Ambani, Adani, Godrej on Bajaj way; vie for a bigger slice of NBFC pie

ADVERTISEMENT

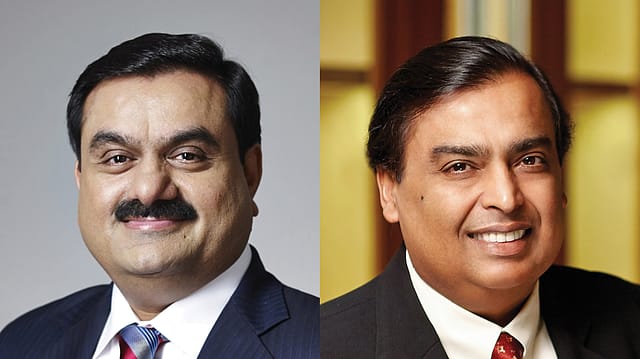

The stage is set for a battle of India's large corporates in the non-banking financial companies (NBFCs) space. As billionaire Mukesh Ambani looks to make a splash in the segment dominated by the Bajaj and Shriram groups, Godrej Capital (GCL) and Adani Capital (ACL) are looking to expand their portfolios in the business loan segment. Tata group is also an established player among NBFCs with a large loan portfolio, mutual funds and two insurance joint ventures.

The focus of Jio Financial Services (JFSL), which will be listed on stock exchanges, will be consumer and merchant loans initially as it enjoys a broad swath of consumers at Reliance Jio, Reliance Retail and Jio-bp. The group has a customer base of over 400 million in telecom and 200 million in retail. In addition, Reliance Retail and the e-commerce platform JioMart have partnerships with merchants which can be leveraged for building a loan base. Reliance Retail's merchant base scaled up two times over last year.

Adani Capital offers loans for farm equipment, commercial vehicles and supply chain, in addition to business loans. Shriram Transport Finance Corp (STFC) is the market leader in the commercial vehicle category, while Mahindra Finance has a strong presence in tractor loans. Both have SME/business loans.

For both the corporate houses, negotiating for low-cost capital will be easier as they have longstanding corporate relationships with the banks. GCL, which started the business by providing home loans to the customers of Godrej Properties Ltd two years ago, also negotiates well with the banks for better rates. GCL is eyeing a balance sheet of ₹6,000 crore by March 2023. By end of FY2024, the balance sheet is expected to touch ₹12,000 crore.

JFSL, which will be demerged from Reliance Industries Ltd (RIL), would be the fifth-largest financial services firm in India in terms of net worth, according to a report by Macquarie Capital Securities. The financial services arm will hold 6.1% stake in RIL which is valued over ₹1 lakh crore according to market value. RIL has recently appointed veteran banker KV Kamath as the chairman of JFSL. Macquarie believes that Bajaj Finance and Paytm will be most at risk after the launch of JFSL.

ACL, which launched in 2017, plans to go for IPO in 2024 to raise at least ₹1,500 crore by offering about 10% stake. The lender to farmers and small and medium-sized businesses, ACL is looking to capture more of the market for loans from ₹30,000 to ₹3 lakh with the help of technology. The firm looks after about ₹3,000 crore of loans, according to its CEO Gaurav Gupta. The lender targets to double the loan book every year.

The sector is lucrative as Bajaj Finance reported 88% jump in net profit at ₹2,781 crore for the September quarter. Net interest income surged 31% to ₹7,001 crore from ₹5,337 crore. Assets under management grew 31% to ₹218,366 crore in September. Gross NPA and net NPA as of September-end stood at 1.17% and 0.44% respectively, as against 2.45% and 1.10% same quarter last year. Bajaj Finance is valued of ₹4 lakh crore on the stock market.

STFC, the flagship company of Shriram Group, posted a 38% rise in net profit during the second quarter to ₹1,067 crore. The company's total income for the quarter under review saw a 14% increase to ₹5,351 crore as demand for both new and used vehicles went up and disbursements were strong. Total assets under management stood at ₹135,249 crore as compared to ₹121,647 crore a year back. Net interest income also saw 23% increase to ₹2,694 crore during Q2.

These NBFCs are unlikely to apply for banking licences as the regulation discourages corporate houses from running full-fledged banks in parallel with other businesses. The lending market in India grew by 11.1% to ₹174.3 lakh crore in March 2022, compared to March 2021. Commercial, retail, and microfinance lending contributed 49.5%, 48.9%, and 1.6%, respectively, to the overall pie.