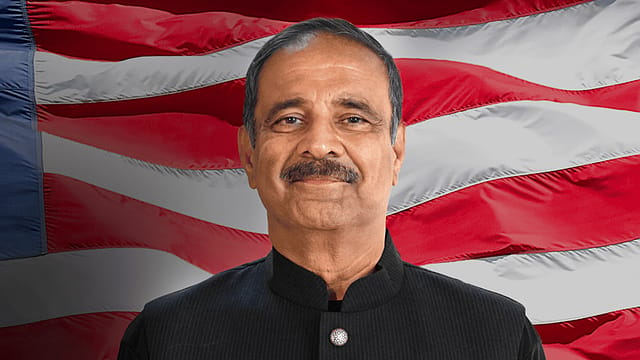

Will Florida businessman Danny Gaekwad miss the Supreme Court deadline in the Religare case?

ADVERTISEMENT

The high-stakes battle for the control of Religare Enterprises Limited (REL) has taken another twist with Florida-based businessman Danny Gaekwad facing increasing uncertainty over his ability to meet the Supreme Court’s (SC) deadline to deposit ₹600 crore by 2 pm today. Despite being granted an extension by the apex court, “Gaekwad’s chances of fulfilling the requirement remain slim, primarily owing to regulatory and logistical hurdles,” says a legal expert.

On February 7, the SC directed Gaekwad to deposit the funds by February 12 to demonstrate his bona fides in his competing bid for REL. When he failed to do so, the SC extended the deadline by a day, providing a last-ditch opportunity to make the necessary deposit. Attorney Mukul Rohatgi, who represented Gaekwad, informed the court that the businessman was unable to transfer funds owing to the need for a pre-approval from the Reserve Bank of India. Given these constraints, neither a bank guarantee nor a cash deposit could be furnished by the applicant.

The SC in its order emphasised that only the timeline for the deposit was being altered, while all other terms and conditions of the previous order remained unchanged. However, given the time-sensitive nature of the deposit, this procedural bottleneck significantly reduces his chances of compliance within the allotted timeframe.

The takeover battle for REL has been a contentious affair, pitting Gaekwad against the Burmans, the promoters of Dabur India. The Burman family initiated the process by acquiring a further stake in REL, triggering a mandatory open offer to public shareholders. Gaekwad entered the fray with a competing bid, offering a higher price per share and seeking to acquire a controlling 55% stake. However, Sebi rejected Gaekwad’s offer, citing that it was time-barred. The Florida-based businessman has since challenged this decision in the apex court, arguing that his offer remains valid until January 2025.

With the SC’s latest ruling mandating the deposit by February 13, the stakes have risen significantly. The inability to furnish the deposit could weaken Gaekwad’s legal standing in the ongoing dispute. If the deadline is missed, it may further solidify the position of the Burmans in the takeover battle, allowing them to proceed with their open offer without further challenge.

Legal experts feel the failure to comply could raise concerns about the viability of his bid and could ultimately lead to Sebi and the SC dismissing his challenge against the Burman family’s acquisition.

The Religare share was quoted at ₹238, up 2.73%, as of 1 pm.