more than being first. We saw 2025-26 as the inflection point for EV penetration in India. That’s why we started our programmes in 2021,” says Jejurikar.

Backed by the government’s production-linked incentive (PLI) scheme, M&M embarked on a bold plan to create a complete portfolio of world-class electric SUVs. This led to developing INGLO — a flexible platform allowing multiple models on the same wheelbase.

Initially, Mahindra’s EV focus will remain in India, but plans include expansion into right-hand-drive markets such as the U.K., South Africa, Australia, and New Zealand, followed later by left-hand-drive markets such as Western Europe.

Cost competitiveness is a key advantage. Mahindra’s EVs are priced 50% lower than comparable models in developed markets, because of frugal engineering, lean teams, and high localisation. “We are an important partner for suppliers, enabling them to make localisation decisions, which keeps fixed costs in check,” Jejurikar notes.

Mahindra’s transformation journey started in 2020-21 with a clear vision: future SUVs would combine striking design, advanced technology, and rugged capability. As part of the new plan, the Marazzo MPV, which didn’t fit the new brand direction, was phased out. In August 2021, Mahindra unveiled a new visual identity, complete with a modern SUV logo.

A major design coup was hiring Pratap Bose from Tata Motors to lead Mahindra’s design studios in India and the U.K. Technologically, the company introduced the XUV700 with expansive infotainment screens and rich connectivity, launching full variant portfolios simultaneously — a first for M&M. The Thar’s relaunch, now smoother with refined petrol and diesel engines, automatic and manual options, and vastly improved ride quality, helped Mahindra reach premium mainstream buyers. Prior investments in noise, vibration, and harshness (NVH) level improvements set the stage for this leap.

Mahindra’s edge, says Jejurikar, lies in being deeply attuned to the domestic customer. In India, cars are not just mobility — they’re status symbols. “The first car you buy is a big step. Every upgrade is a moment of pride. We understand why cars are such an important part of people’s lives here,” he says.

Jejurikar downplays the threat from entrants such as Tesla and VinFast: “Of course, new players dilute volume share. Hence our goal should be around revenue share because our products command much higher average price points.” Agrees Shah: “Competition has always made us stronger. What’s different now is that our electric products stack up well from the start. That gives us confidence.”

During Pratap Bose’s first meeting with Anand Mahindra in mid-2021, the chairman asked, “Pratap, we are an SUV company and want to remain one because that’s what we do best. Do you think that’s limiting?” Bose’s reply was clear: “It’s not a limitation. There are many types of SUVs. Thar and Bolero are boxy; Scorpio is muscular; XUV is athletic like a cheetah; XEV 9e and BE 6 are coupes. But they all share SUV traits — performance, ability, stance, and strength.”

The company’s EV journey has been rapid. “In three years, we went from a sheet of paper to a sheet of steel,” says Bose. The ability to launch electric-origin vehicles within three years is, in many ways, the story of M&M’s transformation, says Veejay Nakra, former president, auto division, and current president, farm equipment division.

In fact, Mahindra’s first step into electrification began in 2010 with the acquisition of Reva. At the time, however, the company struggled to scale: battery chemistry, motors, and core tech were still nascent; infrastructure was absent; by 2019, Reva variants had ceased production.

Four years later, Mahindra launched the XUV400 — a step forward in its EV evolution — shortly after Tata Motors launched the electric Nexon (an ICE conversion) and MG Motor built its EV customer base. Now, Mahindra has entered its third generation of electrification: the era of electric-origin SUVs — Born EV — built from the ground up. Engineering such vehicles requires a different approach from earlier conversions or generation-one models.

The first prototypes of the XEV 9e and BE 6 were ready in Chennai within 18 months of project launch. Soon after, final design data went to toolmakers for body panels, jigs, and fixtures. Senior leaders — Jejurikar; R. Velusamy; Bose, and Nakra — reviewed the models before presenting them to Anand Mahindra and Anish Shah. “Everyone felt these products could disrupt the category and succeed globally,” says Nakra.

At the heart lies the INGLO platform, designed with specific dimensions, weight, and wheelbase. This single platform supports multiple SUVs, spreading one-time investment across several products and maximising returns.

Mahindra’s latest EVs deliver up to 500 km of real-world range, making them viable as primary vehicles for long drives. “One dealer from Bareilly told us his biggest USP for the top-end variant is its 79-kWh battery,” Nakra shares. “Customers can drive from Bareilly to Lucknow and back without recharging. Mumbai-Pune intercity journeys have become far more convenient.”

Mahindra’s EVs also offer premium features typically found in ₹60–70 lakh vehicles — at ₹18–30 lakh, a major edge for buyers. With refined ride quality and silent drive-trains, they deliver a premium driving experience without the high-end price tag.

From the launch of the XUV500 in 2011 to its electric origin in 2025, Mahindra has transformed vehicle performance — from NVH to ride quality, handling, steering, and braking. “It took us 14 years to perfect the door-shutting sound you hear in the BE 6 and 9e — similar to that of premium German cars,” Velusamy says with pride.

Between 2021 and 2024, Mahindra added about 2,200 engineers at the MRV in Chengalpattu. The company also invested ₹800 crore in advanced labs for cell research, battery pack testing, electronics software, EV crash tests, steering, suspension, braking, and cybersecurity. Complementing these is the Mahindra SUV Proving Track (MSPT) in Kanchipuram, 50 km from Chengalpattu, where SUVs undergo terrain and simulation tests.

For EVs, Mahindra sources motors from France’s Valeo and blade cells from BYD; integration of cells into battery packs is done entirely in-house — a core innovation area. “Battery safety is crucial,” Velusamy stresses. “We set it on fire, submerge it in water, run over it with a truck, and even conduct nail-penetration tests.”

The INGLO platform underpins Mahindra’s electric SUVs, built around the battery pack and front and rear suspension, designed to meet strict crash safety standards. The AI layer — MAIA (Mahindra Artificial Intelligence Architecture) — adds neural engines, Cloud services, and connected-car tech. The EVs come with cameras, five radars, and features such as auto-park assist.

Future innovation will focus on larger batteries for extended range. Charging infrastructure is critical. The government’s PM E-DRIVE scheme, with a budget of ₹10,900 crore over two years, offers subsidies to buyers and supports charging network expansion. Private players, including Tata Power and Jio-BP, are rolling out aggressive plans — building momentum for the EV category.

While many components are still imported, localisation is increasing. Mahindra currently imports cells but assembles them locally in Pune. Falling cell prices have also helped reduce costs. As the PLI scheme boosts domestic manufacturing, in-country value addition will rise — improving margins.

Charging time is also dropping. In Mahindra’s EVs, the battery can go from 20% to 80% in just 20 minutes, giving customers confidence for long-distance travels.

“What I find fascinating as a designer,” says Bose, “is that there’s no common ‘Mahindra customer’ profile.” The goal is to bring more people into Mahindra showrooms. Since the launch of the BE products, the brand has attracted many first-time buyers. Women are purchasing the three-door Thar; young customers opt for the XUV700; and the off-road-ready Thar Roxx is attracting families.

With cutting-edge technology and broadening appeal, M&M is not just building electric vehicles — it’s reshaping the way India drives into the future.