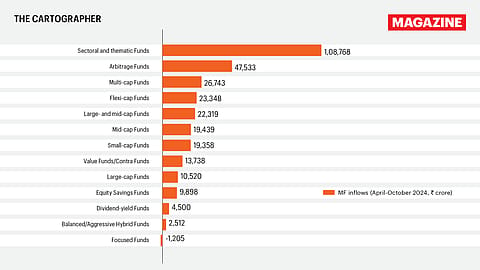

Where did India put its money in 2024? The mutual fund shift explained

Equity inflows into mutual funds see a remarkable surge, reaching ₹3.07 lakh crore.

IN THE FIRST SEVEN MONTHS of FY25, equity inflows into mutual funds have seen a remarkable surge, reaching ₹3.07 lakh crore. Among the various categories, thematic and sectoral funds have clearly been the standout performers, pulling in an impressive ₹1.08 lakh crore. These funds have captured investor interest by focusing on specific themes and growth-oriented sectors, reflecting a more strategic and focused approach to investing. While flexi-cap and mid-cap funds also attracted steady inflows, the overwhelming preference for thematic funds highlights their status as the ‘flavour of the season’. Whether the flavour will eventually leave a palatable experience for investors remains to be seen.