RBI cuts repo rate by 25 bps: Here's how much homebuyers can save monthly

ADVERTISEMENT

Good news for homebuyers! The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) announced a rate cut by 25 basis points to 6.25% on 7 February 2025.

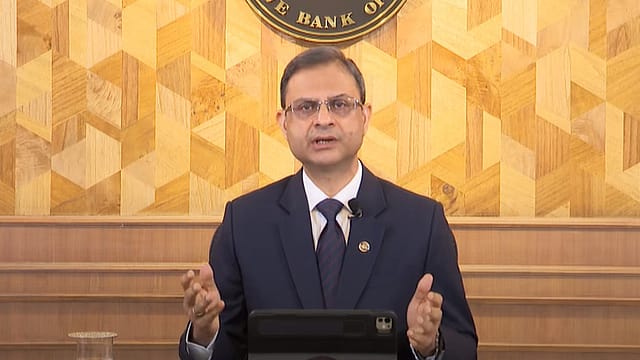

The Monetary Policy Committee (MPC) meeting, chaired by the newly appointed RBI Governor Sanjay Malhotra, was held from February 5 to 7, with the credit policy decision announced today. This marks the first RBI policy under Malhotra’s leadership and the first MPC meeting following the Union Budget 2025-26 presentation on February 1.

While in the budget, adjustments to the tax brackets have unlocked monthly tax savings ranging from ₹9,500 to ₹10,400 for individuals earning over ₹24 lakh annually, the RBI’s decision to cut the repo rate by 25 basis points—from 6.50% to 6.25%—in February 2025 is expected to provide a significant boost to homebuyers.

Lower borrowing costs translate into reduced home loan EMIs, making property purchases more accessible. This move will not only ease the financial burden on existing homeowners but also encourage new buyers to enter the market, strengthening overall demand.

Adhil Shetty CEO of BankBazaar.com says, "One can save ₹22,000 per month for with ₹25 lakh salary and ₹50 lakh home loan."

"The repo rate cut after 2 years is hugely welcome, and we congratulate Governor Malhotra on beginning his term with a bang. With the tax rate cuts earlier this month, the salaried and the middle class have received a double boost to tackle inflation and boost household savings," he added.

For instance, if you have a 20-year home loan at a rate of 8.75% and has paid 12 EMIs by March, with a rate cut of 25 bps kicking in from April, your interest savings will improve by ₹8,417 per lakh. For example, on a loan of ₹50 lakh, you will save ₹4.20 lakh at this rate, with 10 EMIs being shaved off the loan tenure, all other parameters remaining constant.

Shetty recommends that borrowers with good credit scores seek more aggressive payment options like refinancing to a rate lower by 50 bps or more. If they keep the EMI constant with a lower rate — let’s say 8.25% — they will secure per-lakh savings of ₹14,480 over the remaining tenor. These savings of nearly 15% per lakh are substantial."

Assuming the rate kicks in from April 1 after 12 EMIs of this loan have been paid, we get per-lakh interest savings of ₹3,002 from the rest of the year. On a loan of ₹50 lakh, this implies savings of ₹1.50 lakh for the second year of the loan.

Now, if we see these savings in the backdrop of additional savings from income tax slab hikes, a salaried individual can have substantial gains for FY25-25.

"A salaried person with a gross income of ₹25 lakh and a home loan of ₹50 lakh (20 years, 9%, 12 EMIs paid by March 2025) can hope to save a total of ₹1.37 lakh in FY2025-26 or ₹11,461 per month. This will be through a combination of interest savings on the home loan rate reduction of 25 BPS and the tax savings from higher tax slabs from April 1," says Shetty.

Sunny Bijlani- Joint Managing Director of Supreme Universal, says, "Lower borrowing costs translate into reduced home loan EMIs, making property purchases more accessible. This move will not only ease the financial burden on existing homeowners but also encourage new buyers to enter the market, strengthening overall demand."

Thus, this policy shift, combined with stabilising inflation and accelerating urbanisation, creates a favourable environment for homebuyers to buy their dream homes.

Vivek Sinha, Director of Sales and Marketing, KDMG Group, says, "The 25 bps rate cut by the RBI is a step in the right direction for the real estate sector. With borrowing costs coming down, we expect a surge in homebuyer inquiries and improved market sentiment. This decision will also provide a breather to developers by easing financing costs for projects. We urge banks and financial institutions to pass on the benefits to end-users quickly, ensuring maximum impact on housing demand and sales."