Peak XV’s quest for the best

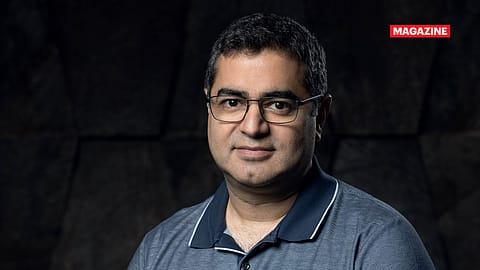

Two years after it carved out a new identity, Peak XV charts the way forward as it aims to build global category leaders from the India-APAC region, says MD Shailendra Singh.

This story belongs to the Fortune India Magazine indias-largest-companies-december-2025 issue.

IN 1972, when American venture capitalist Don Valentine founded Sequoia Capital, he chose to name it after a tree that lives for thousands of years. In 2023, when Sequoia India & Southeast Asia was rebranded to Peak XV Partners, the management took a leaf out of Valentine’s book to name it after the original name given to Mount Everest, a representation of its ambitious roadmap for startups.

This aspiration was on display as founders of Peak XV’s late-stage and IPO-bound investee companies huddled together at The St. Regis Mumbai in September for a ‘crash course’ to better understand India’s capital markets, in preparation for an eventual IPO. The sessions were led by the likes of Sebi chairman Tuhin Kanta Pandey; Raamdeo Agrawal, chairman and co-founder, Motilal Oswal Financial Services Ltd; and fund managers Navneet Munot, MD & CEO, HDFC Asset Management Company Ltd; and Neelesh Surana, chief investment officer, Mirae Asset Investment Managers (India) Pvt. Ltd.

Globally, Peak XV counts 33 portfolio companies that have gone public, including in India, Indonesia, Australia, and the U.S. “We really worked for the past six to seven years trying to get companies ready, and that’s why we were able to have many IPOs,” says Peak XV’s Singapore-based managing director, Shailendra Singh. He doesn’t hide his excitement about the upcoming IPOs of the portfolio companies. “In most years, we have been net cash,” he says, alluding to the returns it made. “It’s gratifying for us that in most years, we actually are the net source of liquidity to our investors.”

The VC firm’s IPO line-up in the coming months includes fintech firms such as online insurance platform Turtlemint, and sleep and home solutions product company Wakefit. Both have filed their Draft Red Herring Prospectus with the markets regulator. Peak XV also continues to hold a sizeable public book in companies such as Honasa Consumer (personal care company behind brands such as Mamaearth, The Derma Co., Aqualogica, and BBlunt) and travel tech firm Ixigo. Explaining the rationale behind holding on to some of the portfolio firms even after IPOs, Singh says, “We try to tailor our approach to the size and the scale of the company, how long we have already been invested, where is that fund in its maturity, and so on… But we take, typically, several quarters after the IPO, before starting our first sell-down.” On an average, the holding period is between two and four years.

Governance takes centre stage as a company decides to go public. As a firm that had a brush with governance-related issues amid fraudulent and unethical practices by investee companies a couple of years ago, Peak XV is now focussed on preparing founders for the long term. “We’re luckily behind that phase now,” says Singh. Highlighting portfolio companies that now operate at scale, Singh says a lot of them now operate with better financial discipline, compounding their growth at healthy rates without burning money; thus making them ripe for the public markets.

But he has a word of caution. “Honestly, I don’t think IPO markets are for everyone. I do think we should be asking a lot of young companies, ‘please don’t go public if you’re not ready’. Subscale companies, especially, should not go public if they’re not ready. I would much rather have our smaller companies not be opportunistic to go public, and stay private longer, and only go for IPO when they get fully ready,” Singh says.

Most of Peak XV’s investment focus in India and the APAC region is concentrated around AI, software and cloud, fintech and consumer sectors, he adds. In India, the VC firm’s long-term strategy is to back “Indian companies for India”. “If you take a 20-year view, we’ll see every kind of company come out of India — from defence to precision manufacturing to spacetech or making fabs here. I think Indian companies will try to build all of that core technology infrastructure for India.” Given the global geopolitical tensions and a faster pace of technology evolution than ever, Peak XV foresees a push for digital sovereignty by countries.

More Stories from this Issue

The other big focus is on startups from India that have the potential to become global category leaders. However, as the race for technology supremacy gathers pace, are Indian or South Asian startups late to the party? Singh doesn’t think so. He cites the examples of AI contract management software company Sirion, Insider (a SaaS company focussed on an AI-driven platform to drive growth and improve marketing ROI), and data intelligence startup Atlan — all investee companies of Peak XV.

Singh feels there is enough room to build global category leaders from India to take on incumbents. “We are very clear that when we back a company, say in semiconductor or in AI, we are not trying to find the best company in India; we are trying to find the best company here that is competitive with the best company in Israel or in the U.S. or in China.” Earlier this year, Peak XV expanded its presence to the U.S. The San Francisco office now has an investment team, two revenue leaders, and an HR leader to help founders tap into the U.S. market for augmenting revenues. “As an independent firm, we now have significantly more capability than before,” says Singh.