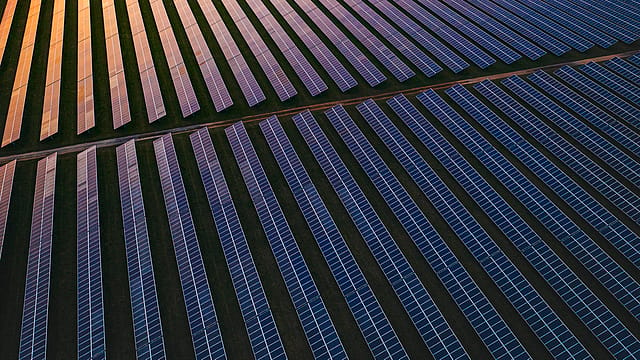

Economic Survey says renewable energy to be 62% of capacity by FY30

ADVERTISEMENT

The Economic Survey tabled in the Parliament says the likely installed capacity by the end of 2029-30 is expected to be more than 800 gigawatt (GW), of which non-fossil fuel would contribute more than 500 GW, about 62% of the then total installed capacity.

India at the recent COP 27 had updated its Nationally Determined Contributions (NDCs) by advancing its target of installed electric capacity from non-fossil fuels ahead of 2030, to 50%.

The country had announced a Long-Term Low Emission Development Strategies (LT-LEDS) last year to achieve the net zero emission goals by 2070, committing 50% of whole energy requirement from non-fossil fuels. The country has achived its NDC target (40%) of installed electric capacity from non-fossil fuel sources in advance, says the survey.

The survey says 500 GW capacity will result in the decline of average emission rate of around 29% by 2029-30, compared to 2014-15.

The survey says India is progressively becoming a favoured destination for investment in renewables and during the period 2014 -2021, total investment in renewables stood at $78.1 billion in India. The National Green Hydrogen Mission, approved by the government with an outlay of ₹19,744 crore last year to make India an energy-independent nation, and to de-carbonise the critical sectors, will result in 3.6 giga tonnes of cumulative CO2 emission reduction by 2050.

The survey says India's Long-Term Low Carbon Development Strategy (LT-LEDS) focuses on the rational utilisation of national resources with due regard to energy security. This strategy is in line with the vision of LiFE, (Lifestyle for the Environment), calling for a worldwide paradigm shift from mindless and destructive consumption to mindful and deliberate utilisation.

Recognising finance as a critical input for achieving climate action goals, the survey says India has taken efforts towards mobilising private capital. The issuance of Sovereign Green Bonds will help the government to tap the requisite finance from potential investors for deployment in public sector projects aimed at reducing the carbon intensity of economy. A framework in this regard has been issued in compliance with International Capital Market Association (ICMA) Green Bond Principles (2021), the survey states. A Green Finance working committee has also been set up to oversee and validate key decisions on the issuance of sovereign green bonds.

The Reserve Bank of India has notified the indicative calendar for the issuance of Sovereign Green Bonds for the fiscal year 2022-23, totaling ₹16,000 crore, said the survey.