Fortune 500 India: SBI on a fast and furious growth path

Ranked fourth on the list, the country’s largest lender aims to expand its asset size from 20% of India’s GDP to 25% in the coming years.

This story belongs to the Fortune India Magazine indias-largest-companies-december-2025 issue.

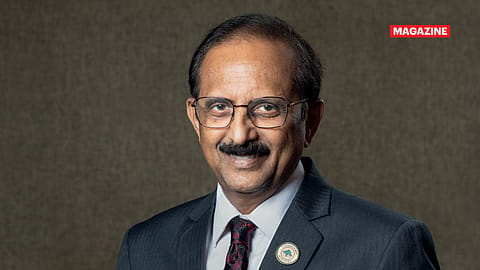

ON A HUMID Mumbai afternoon, Challa Sreenivasulu Setty walks into a room on the 18th floor of the headquarters of the country’s largest public sector lender, which now has consistently ranked among the Top 10 on the Fortune 500 India list for the past 16 years. Speaking in a measured tone, the 27th chairman of the State Bank of India sets the context for Fortune India, dispelling any concerns over the underpinnings on which the economy rests. “Over the past five years, we have had Covid, global uncertainty in terms of disruptions, supply-chain issues, and trade shifts happening because of tariff barriers. But all through this, the Indian economy has stayed resilient. We have weathered uncertainties much better than many other countries globally,” explains Setty.

Hailing from what was once undivided Andhra Pradesh and now Telangana, it would not be far-fetched to state that the 60-year-old, who spent his school vacation collecting debts for his father who was a grocer, knows the multiplier effect credit can have on businesses and the economy, in general.

SBI, which came into existence 70 years ago, is today one-fifth of India’s GDP. Setty believes big will not just get bigger, but better too. As of the end of FY25, SBI’s balance sheet size crossed ₹66 lakh crore. The bank, which has doubled its balance sheet once already since 2018, wants to double it again: this time in six to seven years. It would have sounded ambitious coming from a startup founder, but coming from Setty, it sounds inevitable and based on observable patterns.

“JP Morgan’s balance sheet is about 13% of the U.S. economy; ours is already about 20% of India’s GDP. As the Indian economy grows towards $7-8 trillion, hopefully SBI’s asset size at 25% of GDP will place us if not in the Top 10 but in the Top 20 global banks by assets for sure,” says Setty.

With 560 million customers, 23,000 branches, a dominant 30% share in UPI, and a balance sheet galloping towards ₹100 lakh crore, SBI wants to alter its DNA without altering its character. It wants to become digital-first while remaining human-shaped; expansive without being reckless; a partner to emerging industries without neglecting the slow pulse of industrial India.

“Our balance sheet has doubled since 2018 without doubling headcount or branches, which shows how technology enables scale. Our focus now is to leverage technology to defend and grow market share from 23% in deposits to 25%, and above 20% in loans,” adds Setty. For context, SBI serves 560 million customers, acquiring around 60,000 daily. In UPI, the digital payments network of India, it accounts for 30% market share.

IT’S TIME TO INVEST

More Stories from this Issue

What was once lamented as India’s twin-balance-sheet problem — indebted corporates and stressed banks — Setty believes, has become a “triple-balance-sheet advantage”: corporates deleveraged, banks cleaned up, and the government became fiscally sturdier. “This means the economy is primed for capital investment,” says Setty.

Another interesting feature is that most of the core sector is working at about 75% capacity utilisation, which means it’s the right time for expansion. However, captains of India Inc. are looking at stretching their capacities farther before placing their bets on expansion. Setty, though, feels that it’s better being early than late. “Technology is helping them delay capital expenditure. One piece of advice I give to industry is do not wait for demand to stabilise. At 75-80% capacity utilisation, it’s time to invest,” says Setty.

Behind that advice sits ₹7.2 lakh crore of sanctioned corporate pipeline. Much of it won’t convert immediately, because Indian corporates, suddenly flush with internal cash, prefer to spend their own money before reaching out to lenders. But Setty won’t mind playing the waiting game as SBI, after all, is used to adding heft across cycles.

Emerging industries — semiconductors, green hydrogen, green steel — are not domains banks traditionally understand. Hence, SBI is building a Centre of Excellence for Emerging Industries, which will decode new technologies, assess risk, and design financing models not reliant on subsidies.

(INR CR)

Keeping in sync with the changing contours of India’s entrepreneurial landscape, SBI is tending to India’s startup ecosystem with six specialised branches offering compliance and advisory services. “Conventional balance-sheet lending won’t help startups,” Setty notes. But guidance will.

For decades, corporate credit was the mountain on which Indian banking stood. But that context is changing. Rising retail credit, and MSMEs seeking working capital are keeping bankers busy.

SBI has responded by turning towards data. The bank’s Business Rule Engine pulls GST filings, income-tax data, and bank statements into decisions made in under 2 minutes for MSME loans up to ₹5 crore. And ₹75,000 crore has already flowed through this algorithmic bloodstream.

Analysts, too, are positive about the roadmap. Jai Prakash Mundhra, an analyst with ICICI Securities who is bullish on the stock, says: “SME growth remains robust. SBI has delivered over 15% YoY growth in SME for the 11th consecutive quarter. The bank sees huge unaddressed demand in MSME, which bodes well for a long growth runway. Digital changes have made underwriting stronger for the bank.”

GOING FOR DOUBLE

When SBI launched YONO seven years ago, few predicted its effect. The bank doubled its balance sheet without doubling branches or headcount. Setty sees technology not as a replacement but as a multiplier.

YONO 2.0 is coming — an omnichannel reinvention, a single stitched experience across mobile, web, and branch. Inside the bank, a different tech revolution hums: Ask SBI, a GenAI-powered knowledge engine for employees. A teller can ask, “How do I close a PPF account?” and receive a scripted, consistent answer. Technology here becomes a quiet editor of human fallibility.

To support this transformation, SBI has hired 1,500 specialists in AI, data sciences, and design: not contractors, but permanent staff. In a hierarchy built on decades of tradition, this is the most radical change of all. “For the first time, we’ve done large-scale recruitment of around 1,500 specialists, not just coders, but subject experts in artificial intelligence, data sciences, UI/UX design, and related fields. We believe we must build our own data and expertise,” explains Setty.

“Physical branches won’t become irrelevant. They’ll evolve into value-added service hubs. They’ll onboard customers through digital channels and cross-sell products. We’re rewriting our core code across all channels. This rollout should happen within this calendar year,” says Setty.

The plan to double its balance sheet is simple.

No mergers. No grand acquisitions. Just organic growth at 2-3% above nominal GDP, compounded faithfully. With India’s economy poised to expand towards $7-8 trillion, SBI’s own ascent into the Top 20 global banks seems less ambition and more arithmetic.

“Our growth plan is purely organic. We’re not looking at mergers to drive it. If you assume nominal GDP growth of around 10% and SBI’s typical growth 2-3% above that, the compounding effect naturally doubles the balance sheet in six to seven years. We’re not expecting further public-sector bank consolidation to feed our growth,” reveals Setty.

In the September quarter of FY26, SBI’s deposits rose to nearly ₹56 lakh crore, with a healthy domestic credit-to-deposit ratio of 69.82%. Its CASA base of ₹21.24 lakh crore continues to lean heavily on savings accounts (₹17.96 lakh crore) compared to current accounts (₹3.28 lakh crore), prompting questions about whether corporate funds are migrating away from CAs and into overnight mutual funds.

Setty rejects the notion of an exodus. “Current accounts are essentially operational,” he explains. “We used to get substantial CASA balances from government accounts, but governments have become more efficient in cash management. That naturally reduces those balances.” The real story, he argues, is evolution, not erosion. “Business current accounts have not declined. We’ve stopped selling current accounts as simple accounts; we now sell them as cash-management solutions.” With automated liquidity management — funds sweeping into investments or returns, SBI’s business CA balances are, in fact, rising. For instance, the growth in CA deposits for Q2FY26 was 17.90% vs 6.3% for savings accounts. “They’re [Business CA] not enough to replace large government balances, but they’re far from irrelevant,” Setty emphasises.

Mundhra of ICICI Securities believes the bank is positioned well. “CASA growth has been granular and is reflective of the various initiatives taken, the rich customer franchise and deep distribution,” mentions Mundhra.

A DIGITAL-FIRST BANK

SBI, Setty insists, will become a digital-first bank “without losing its core values of customer-centricity, inclusiveness, and trust.” Setty’s leadership mantra is deceptively simple: people and technology.

“For any organisation, especially in BFSI, adoption of technology and digitalisation is no longer optional. It’s a compulsion. This has helped SBI tremendously over the past five to seven years since we launched YONO. Our focus now is to leverage technology to defend and grow market share. We expect total business (loans + deposits) to reach ₹100 lakh crore by the end of this fiscal and aim to double that in six to seven years,” says Setty.

Even as consumer lending accelerates across the system, questions persist about whether rising unsecured personal loans pose fresh risks. Setty dismisses the alarmism. “Not really,” he says plainly. “There were some concerns around unsecured loans, but those have largely been addressed. Each entity follows its own model.”

For large banks such as SBI, personal loans are effectively secured because they’re lent against salaries, says Setty.

While he acknowledges isolated stress pockets in smaller segments of the market, he sees no systemic red flags.

Not surprising that the Street is bullish on the bank, which in November crossed a milestone that would have sounded fanciful a decade ago. It has become the first public-sector bank and only the sixth Indian company to join the ₹9 lakh crore market-cap club.

With strong RoAs and RoEs, and a sector many believe is operating near peak performance, Setty is circumspect but steady. “The current strong performance reflects benign asset quality,” he notes, pointing out that globally too, asset-quality issues have remained muted despite geopolitical disruptions. Much of this resilience, he believes, is structural. “Post the global credit crisis, underwriting standards have improved significantly. Banking is cyclical, but maturity lies in delaying and managing cycles. Indian banks are better positioned now on both counts.”

If SBI does double again, few will remember the exact moment the transformation began. But the clues are evident: in Setty’s calm certainty, in the bank’s tech makeover, and a country of over a billion rising with its own ambitions.