India’s semiconductor component market to be worth $300 bn by 2026

ADVERTISEMENT

The demand for semiconductors is growing astronomically worldwide, and India’s semiconductor component market will rise manifold to touch the total revenue worth $300 billion during 2021-2026. In 2021, India’s end equipment market stood at $119 billion in terms of revenue, which is expected to grow at a CAGR of 19% from 2021 to 2026.

Though the government’s initiatives – from ‘Make in India’ to Production Linked Incentive (PLI) scheme – will help accelerate this journey, additional reforms are needed to boost local manufacturing and sourcing of semiconductor components, according to the ‘India Semiconductor Market Report, 2019-2026’ report, jointly prepared by the India Electronics & Semiconductor Association (IESA) and Counterpoint Research.

“If this is done, the semiconductor market can be a major contributor to economic growth, and India’s push to become a $5-trillion economy,” says the report.

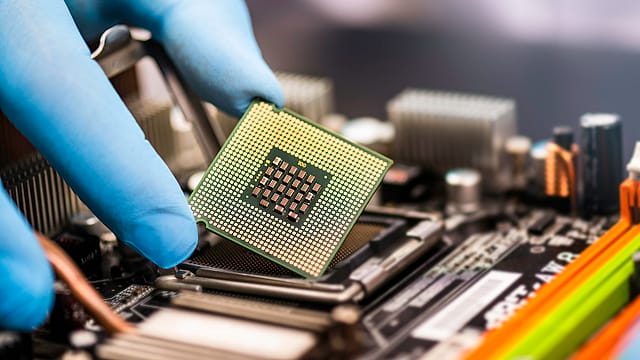

Krishna Moorthy, president and CEO, IESA, an industry body representing the electronic system design and manufacturing (ESDM) and intelligent electronics industry in India, says before the end of this decade, there will be nothing that will not be touched by electronics and the ubiquitous ‘chip’. "Be it fighting carbon emissions, renewable energy, food safety or healthcare, the semiconductor chip will be all-pervasive.”

IESA is the premier industry body representing the ESDM sector and intelligent electronics industry in India. India’s mobile and wearables, IT and industrial segments currently contribute around 80% of the semiconductor revenues. The country is aiming to be the second largest market in the world in terms of scale and growing demand for semiconductor components. Major drivers of semiconductor demand are digital transformation among consumers, enterprises and the public sector via the adoption of new technologies.

While the country is becoming one of the largest consumers of electronic and semiconductor components, most components are imported. Currently, only 9% of India's semiconductor requirement is met locally. The share of local sourcing is expected to grow to over 17% by 2026. This translates into a six-fold rise in potential locally-sourced semiconductor revenues, shows the report.

Government policies including PLI scheme, New Electronics Policy 2019, electronics manufacturing clusters, and Scheme for Promotion of manufacturing of Electronic Components and Semiconductors (SPECS) are all being equipped to boost domestic design, manufacturing and assembly. To help drive more initiatives under the themes of Make in India and Digital India, the government, in its last Budget, had pushed the total allocation to $936.2 million, says the report.

It also says the next big boom for semiconductor components will come from across sectors. "However, the telecom sector with the advent of 5G and fibre network rollout will be a key catalyst in boosting the semiconductor components consumption,” says Counterpoint Research vice president Neil Shah.

To make India a global leader in electronics manufacturing, the Centre has launched the Semicon India programme with a total outlay of ₹76,000 crore to develop the semiconductor and display manufacturing ecosystem. The scheme aims to provide financial support to companies investing in semiconductors, display manufacturing and the design ecosystems.