Global equities may see correction as they have not priced in rising public debt: RBI Governor

The RBI Governor said that inflation is range-bound across most advanced economies, and central banks are witnessing some slowdown in the economy.

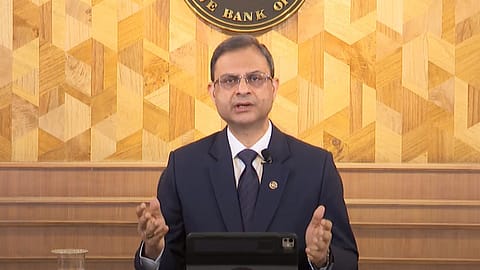

Reserve Bank of India (RBI) Governor Sanjay Malhotra stated on Friday that the tech rally in U.S. stocks suggests that global equity markets have not fully priced in rising public debt levels, and a correction may be imminent. Malhotra said India’s growth remains resilient despite the recent odds against its favour.

“While the Central banks in the advanced economies are concerned about the elevated levels of public debt in their economies, and worry about a disruptive resolution, full risk perhaps is not priced in. This raises a spectre of fiscal dominance, where monetary policy could become constrained by the need to ensure debt sustainability. Equity markets, too, seem to be a bit complacent, and I am talking about global stocks generally. They have been particularly buoyant led by technology leading to worries that a correction might be in the offing,” Malhotra said at the Kautilya Economic Conclave, 2025 in New Delhi.

“In all likelihood, tariffs, combined with large and stretched public debts almost everywhere in the world, will have some material impact on the respective economies and therefore on the global economy. As of now, it seems that these risks are not priced in the equity markets. And there is a greater tolerance too for inflation,” Malhotra said.

Malhotra said inflation is range-bound across most advanced economies, but is above target levels, and central banks are in a gentle easing cycle as they witness some slowdown in the economy.

Where does India stand

Malhotra said India’s macroeconomic fundamentals remain strong built assiduously over the decades. “We have strong forex reserves, low inflation since February, a narrow current account deficit, a very credible fiscal consolidation path and very strong balance sheets of our banks and our corporates. This is to be attributed to the steadfast attention to the macroeconomic stability, price stability, financial stability and even policy stability,” he added.

He said the Indian economy appears to have settled into an equilibrium of resilient growth, despite recent challenges. “This is quite a feat for a large emerging market and makes India stand out as an anchor of stability in a volatile world,” said Malhotra.