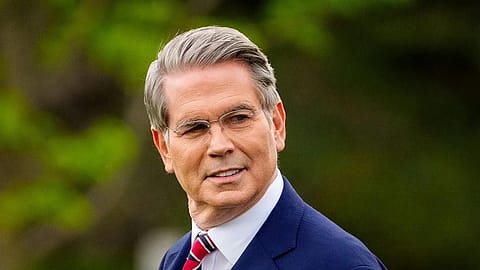

India ‘recalcitrant’ in trade talks, says US Treasury Secretary Scott Bessent

“The big trade deals that aren’t done or aren’t agreed - Switzerland is still around, India has been a bit recalcitrant,” says U.S. Treasury Secretary Scott Bessent.

United States Treasury Secretary Scott Bessent has said that India has been “a bit recalcitrant” in its trade talks with the US.

“The big trade deals that aren’t done or aren’t agreed - Switzerland is still around, India has been a bit recalcitrant,” he told Fox Business.

This comes days after US President Donald Trump ruled out trade negotiations with India amid 50% tariffs, stating there will be no trade talks until the issues between the two countries get resolved. Trump had also warned of “secondary sanctions” on countries that are buying Russian oil.

On August 6, Trump signed an executive order that imposed an additional 25% “penalty” tariff on imports from India for continuing to purchase oil from Russia, taking the overall tariffs on Indian goods to 50%.

The additional tariff widens the gap compared with the 15-20% tariff rates for other countries in Asia-Pacific, according to Moody’s Ratings. Beyond 2025, the much wider tariff gap compared with other Asia-Pacific countries would severely curtail India’s ambitions to develop its manufacturing sector, particularly in higher value-added sectors such as electronics, and may even reverse some of the gains made in recent years in attracting related investments, Moody's warned.

The ratings agency expects India's real GDP growth to slow by around 0.3 percentage points compared with its current forecast of 6.3% growth for fiscal 2025-26 if India continues to procure Russian oil at the expense of the headline 50% tariff rate on goods it ships to the US. Moody’s, however, added that resilient domestic demand and the strength of services sector will mitigate the strain.

On the other hand, a decision to curtail Russian oil imports to avoid the imposition of the penalty tariff could pose difficulties in procuring alternative sources of crude petroleum in sufficient amounts and in a timely fashion, proving disruptive to economic growth if the overarching supply of oil to the economy is interrupted, cautioned the ratings agency. Since India is among the world's largest oil importers, a shift towards non-Russian oil would tighten supply elsewhere, raise prices and pass through to higher inflation, it said. "The consequently larger import bill would also contribute to a wider current account deficit against the backdrop of weaker tariff competitiveness that potentially undermines investment inflows," said Moody's.

Recommended Stories

Since 2022, India has increasingly ramped up its crude oil imports from Russia. India's imports of Russian crude rose to $56.8 billion in 2024 from $2.8 billion in 2021, corresponding to a rise in India's share of total crude oil imports to 35.5% from 2.2%, the ratings agency said. In 2024, China was the only country that imported more oil from Russia, it added.