Time For Realty Check!

ADVERTISEMENT

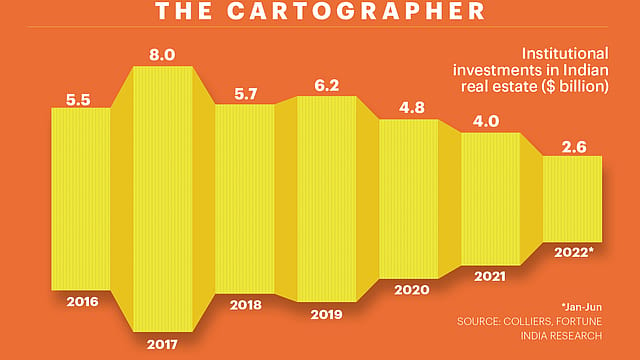

Institutional investments in the Indian real estate sector touched $1.5 billion during the second quarter of the current calendar year, an 18.8% drop over the corresponding quarter of 2021, says a report by Colliers. Even though geopolitical environment has cast a shadow over India's GDP growth, office assets remain the preferred choice of investment for capital investors, accounting for 42% of the total inflows in Q2. Interestingly, domestic investors are back in business, accounting for 44% share of the Q2 flows. Despite housing prices surging in eight cities, investor appetite for residential investments remains weak. It will be interesting to see whether CY22 flows will be lower than CY21 given the fragile state of the global economy and increasing geopolitical unrest on the Russia-Ukraine and China-Taiwan front.

— V. Keshavdev