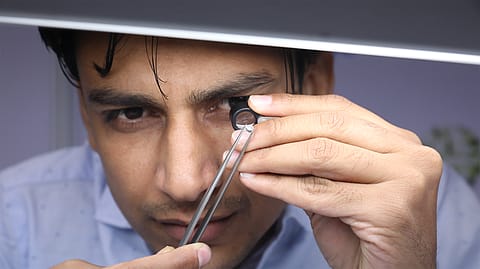

Trump’s tariffs can crush India’s diamond polishing sector; industry looks at a massive $12.5 billion loss

Trump tariffs impact on India: Country's natural diamond polishing industry can face a big fallout and massive revenue loss.

A big fallout from the imposition of 50% tariffs on India by U.S. President Donald Trump will be seen in the country's natural diamond polishing industry, with the sector likely to face a whopping 28% to 30% fall in revenue, amounting to almost $12.50 billion this fiscal, said ratings firm, Crisil.

Crisil, in its note, also highlighted that this steep fall in revenue for the sector comes on the back of degrowth, which the diamond polishing industry has been witnessing for the past three fiscals due to falling demand in China and U.S. as lab-grown diamonds climb up the demand ladder.

"The 50% tariffs, effective this week, makes exports to the US tough for two reasons: one, the industry’s low margins make absorption of the incremental levy very difficult and two, declining demand means passing on the incremental burden to consumers will not be easy. The consequent reduced operating leverage could erode the operating margin of diamond polishers by 50-100 basis points and pressurise their credit profiles," Crisil said.

The ratings company also noted that the Indian polished diamond industry derives almost 80% of its revenue through exports, and the U.S. being an important market, already corners almost 30% out of the 80.

"Sales had begun getting impacted after a 10% tariff was imposed in April 2025. Hence, the share of the US in India’s polished natural diamonds slid 1100 basis points in the first four months of this fiscal to 24%," Crisil said.

Crucially, the research note argued that Indian natural diamond polishers, anticipating growing demand due to the coming festival months, had increased productions, in July and August. Therefore, in July, exports had already surged by 18%.

"Competition from lab-grown diamonds in markets such as the US will continue to dent revenues, with the variety having already captured ~60% of the market share by volume. Subdued Chinese demand adds to these woes," Crisil warned.

Painting a bleak picture, Rahul Guha, Senior Director, Crisil Ratings, argued that India is a country which polishes about 95% of all diamonds produced in the world. And the case is not that due to the tariffs, the domestic market within India can give the much needed buffer.

"To be sure, consumption in India has been increasing sequentially over the years, but the incremental demand doesn’t have the heft to fully offset the losses in the US and China," Guha argued.

"The industry's ability to navigate the market dynamics, including tariffs, is crucial to its future. Diamond polishers can take three steps: increase domestic sales; push sales in alternative geographies; and set up polishing facilities in trading hubs as rerouting via low-tariff nations is not an option. Even if retailers explore alternative sourcing options in lower-tariff countries such as the UAE or Belgium, a significant portion of the diamonds would still be polished in India and thus subject to higher tariff," Crisil said.

However, the situation is so dire that because demand has been consistently falling, and retailers from the U.S. would not absorb the high tariff cost, hence, diamond polishers are staring at a scenario where their operating margins could decline to 3.5 to 4%, from a peak of 5% it witnessed in 2023.

(INR CR)

"Diamond polishers are expected to keep a lean inventory to control debt. Miners have cut production to limit the fall in prices, in line with subdued demand. Timely collection from customers abroad will be monitorable amid slowing demand. Debt levels of diamond polishers should reduce over the medium term," the rating agency said.

Talking about the impact of tariffs, Himank Sharma, Director, Crisil Ratings, has warned that in the wake of the ongoing situation, diamond polishers are likely to see their credit risk profiles more stressed.

“While limited reliance on external debt has helped diamond polishers maintain a stable capital structure, declining scale of operations and pressure on profitability will likely test their credit risk profiles. Specifically, while the financial leverage1 is expected to be relatively stable at 0.7-0.8

time, the interest coverage could decline to ~2 times from 2.3-2.5 times last fiscal," Sharma said.