MFs Face a Tough Battle for Flows

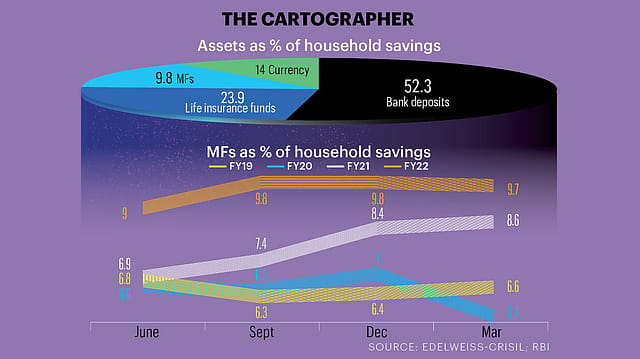

IN A NATION OF SUPERSAVERS, deposits continue to be the most favoured investment with 52% of overall household savings (as of March 2022) still locked up in banks. Life insurance comes second at 24%. But what's glaring is that the share of mutual funds, as per a report by Edelweiss-Crisil, is abysmally low at 9.8% even as investment in currency is still higher at 14%! Though assets under management (AUM) are at a record high of ₹40 lakh crore (as of December 2022) compared with ₹21 lakh crore in December 2017, it seems individuals have not embraced MFs completely — which poses both a challenge and an opportunity for the industry. While individuals dominate the share of the AUM at 59% — with SIP AUM rising to ₹7 lakh crore — dismal returns mean fund houses will have to put their might — both distribution and marketing — to swing savings their way. But the removal of long-term tax benefits on debt funds just made things worse for the industry.