Zomato's 10-minute delivery is litmus test for industry; will the gamble pay off?

ADVERTISEMENT

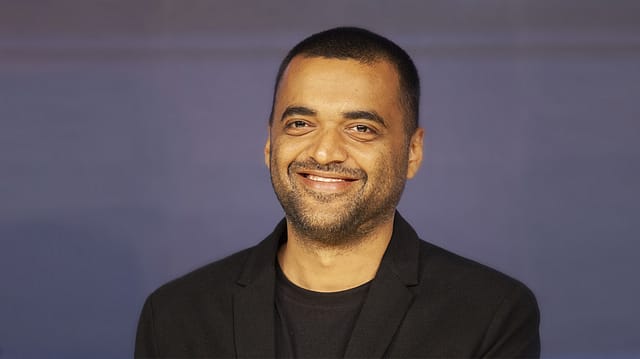

Call it a current fad but tech companies seem to be sold on the idea of quick commerce or what is simply described as instant delivery. The trend that was started by e-grocers and largely firms focusing on deliveries of convenience items like Blinkit, Dunzo, Zepto or Swiggy's Instamart vertical is now being replicated by other segment players. Zomato is making a bold bet of delivering food in 10 minutes. By founder and CEO Deepinder Goyal's own admission, items like maggi, poha, tea, coffee, bread, omelette and biryani can be delivered instantly. Goyal justifies this move by saying that innovation is at the forefront of tech and the current 30-minute average delivery time by Zomato is "too slow" and is under the threat of soon becoming obsolete. After all, customers are increasingly demanding quicker answers to their needs. "They don't want to plan, and they don't want to wait. In fact, sorting restaurants by fastest delivery time is one of the most used features on the Zomato app," he said in a blogpost late last month. The idea seems palatable, at least on paper, and the company has a huge repository of customer data which it can leverage to decode consumer preferences of key areas or markets. But in a price-sensitive country where customers will be more than willing to wait for their food deliveries rather than paying higher charges, questions arise around the viability of the model. Also, it is difficult to surmise how the swift deliveries can be fulfilled without compromising on the quality of the food.

"Almost nothing can be served in 10 minutes. Even in your own house, if you want to make a cup of tea, you will be mentally prepared to make five to six minutes of effort. Who is this customer who would want something to be delivered in 10 minutes? And what can be delivered in this span of time without compromising on the quality of food and consumer experience," says Arvind Singhal, chairman and managing director at Technopak Advisors. Besides, the model also entails costs. When the delivery time is longer, food aggregators can bunch multiple orders, driving down the cost of delivery in the process.

"In case of 10-minute deliveries, the riders need to be pretty much stationed at the stores. Since the delivery radius will be small, more riders will be needed to fulfil the quick orders and the rider utilisation will be low. More people would mean more costs," says Rajat Tuli, partner at Kearney. One way to recover the cost would be levying higher delivery charges but price-sensitive consumers may not be willing to shell out more, says Tuli. In case of 10-minute grocery deliveries, some companies had tried to implement surge pricing.

Blinkit started to charge surge fee during peak demand hours. Singhal says that surge pricing seems to have not worked in the case of 10-minute grocery deliveries, pointing out how companies in the space are struggling to make money and if Zomato adopts a similar pricing template, it is unlikely to work in this case too. Industry experts say Blinkit lost money on every order after it pivoted to the cash guzzling quick commerce model.

Zomato says that it has a plan in place to make the model work: it is building a network of kitchens or what it calls 'dense finishing stations' where some bestseller items from various restaurants will be assembled and packed for delivery. These kitchens will be located in close proximity to high-demand customer neighbourhoods. The service, Zomato Instant, is being tested with four stations in Gurgaon. Analysts say the strategy will only work in case of ready to eat products which are easily available off the shelf like sweets or at best for something like idli and sambar which are typically pre-cooked. "If something which requires packaging, assembling and heating, 10-minute deliveries may be difficult," says Tuli.

An investor with a venture capital fund says the kitchen costs will probably get amortised over multiple types of orders. The challenge, however, will be the delivery cost. For the economics to make sense, the average order value (AOV) will have to be decent. If AOV is low, it will be difficult to make the model viable. "Even if you earn say 30%-40% as gross margin on an order that has low AOV, it won't be enough to sustain the cost of delivery," explains Amit Nawka, partner deals and India startup leader at PwC. If a company wants to build a standalone business around such a quick delivery model, it will not work, say industry observers. "If it is part of a larger basket or one of the segments of a business, then it makes sense," they say.

Zomato claims that "due to demand predictability at a hyperlocal level, we expect that the price for the customer will get significantly reduced, while the absolute rupee margin/income for our restaurant partners as well as our delivery partners, will remain the same," without getting into the specifics. It is also not clear if the firm plans to gradually shift the larger chunk of deliveries under the instant delivery model going ahead. Consolidated losses for Zomato declined to ₹67.2 crore in Q3FY22 from ₹352.6 crore in the year-ago quarter.

Few analysts say that it may be Zomato's ploy to get new users on board. The company is already capturing the entire gamut of a customer's food requirements spanning breakfast, lunch and dinner. It now wants to tap into the quick snacking segment and make sure that customers don't have to step out to buy small, quick bite items. "This way, existing customers will have all their needs met. It also provides Zomato an opportunity to push the new users to make regular food orders," says the VC investor who did not wish to be identified.

A basic food menu can be categorised into everyday food items, occasion food and special food. Zomato may be targeting the everyday food segment through the launch of instant delivery, says an analyst on condition of anonymity. Given that offices are reopening, the share of lunch orders will go up and the firm wants to cater to this clientele base by serving quick orders. "As individuals, we are not big on experimenting. When it comes to everyday food, people typically order from two to three places and go for specific types of food. Due to the sheer amount of data available with food delivery firms, they have the ability to predict consumer behaviour," he adds.