Religare vs Burmans: SEBI rejects Gaekwad’s bid for open offer in NBFC

U.S.-based entrepreneur Danny Gaekwad had proposed an open offer for a 26% stake in Religare at ₹275 per share, a 17% premium over the Burmans' offer

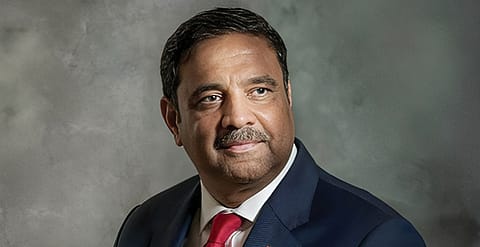

In another twist to the Religare saga, SEBI has rejected a request from Florida-based entrepreneur Digvijay alias Danny Gaekwad, who sought permission to make a "competing open offer" for a 26% stake in NBFC Religare Enterprises (REL).

SEBI, in its response to his application, says: “The letters submitted by Digvijay Laxmansinh Gaekwad are being returned since the same is not an exemption application in terms of Regulation 11 of SEBI (SAST) Regulations, 2011.”

In a surprise move amid the ongoing battle between Religare Enterprises and the Burban family over its control, U.S.-based entrepreneur Gaekwad had proposed an open offer for a 26% stake in Religare Enterprises at ₹275 per share, a 17% premium over the Burmans' offer of ₹235 per share.

The counter bid came just two days before the open offer of the Burman family was to open on Monday. The Burmans, who have long sought to consolidate their control over REL, had announced an open offer last year.

Currently, the Burman family entities own a 25% stake in Religare Enterprises and is the largest shareholder of the company. With the open offer, their stake in REL would increase to 53.94%. Gaekwad, on the other hand, had proposed to pick up to 55% stake in the company.

Recommended Stories

He had proposed to acquire up to 9,00,42,541 fully paid-up equity shares of the face value of ₹10 each, representing 26% of the Expanded Voting Share Capital of Religare Enterprises from the public shareholders of Religare by M.B. Finmart, Puran Associates, VIC Enterprises, and Milky Investment & Trading.

Gekwad, in his SEBI application, had said he believed the business of REL was robust and would be even better with a stable and committed promoter or investor who can provide adequate capital and undivided attention to the business. "Unlike the Burmans, I do not have any other NBFC in our group and will be able to provide our undivided attention and infuse capital into the business," he said.

(INR CR)

Notably, the independent directors led by Saluja have long pushed back against the Burman family’s moves, arguing that the company’s value and prospects deserve better recognition. Their concerns about the transparency and fairness of the Burman offer have been well-publicised.