Fortune 500 India: Unlock, scale, dominate is RIL's blueprint for growth

Giga-scale factories, AI-native platforms and the next generation’s leadership mantra — India’s largest private sector company and the No. 1 on this year's list, is building on its scale and capital to leapfrog into the next phase of growth.

This story belongs to the Fortune India Magazine indias-largest-companies-december-2025 issue.

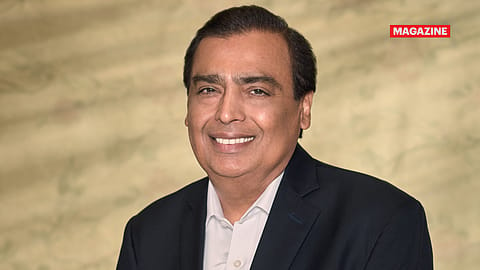

THE MEN STREAMING into Maker Chambers IV at Nariman Point these days are largely investment bankers, and their presence signals one thing — the build-up to what could be India’s most-anticipated stock market event. Across the table sits Mukesh Ambani and, beside him with growing regularity, his elder son Akash, who is quietly steering conversations around the planned public listing of Reliance Jio.

For global investors, the countdown has already begun. If Reliance Industries Ltd (RIL) proceeds with its plan to list Jio by mid-2026, the markets could witness one of the largest value unlocks in India’s corporate history. Bankers have started framing expectations around a valuation of $130–170 billion, a scale that would instantly place Jio among the country’s top listed companies. The excitement is not just about monetisation, but about how the listing may reshape dynamics within one of India’s most influential conglomerates.

Mukesh Ambani has long positioned RIL as a company driven by audacity — by building businesses at industrial scale and entering spaces where few Indian corporates have ventured. “Reliance has always been about creating impact, about doing things which nobody else has done,” he told employees recently. He believes the conglomerate is entering a unique window where it can aspire to be among the world’s Top 20 corporations, not just by financial strength, but by technological depth and societal reach as well.

The Jio IPO will likely set off a cascading effect. Once the digital arm lists, the next major unlock is expected to be Reliance Retail Ventures Ltd (RRVL), led by Isha Ambani. Meanwhile, Anant Ambani is shaping the group’s push into the green-energy frontier, where RIL is building five giga-scale manufacturing facilities in Jamnagar. Together, the siblings are redrawing the contours of the group — from consumer brands to data networks, from entertainment to renewable energy, from petrochemicals to artificial intelligence (AI).

RIL’s performance numbers highlight this pivot. In FY25, net profit rose to ₹69,648 crore, while total income increased 8.2% to ₹9,97,795 crore. Investments for the year reached ₹1.31 lakh crore, nearly matching the previous year’s capex, underscoring a sustained investment cycle across emerging and legacy businesses. Despite aggressive spending, net debt remained at ₹1.17 lakh crore, supported by a strong ₹2.3 lakh crore in cash and equivalents. Ambani described FY25 as a year shaped by fragile global conditions and shifting geopolitics, yet said Reliance delivered stability through operational discipline, customer-centric innovation and its role in powering India’s growth ambitions.

NEXT-GEN GAINING GROUND

The generational shift at Reliance is unfolding not through a dramatic declaration but through a deliberate redistribution of responsibilities. Ambani’s description of his children as “three bodies but one soul” is now reflected in the group’s organisational design. Akash Ambani, chairman of Reliance Jio Infocomm Ltd, is involved in the expansion of 5G and digital services. The corporate world expects his emergence as the chairman of a listed Reliance entity. Isha Ambani oversees the retail engine, covering e-commerce and fast-moving consumer goods (FMCG). Anant Ambani is part of the leadership driving the new energy architecture. Together, they are shaping the leadership playbook for a $125-billion enterprise.

More Stories from this Issue

Jio remains RIL’s strongest story of pace and penetration. In less than nine years, it has crossed 500 million subscribers, outpacing global peers in speed of scale. Its broadband network has reached 25 million homes, with targets of 50 million by next Diwali and 100 million within two years.

Financially, Jio Platforms Ltd (JPL) closed FY25 with a net profit of ₹26,120 crore on gross revenues of ₹1.50 lakh crore. Led by Akash, the company has begun embedding artificial intelligence into its core — from telco-specific language models to AI-native network layers that reduce costs, automate operations and enhance personalisation. For market watchers, the Jio IPO is not just another listing; it marks a pivotal moment in the evolution of India’s digital economy.

At RRVL, the strategic lens has sharpened. RRVL delivered ₹12,388 crore in profit and ₹3.31 lakh crore in revenues in FY25. Its physical network grew to 19,821 stores, even as it shut 2,155 loss-making outlets and opened 2,659 larger, more productive ones — signalling a shift towards a more curated and efficiency-focussed footprint. The FMCG portfolio is also gaining weight, with revenues crossing ₹11,450 crore and brands such as Spinner (sports drinks) and Velvette (personal care) gaining wider consumer traction.

Entertainment has undergone its own reset. The creation of JioHotstar, formed through the merger of JioCinema and Disney+ Hotstar, has placed Reliance firmly at the forefront of India’s streaming landscape. With a 63.16% stake, the merged entity reported ₹18,454 crore in revenues and ₹1,903 crore in net profit in the first half of FY26, giving RIL unprecedented control over content distribution and audience access.

(INR CR)

Meanwhile, the oil-to-chemicals (O2C) business, which has been the backbone of RIL for long, delivered steady results despite global volatility. The oil and gas segment recorded a PBIT of ₹15,840 crore in FY25, aided by strong output from KG-D6 and CBM (coal bed methane) fields.

Reliance’s employee base has crossed six lakh, representing talent from more than 60 nationalities. Insiders say the organisational depth being built will ensure that leadership continuity will never be a constraint for the next generation. Mukesh Ambani often calls Reliance “a company of engineers,” reflecting its foundation of technical talent across hydrocarbons, digital, retail and new energy.

BETTING BIG ON GREEN, AI

RIL’s ambition rests on a simple, but bold mantra — double the company every four to five years. The pattern has repeated multiple times. Between FY06 and FY10, the company added the second refinery, expanded hydrocarbon production and launched retail. Post-Covid, telecom and retail triggered another doubling cycle. The next decade will be driven by renewable energy, AI-native digital systems and a new generation of consumer businesses.

The green energy platform is central to this next leap. In Jamnagar, RIL is building five giga-scale factories across solar modules, fuel cells, green hydrogen, advanced batteries and power electronics. The first phase of the solar PV plant is nearing completion, with an internal target of 10GW (gigawatt) of capacity. A 30-GWh (gigawatt-hour) battery unit is coming up alongside.

A solar project is also being developed across 550,000 acres in Kutch, with engineering, feasibility studies, and land development in progress. Solar power generation is expected to begin during the first half of next year, primarily for captive use and green fuel production. It is developing an end-to-end energy ecosystem that includes 24/7 power supply and green chemicals, and it is expected to become fully operational within the next four to five quarters. These investments aim to position Reliance among the world’s leading integrated clean energy manufacturers, supporting its goal of net-zero emissions by 2035.

Artificial intelligence forms the second major pillar. Across the group, AI is being embedded as the operating fabric of all digital businesses. It will shape how Jio networks run, how retail predicts demand, how entertainment personalises content, and how financial services deliver at scale. The development of sector-aligned language models, consumer-centric AI engines and enterprise automation tools has become central to the digital blueprint being executed by the next generation.

The third lever of growth lies in RIL’s expanding consumer ecosystem. From FMCG to omnichannel retail, from entertainment to digital commerce, Reliance is building platforms designed to reach tens of millions of users. Each business is being developed with standalone scale and future listing potential, echoing the strategic arc and direction that has brought Jio to this moment.

With the Jio IPO approaching, RIL is preparing for a transformative phase. The company aims to hit ₹1 lakh crore in net profit before embarking on a broader series of demergers that will unlock value across its diversified verticals. Telecom, retail, new energy, FMCG, entertainment and financial services are all being shaped to operate with the autonomy and identity of eventual listed entities.

Executives describe this transition as the start of a “deep-tech and decarbonisation decade” — one where RIL’s shape will be defined by giga-scale factories, AI-native platforms and the next generation’s leadership imprint. The ecosystem Mukesh Ambani built through scale, bold capital allocation and constant reinvention is now being prepared for its next orbit.

For Ambani, this phase is a continuation of a familiar playbook — build future-ready businesses, invest at scale and create platforms capable of transforming entire industries.