RIL fixes record date for 1:1 bonus issue, raises authorised share capital

ADVERTISEMENT

Shares of RIL surged 1.1% today despite the broader market indices trading in negative after the company fixed Monday, October 28, 2024, as the record date for determining shareholders eligible for 1:1 bonus shares. This is the first bonus issue by the company since 2017 when the conglomerate issued bonus shares at a 1:1 ratio.

The announcement came following the RIL board's announcement, with 99.92% voting in favour of the bonus issue. The RIL board also sought approval to increase authorised share capital and consequent alteration to the capital clause of the Memorandum of Association. Around 98.96% of votes were polled in favour of the proposal.

The authorised share capital for bonus issue is ₹50,000 crore, which consists of 4,900 crore shares of ₹10 each and 100 crore preference shares of ₹10 apiece each.

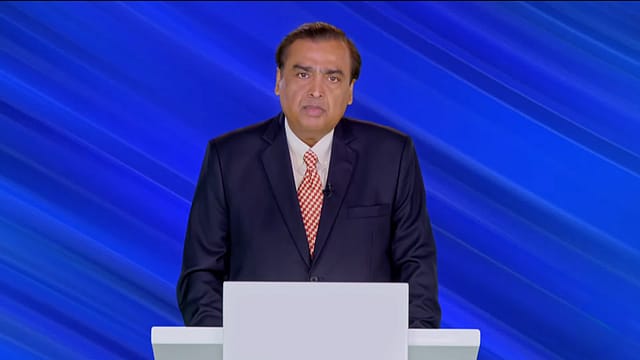

RIL chairman Mukesh Ambani announced the bonus issue in August during the company's annual general meeting (AGM). "When Reliance grows, we reward our shareholders handsomely. And when our shareholders are rewarded handsomely, Reliance grows faster and creates more value. This virtuous cycle has been the guarantor of your company’s perpetual progress," he said.

For Q2 FY25, RIL posted a consolidated profit of ₹16,563 crore, down 4.7% compared to ₹17,394 crore in the year-ago period. Consolidated revenue from operations increased marginally by 0.2% year-on-year (YoY) to ₹2.35 lakh crore, while the consolidated EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation) stood at ₹43,934 crore, up 2% YoY. The EBITDA margin dropped to 17% as compared to 17.5% in the previous year.

As of September 30, 2024, RIL’s total debt was ₹3.36 lakh crore, up from ₹2.95 lakh crore at the close of Q2 FY24. The net debt remained elevated at ₹1.16 lakh crore from ₹1.12 lakh crore at the end of Q1 FY25. The management has guided to lower capex intensity by FY25 as 5G capex has been completed, while new energy and retail capex remained high.

RIL shares surged 1.1% to ₹2,718.95 today (12.15 PM) against the previous closing price of ₹2,708 on the BSE. After three hours of trade, the country’s most valued stock settled 0.56% at ₹2,723.30, while the market capitalisation declined to ₹18,42,104.19 crore. The BSE benchmark Sensex and NSE Nifty are trading in negative at 0.55% and 0.73%, respectively. At the current level, RIL shares trade nearly 15.3% lower than its 52-week high of ₹3,217.90 touched on July 8, 2024. The counter has gained 18.4% from its 52-week low of ₹2,221.05 hit on October 26, 2023.