Capital gains tax too complicated, needs re-look: Govt

ADVERTISEMENT

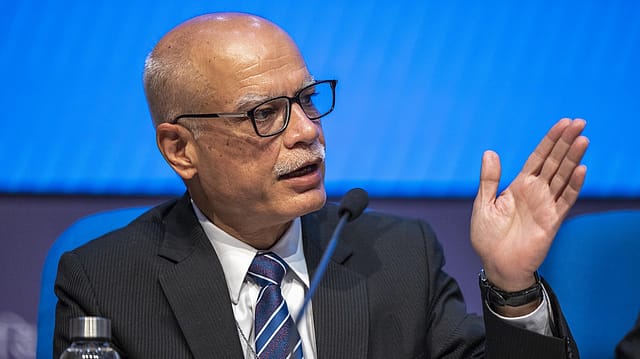

Calling the capital gains tax structure "too complicated", revenue secretary Tarun Bajaj today called for a need of an absolute review of the present structure of the capital gains taxes.

Addressing a post budget interaction with the Confederation of Indian Industries (CII), Bajaj says, "My view is that we need to have an absolute re-look of the capital gains tax. Whenever I discuss it outside, it creates a lot of friction."

Pointing at the complications in the capital gains tax structure, Bajaj says, "Number one is the rate itself, second in the issue of period. It is too complicated. For real estate we have made 24 months, for shares it is 12 months, for debt it is 36 months. So, we really need to work on it."

Maintaining that capital gains is a work in progress, Bajaj also says that the Centre has done some work in this direction and but a lot needs to be done. "We have done some work and reviewed the rates and duration elsewhere in the world. I think a lot of work needs to be done," Bajaj adds.

It may, however, be noted that the ministry of finance had received multiple representations on capital gains tax ahead of the Budget. Most of the demands pertained to uniformity in the Long Term Capital Gains tax across the asset classes.

LTCG rates vary on various asset classes depending on the holding tenure as well as the type of the asset. For example, holding period for listed equity for the purpose of LTCG is one year, while it is two years in case of unlisted shares. Holding period in the case of a listed debenture for LTCG to be applicable is one year while it is three years for unlisted ones. Similarly, LTCG is applicable if equity mutual funds are redeemed after one year while in case of the debt mutual funds it is three years.

During the interaction, Bajaj also mentions that personal income tax and several GST related issues are also work in progress for the government.

"There are some areas in which work is in progress and in the next few budgets we should be unveiling those efforts too. I can mark two areas specifically. On the GST side there are a lot of things that need to be done and we will attempt to make changed to the GST framework," Bajaj says.

"The last bit is personal income tax. That is also a work in progress and would need some more time from us. I look forward to suggestions on personal income tax," Bajaj adds.