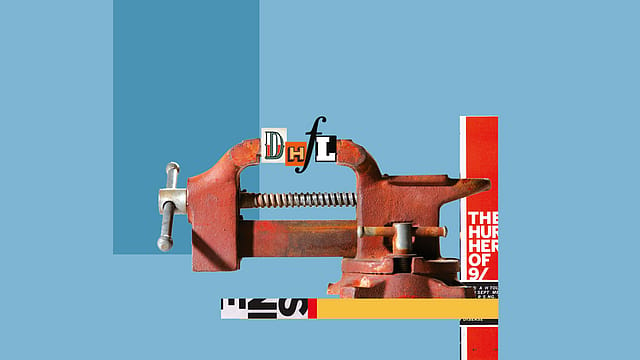

DHFL’s survival blues

ADVERTISEMENT

There have been solid signs of trouble at India’s leading housing finance company (HFC) Dewan Housing Finance Corporation (DHFL) for some time now. The tell-tale one? The 91% fall in its share price from 52-week high of ₹690 to 52-week low of ₹60 in 194 trading sessions from September 3, 2018, to June 19, 2019, on the Bombay Stock Exchange (BSE). And the latest? The company’s admission of its fears about the future.

In the notes to DHFL’s financials released on July 13, titled ’Outcome of the board meeting’, it said the company was undergoing substantial financial stress. “The company's ability to raise funds has been substantially impaired and the business has been brought to a standstill with there being minimal/virtually no disbursements,” DHFL disclosed. “These developments may raise a significant doubt on the ability of the company to continue as a going concern,” it added.

The note further stated that DHFL has suffered consistent downgrades in its credit ratings since February 2019. On June 5, credit rating agencies reduced DHFL’s rating to 'default grade' despite there being no default till that date, the HFC claimed. “The ability of the company to continue as a going concern is predicated upon its ability to monetise its assets, secure funding from the bankers/investors, restructure its liabilities and recommence its operations,” the note read.

It’s a steep task. The latest default was reported on July 13, the same day the aforementioned note came out. DHFL disclosed that it has defaulted on interest payment obligations to the tune of ₹48 crore on interest outgo towards two different set of non-convertible debentures (NCDs) due on July 6 and July 8. DHFL also disclosed that its default included principal repayable worth ₹2,000 crore—₹1,700 crore and ₹300 crore repayable on July 6 and July 8 respectively.

The HFC’s unaudited results released also on July 13 for the quarter ended March 2019 is worrisome. The board noted an 8% annual growth in the company’s assets under management from ₹1,11,318 crore in March 2018 to ₹1,19,992 crore in March 2019, while revenues grew 19% from ₹10,864.4 crore to ₹12,900.6 crore. The bad news is ₹1,036 crore net loss in March 2019 against ₹1,240 crore profit a year ago.

Kapil Wadhawan, DHFL’s chairman and managing director, said in a release: “In the backdrop of a significant slowdown in disbursement and loan growth post September 2018, the financials of the company have been quite strained for the quarter impacting the overall performance of the year.”

DHFL’s operating profit was ₹372 crore for the quarter and ₹2,378 crore for the whole year. However, due to the additional provisioning of ₹3,280 crore (including net loss on fair value worth ₹3,190 crore), the company reported a net loss of ₹2,223 crore for the quarter and ₹1,036 crore for the whole year.

"Since the last nine months, with single-minded focus, we have met all our financial obligations and are looking to return to business normalcy at the earliest,” Wadhawan said. “Since September 2018, DHFL has managed to make repayments of over ₹41,800 crore primarily through securitisation of assets and repayment collections,” he added.

Among disclosures pertaining to resolution process and onboarding strategic investors in DHFL, the release said that DHFL aims to continue to protect all stakeholders, creditors and investors, big and small. DHFL business objectives, it said, have been in support of the government's mission and policies aimed at funding and financing affordable homes. “We are very enthusiastic about starting our business operations soon so that we can continue to contribute to the success of the government's national 'Housing for All by 2022' mission.”

But the situation is grim. DHFL’s gross non-performing assets (NPAs) as percentage of its assets has grown from 0.96% for the quarter as well as fiscal ended March 2018, to 2.74% for March 2019. And with no disbursements, the stress on the HFC is huge. No wonder, that DHFL’s recent disclosure of ₹2,048 crore default on mix of principal and interest on two set of NCDs was disclosed on the same day of results release.