India-UK CETA to boost exports across sectors, but compliance and innovation key: Grant Thornton

ADVERTISEMENT

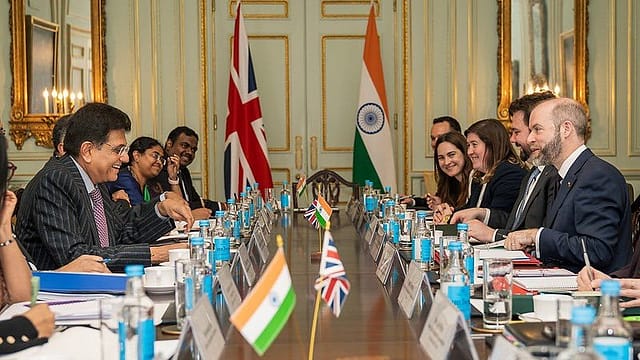

The India-UK Free Trade Agreement (FTA), formally signed on 24 July 2025, is expected to significantly benefit key sectors, including goods and services, mobility and professional movement, and MSMEs. However, to fully capitalise on the agreement, Indian industry must rapidly strengthen compliance frameworks, invest in product quality and innovation, and engage with newly established trade facilitation platforms, according to Grant Thornton Bharat’s latest report.

"Close coordination with trade bodies and state agencies will be vital in translating tariff reductions into tangible export growth, particularly for MSMEs and labour-intensive sectors," the report states. By prioritising upskilling, digital transformation, and sustainability, firms will be better positioned to meet UK market standards and capitalise on new opportunities, the GT report says. "Ultimately, the effectiveness with which the industry adapts and collaborates will determine the extent to which the CETA drives export expansion, value chain integration, and long-term competitiveness," it adds.

Talking about the impact of the deal on various segments of the economy, the report says in labour-intensive industries like textiles, the deal allows zero-duty market access for 1,143 tariff lines. "India, previously at a disadvantage compared to Bangladesh or Pakistan, can now compete on a level playing field and is expected to gain at least 5% additional UK market share in one to two years."

Leather and footwear tariffs will drop from 16% to 0. MSMEs in Agra, Kanpur, Kolhapur, and Chennai will benefit, with exports expected to exceed USD 900 million and a 5% gain in the UK market share in one to two years. In gems and jewellery, the FTA is projected to double exports in two to three years. In sports goods/toys, Indian exports (e.g., soccer balls, cricket gear, non-electronic toys) will be more price-competitive, as rivals like China or Vietnam lack similar FTAs.

The FTA may double engineering exports to over $7.5 billion by 2029–30. Also, zero-duty access to the UK will boost electronic exports, including smartphones, optical fibre cables, and inverters, says the report.

India-UK FTA: Experts call deal 'most substantive', project £28 bn trade boost, 1 mn jobs

In agri-food, India gets duty-free access to the UK for fruits, vegetables, cereals, turmeric, pepper, cardamom, and processed foods (mango pulp, pickles, pulses). Over 95% of agri and processed food tariff lines now attract zero duty. This is expected to boost agricultural exports by over 20% in three years, supporting India’s USD 100 billion agricultural exports target by 2030.

In the auto sector, Indian auto components previously faced tariffs as high as 10% in the UK. With CETA's provisions, these have now been eliminated, creating duty-free access that enhances the competitiveness of Indian manufacturers and opens up new avenues in one of the world's most sophisticated automotive markets.

In pharma, zero-tariff access makes Indian generics more competitive; medical devices (e.g., surgical, diagnostic equipment) will also be duty-free, reducing costs for med-tech firms. Chemicals exports to the UK could rise by 30–40%, with plastics projected to grow by 15%, reaching a 2030 target of $186.97 million.

For services, the agreement provides guarantees for UK services sectors, including telecoms, construction, IT/ITeS, financial, legal, business consulting, architecture, and engineering, across India’s growing economy (UK services exports exceed £500 billion worldwide). In mobility and professional movement, the agreement allows easier, streamlined pathways for business visitors, intra-corporate transferees, contractual service suppliers, and independent professionals (e.g., architects, chefs, musicians, yoga instructors).

In the area of digital trade and intellectual property, the FTA allows secure cross-border data flows, robust data protection, recognition of digital signatures, electronic contracts, and anti-spam measures. Both nations have also agreed to strive for high environmental standards, support the transition to net-zero emissions by 2050, and foster trade in environmental goods and services.

For MSMEs, dedicated SME contact points, simplified customs, and regulatory support will lower fixed costs and facilitate Indian and UK SME's entry into each other’s markets, says the GT report.