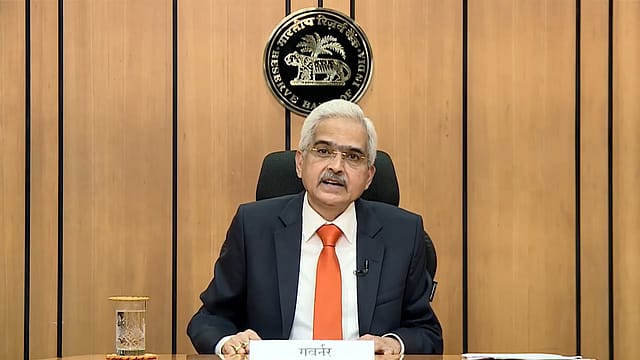

Hope most ₹2,000 notes will return before set deadline, says RBI Guv

ADVERTISEMENT

Reserve Bank of India (RBI) Governor Shaktikanta Das today said the Indian exchange system is quite robust, and its exchange rate is among the least volatile among other countries. He also said the security features of either ₹500 or ₹2,000 currency notes have not been breached so far.

"Even if you compare with the U.S. dollar, the Indian rupee's exchange rate has remained stable despite the crisis in the financial markets created due to the war in Ukraine, and the failure of certain banks in advanced economies. The Indian exchange system is very stable and robust."

The central bank on Friday announced the withdrawal of ₹2,000 denomination banknotes but said it will continue to remain a “legal tender”, meaning legal currency, before it is phased out in a time-bound manner. To complete the exercise in a timely manner and to provide adequate time to the public, all banks have been asked to provide a deposit or exchange facility for ₹2,000 banknotes until September 30, 2023.

The RBI governor hoped that all ₹2,000 currency notes worth ₹3.62 lakh crore will come back, and the extension of the deadline will depend on the future situation.

On purpose behind the decision, the RBI governor said: “Either you want to exchange currency notes or you want to deposit in account in cash, there is a set procedure in banks that they must follow, and we have asked banks to follow that only.”

He said the RBI does not monitor the information regarding how much cash is being deposited, that's up to banks and they follow the set guidelines.

“Banks have not been given any additional guidelines when it comes to ₹2,000 banknotes,” the RBI governor said. "For example, if one deposits more than ₹50,000 in the bank, they must produce PAN card details. So the existing banking rules will remain in place."

The RBI governor said the high-denomination note of ₹2,000 was introduced to replenish the currency. “What you call remonetisation and that purpose has been fulfilled.”

The security features of either ₹500 or ₹2,000 currency notes have not been breached so far, he said, adding the 'fake currency' that is seen in the market is just sophisticated photocopying. "In any system, there are always efforts to inject fake currency, mostly happen outside the country, so high-value notes are always vulnerable to efforts on the part of fraudsters to try and clone."

This time around, the RBI’s decision is mainly driven by a need to ensure a clean note policy, he said.

On some bank ATMs still disbursing ₹2,000 notes, the RBI government said most of the banks have modified their ATMs, and if some are still disbursing the ₹2,000 notes, it's up to them to correct those.

On whether the decision this time was taken after the government's intervention or was solely taken by the RBI, the governor said it's not related to public concerns.

The RBI chief, answering the timing of the decision, said the question of timing can be raised at any time. "It's not really relevant".

Additionally, he said the securities features of this new ‘Mahatma Gandhi Series’ notes have not been breached. “So the integrity of our currencies continues.”

With the sucking out of ₹2,000 from the system, the RBI governor said it'll depend on demand. "Some of it (₹2,000) will be deposited in the system, and some of it will be exchanged. The RBI monitors the liquidity in the system. On a day-to-day basis monitors the liquidity in the system and monitor it."